Fake tan. Gym gear. Online equity trading platforms.

All products that are currently being promoted by influencers on social media, as a wave of influencer personalities use social platforms to build audiences and create a lucrative careers for themselves.

While most of us think of influencers as being most lifestyle focused, there’s a growing segment of financial influencers, or ‘finfluencers’ who are focusing on home loans, trading and other money topics that impact our daily lives.

This new breed of finfluencers may not have an AFSL, but they do deliver financial information to help their audiences build healthy money habits and get ahead with everything from day-to -day personal finance advice to long-term wealth building.

Of course, there have always been mainstream media influencers. Shane Oliver, Mark Bouris, Effie Zahos and David Koch have used their smarts, success, and platforms to guide public opinion and sometimes policy. The road to attaining that level of influence has traditionally taken time to travel. Demonstrating that you’re worth listening to required summiting the peak of the financial industry, building a successful business, or a consistent presence on the nation’s TV screens.

Social media has changed that. Today, anyone with a smartphone can create content, build an audience and influence their behaviour. Social media is circumventing traditional media, PR and, to some extent, advertising. Due to the tight focus of their audiences and the outsized results they can deliver, finfluencer content creators can be an effective addition to almost any campaign, no matter what the product or audience.

Why influencers work

Finfluencers are successful because they’ve done the hard work of building an audience of people who choose to listen to them and trust them.

Actively engaged audience

The reason why so many organisations’ content marketing campaigns fail is that no-one is listening.

Influencers have invested their own time and money to build a media presence, and even with so much noise out there, if they’ve built an engaged audience, it means that their content is likely high quality, or at least resonate with those who follow them. Their audience is choosing to engage with them and therefore no cut-through is needed – they have achieved that.

Authenticity

While social media can present life through a lens, for creators who are producing regular content on a long-term basis, their real personality inevitably comes through – there’s only so long a facade can be kept up. This sense of authenticity can be added to by the nature of some of the channels, where ummmms, ahhhhs and fluffed lines are retained rather than edited out.

For the audience, this authenticity means results in the final piece of the puzzle: trust.

Trust

For any type of marketing campaign to be effective, the audience has to believe what they are being told. The best way to do this is to show them and allow them to come to their own conclusions, rather than trying to convince them through marketing copy.

This is where influencers excel – the relationship they have built with their audience means that their recommendations are trusted, while showing how they use a product allows their audiences to come to the conclusion that it could be a good fit for their needs.

Financial influencer channels

Most content creators publish across a variety of channels – some short-form, some long-form. Short-form content tends to skew younger and is more easily consumed on mobile, while longer form can attract a more mature audience more willing to dedicate time to consumer content. Of course, there are no set rules – we’ll take a look at several platform used by content creators, with examples of successful content creators on each.

TikTok

Starting with the ‘youngest’ channel, Tik Tok was formerly known as ‘Music.ly’ and has exploded in popularity over the past two years with the most popular content showcasing dance routines and comedy skits.

