Creating an exceptional customer experience through UX-led design can have a significant impact on the way financial institutions deliver their services. If done right, it can transform your business to be truly customer centric. This shift in positioning can have a huge impact on your bottom line. Putting it in to context, when looking at the success of businesses such as PayPal, Amazon and Uber, their industry domination derives from their excellence in operations and technology but ultimately, what really sets them apart is their emphasis in creating seamless UX.

Great UX does not happen by accident

It can be hard to predict exactly how a customer is going to interact with your business online. However, delivering a great user experience can influence audiences, providing them with easy access to the tools and information they need to make purchase decisions about your product.

Creating a logical and insightful online user experience does not happen by accident. The most successful sites have applied the science of developing a great user experience, where the user journey has been carefully planned and plotted way before it gets to the design stage. In Australia, which has incredibly high internet usage, great user experiences are more relevant than ever. But what exactly does ‘UX’ mean and what part does it play in contributing to the success of your business?

What actually is UX?

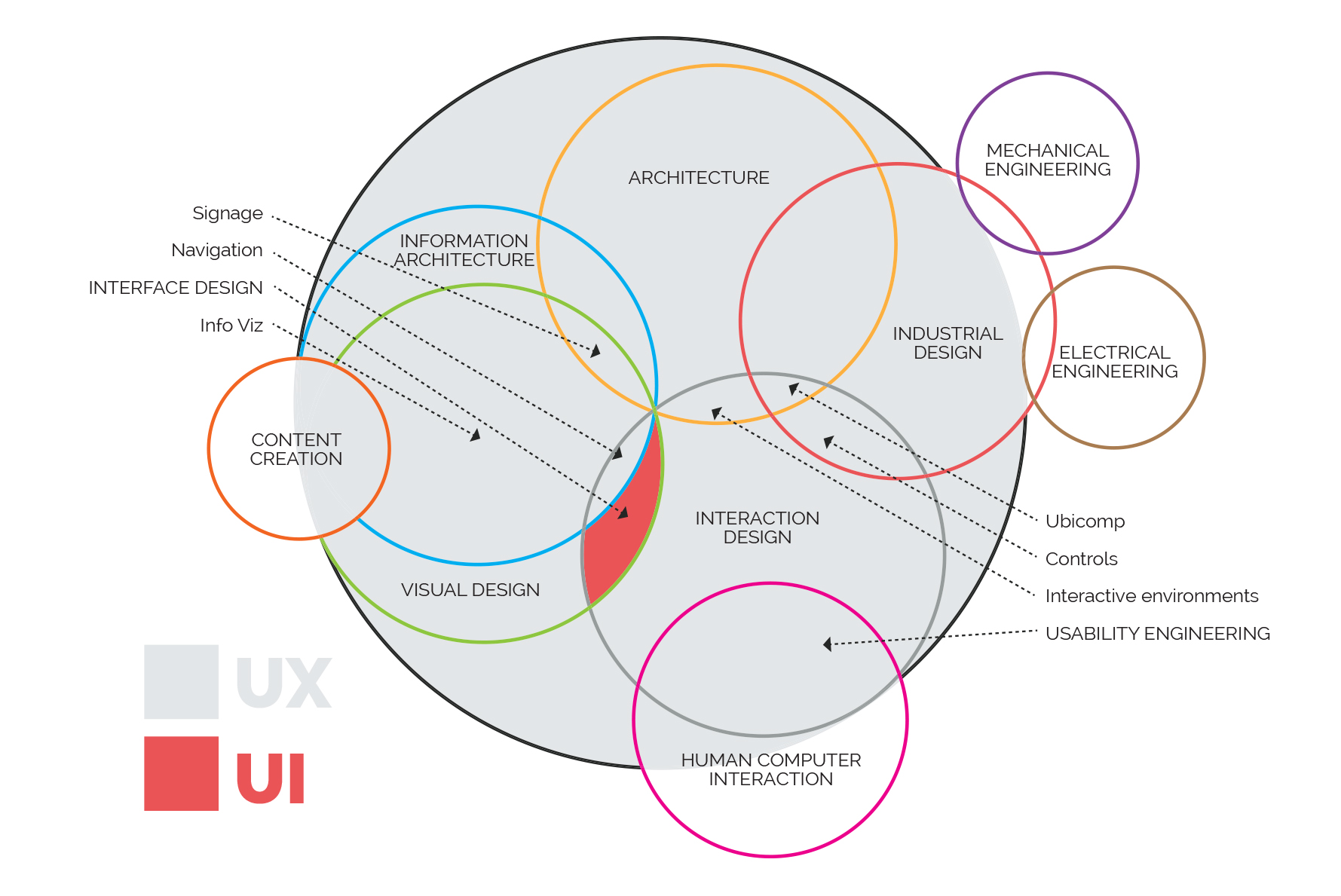

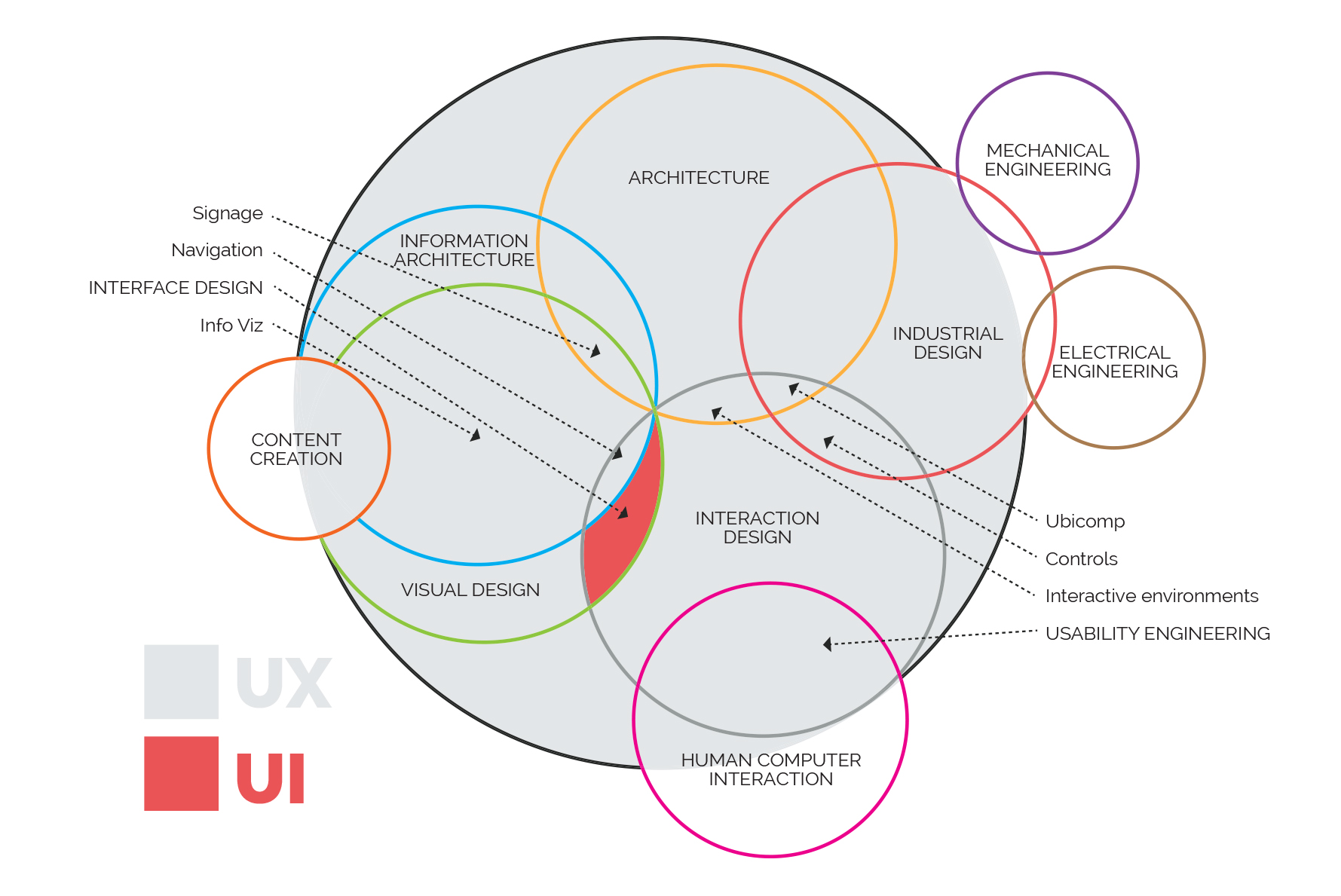

In summary, user experience (or ‘UX’) encompasses the entire experience of your end-user’s interaction with your company, its services and its products. According to Don Norman, the originator of the term ‘UX’, “True user experience goes far beyond giving customers what they say they want, or providing checklist features. In order to achieve high-quality user experience in a company’s offerings there must be a seamless merging of the services of multiple disciplines, including engineering, marketing, graphical and industrial design, and interface design.”

Why UX is essential to financial companies?

With this in mind, how effectively is UX being used in the financial service industry?

In 2014, research revealed that 92% of Australian adults used the internet regularly. Whilst this research highlighted that the largest proportion of users are the 18-44 age group (100%), it also showed that 68% of those users are aged 65+, with the number expected to be much higher in 2016. The fallacy that internet usage is the domain of the young, traditionally not the core demographic for non-retail banking firms needs to be addressed.

In addition to this, statistics revealed that there are 15 million+ smartphone users in Australia, and 68% of people having access to multiple devices. These numbers are increasing and will eventually reach full saturation. To put this into context – most of your customers have a smart phone; if your online presence does not have a user experience that responds to the device on which it’s being viewed, you’re already behind.

As an industry, financial services can no longer hide from the fact that having a user focused online presence is the most important part of their businesses marketing strategy.

Unfortunately, apart from some of the bigger banks, the financial services industry, on the whole, struggles to understand the true value that good UX brings to their business, particularly in the B2B space. The sentiment is one of frustration for having to spend so much time and money researching, planning and creating something that lacks permanence and that has to be continually updated and maintained. The hard truth is that unless these businesses change their focus and properly invest in their online communication, they will get left behind. In the end, the market will ultimately decide whether a business survives or not.