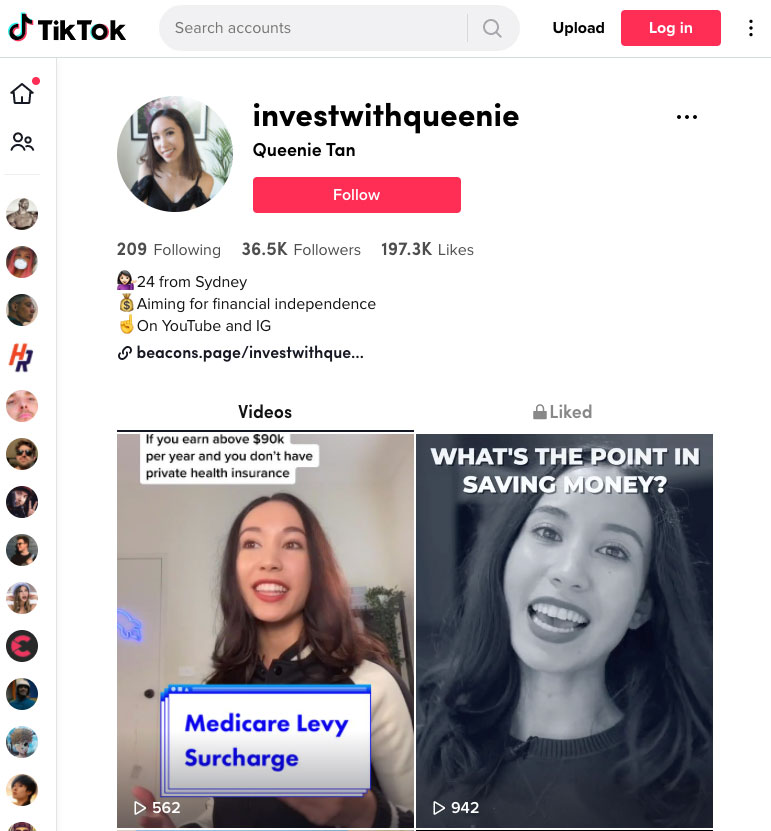

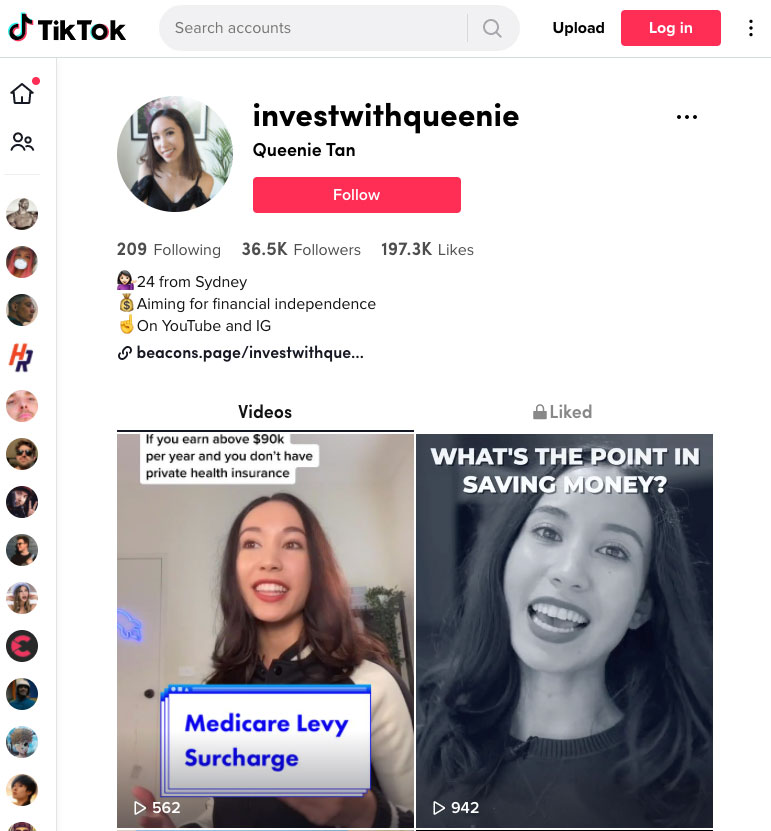

Queenie Tan is a 24 year old marketing professional from Sydney who shares content with her 27,500 followers on a variety of personal finance and investing topics, from where to invest $1,000 to explaining how inflation works.

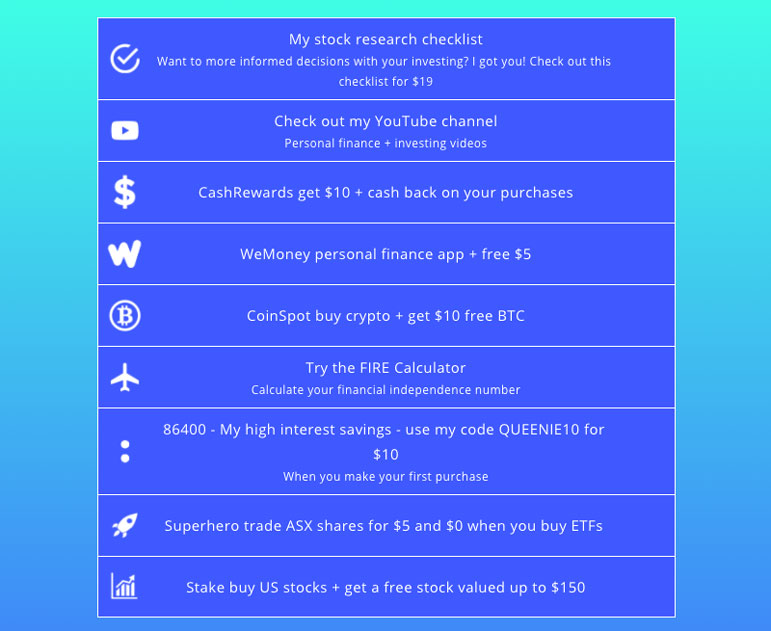

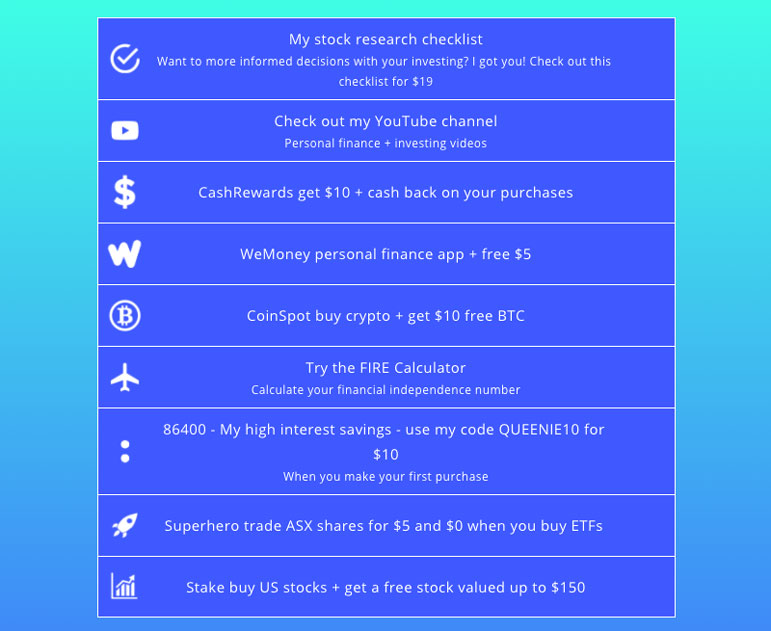

Like other social platforms, TikTok allows content creators to include a link in their profile, and here Queenie shares a range of content – from free value-add content on her own site e.g. the ‘FIRE’ calculator which allows people to learn how much they need to have saved to retire early, to affiliate links to trading platforms and other financial products:

For marketers, the opportunity here is to partner with a content creator and offer something that benefits both them and their audience. Almost every link in Queenie’s bio includes a benefit for the person taking up the offer, as well as a referral fee for Queenie.

Of course, your audience may not match with Queenie’s, but the principle of reciprocity, or mutual gain, is one that can be applied to almost any performance-driven marketing campaign.

Twitter

Twitter can be a great source of real-time news and for audiences that benefit from regular updates, it can be the perfect place to grow awareness.

The active trading community is a great example of this, with many influencers sharing stock tips, screenshots, trading wins and losses.

Active users may be professional traders (Assad Tannous with nearly 100k followers), media personalities in the investment space (David Scutt of AusBiz.tv with 20k followers) or just enthusiastic amateurs who keep their actual identity a secret (@Stockrocker_ASX with 15k followers), but each has grown a following of people who look to them for tips and advice:

Twitter tends to be less obviously monetised than other platforms, possibly because the creators aren’t necessarily trying to build a personal brand they can monetise – many don’t need to. However, if you have a product that fits with an active audience on Twitter, it can be a great source of exposure to build your brand.

Youtube

Youtube lends itself to longer-form content, with content creators being rewarded by Youtube’s algorithm based on the length of time people stay on the platform and watching videos.

10 minutes is the magic number here, which is why many videos tend to be 10-12 minutes long – long-enough to receive the monetisation benefit, but not so long that people lose interest.