Fintech gets it…

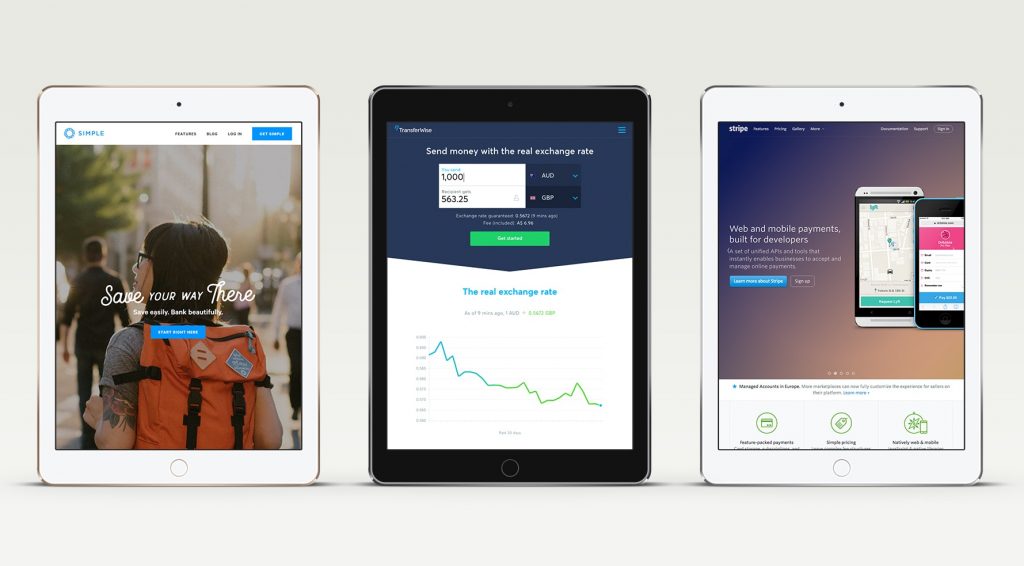

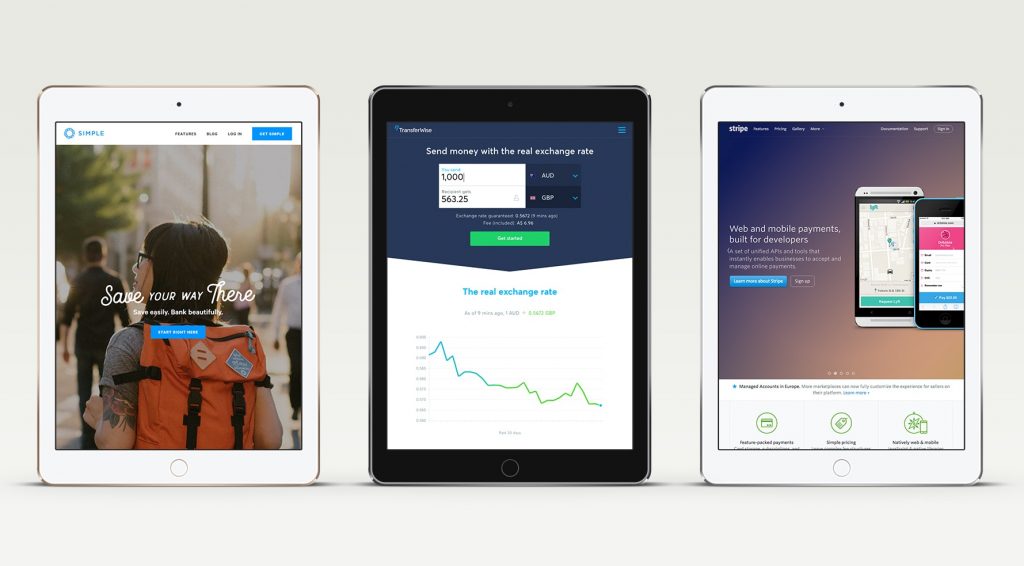

On the other hand, Fintech companies, in recent years, have shifted much more towards understanding the value of great UX design, particularly when creating B2C interfaces. These businesses have transitioned away from focussing mainly on their technology, security and back-end systems. Cumbersome, complicated products have given way to a new wave of minimalistic, functional interfaces. User experience is imperative to these Fintech businesses, with every key interaction that the user makes potentially bringing in revenue to the organisation. Automation is a key part of the overall design, the simpler the service and functionality, the less money gets spent on costly customer service.

Fintech companies realise that user experience and strong design can truly differentiate their product from their competitors. User centricity is pushing away from system centricity, forcing design and technology to work together, on equal terms.

Below are some examples of high quality designed User Experience Fintech websites that now set the standard for this industry:

- Transferwise (a business that solves the problem of overpriced international money transfers)

- Simple Bank (one of the most minimalistic banking experiences tackling a traditional industry)

- Stripe (which allows businesses to implement and customise their payment gateways pretty much anywhere).

Where can you start?

Understanding the importance of user experience for your business can be a challenge to get your head around. To get started, begin with focusing on 3 basics:

- Function vs Beauty: the site should focus on the customer’s requirements first, followed by visual impact second. On the whole, financial user interfaces are tools, so it’s best to ensure the design of the site supports exactly what the customer is wanting to do.

- Amplify vs Simplify: be smart with editing the information you have on the site by keeping it simple. There is a tendency for financial services businesses to cram every message possible onto their site in order to fully convey all of the offers of the business. This smorgasbord of information runs the risk of overwhelming the customer, making it impossible and very annoying to engage with. Balancing the customer’s needs against a business’s requirements is not an easy task. Wherever possible, practice the art of restraint, making sure that what’s viewable on the site is completely essential.

- Market vs User: both types of research are important in their own right, they are not the same thing so wherever possible, make sure to cover off both types. Some businesses do not fully understand the value of these separate research streams, often believing that the two can be merged into using the same data in order to save time and money. To clarify; market research is a broad piece of work that focusses on customers opinions and trends, while user research focusses on usage patterns, how people actually use the product rather than how they say they will use it.

If you would like to know more about the importance of user experience for your financial services website and how Yell can help, please contact us.