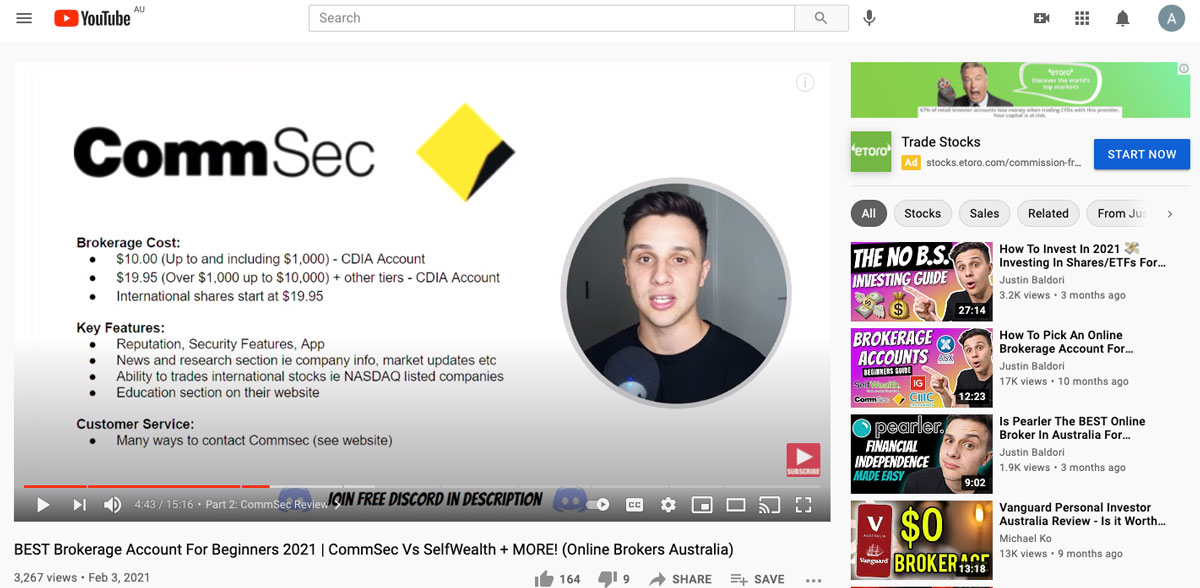

Justin Baldori is a 25 year old Melburnian with over 15,000 subscribers who discusses investment tips and reviews and compares investing platforms:

Like Queenie, Justin primarily monetises his audience through performance-based marketing, with links in his bio to a range of products he endorses.

Instagram

‘Insta’ is primarily a visual platform, and financial-focused accounts are no different. Memes, inspirational messages and a tight color scheme all contribute to ensuring that finance content fits with what users have come to expect.

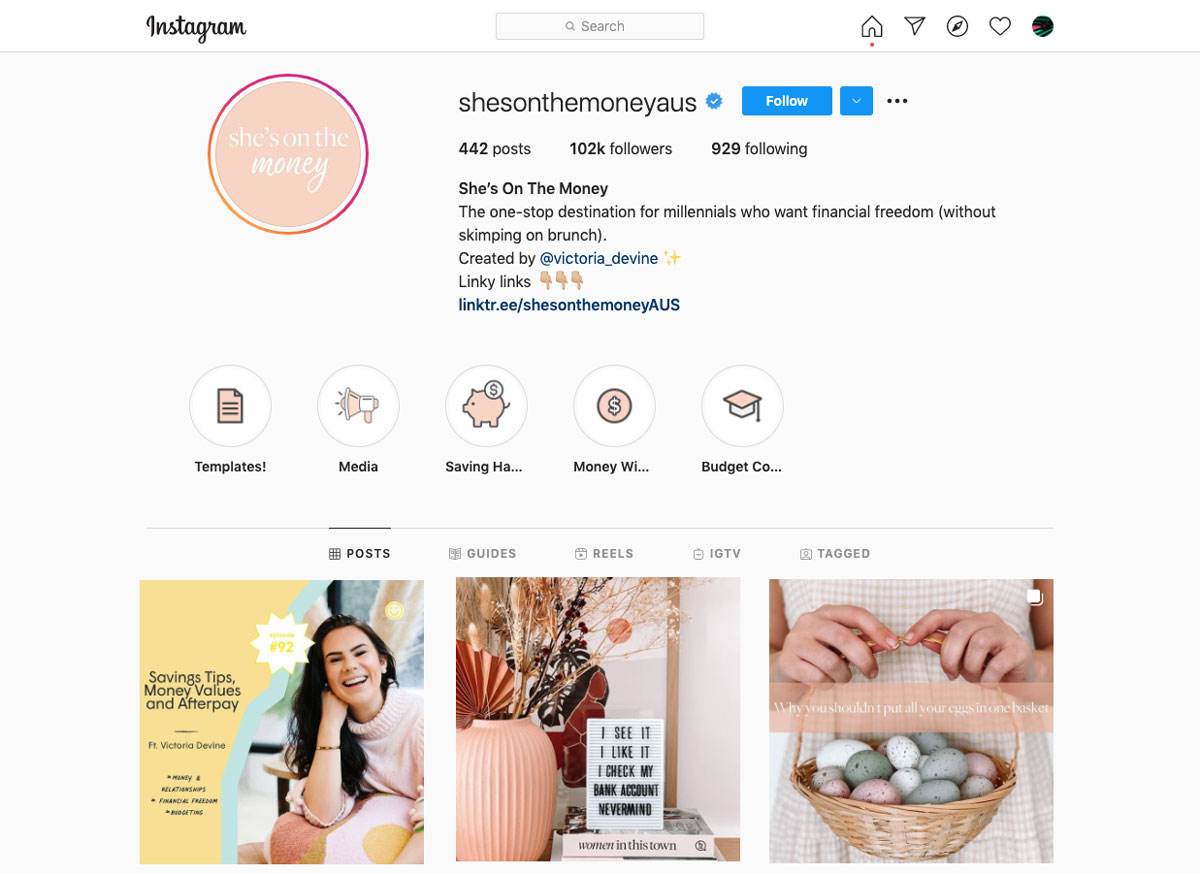

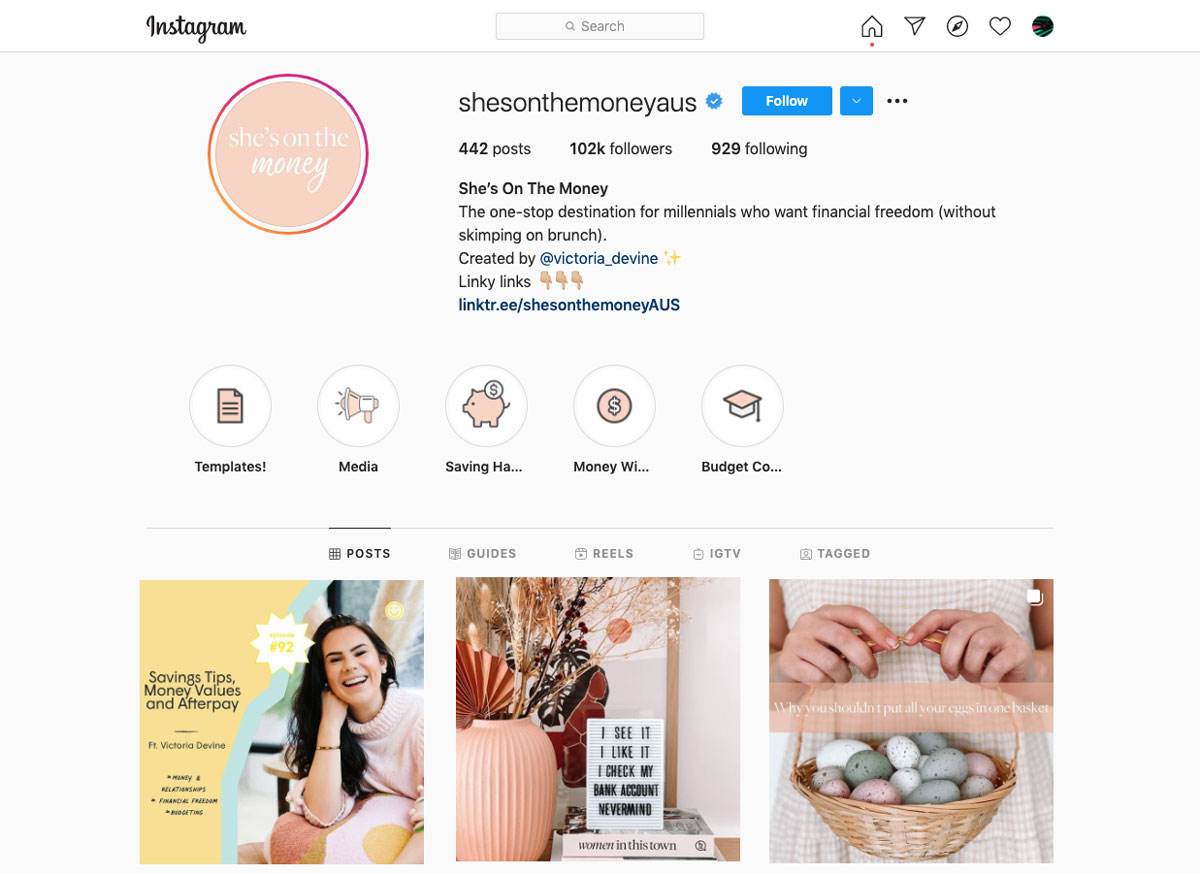

Like TikTok, Instagram is a short-form content platform and is often used as part of a larger content marketing strategy. @shesonthemoneyaus is just one of the channels that Victoria Devine (who does have an AFSL) operates, which also incorporates a blog, Facebook group with 165k members, podcast, online courses and a soon-to-be-launched book.

What’s obvious when reviewing her content is how tightly tailored it is to the target audience. Victoria clearly has a clearly-defined target persona and ensures that all her content is answering their needs.

Podcasts

Podcasts can be one of the best ways for content creators to build personal connections with their audiences. Easy-to-consume and informal in tone, audiences can feel like they really know a host, even if they have never met them. With this familiarity, comes deep trust.

Business, personal finance and investing are some of the most popular podcast categories, and Equitymates, hosted by Bryce Leske and Alec Renehan aims to explain investing ‘from beginning to dividend’ for their audience of young, Australian investors.

Podcasts are often monetised by ads delivered by the presenters, frequently at the beginning of the podcast to ensure that as many listeners as possible hear it. This may be a flat-fee, based on the number of listeners, or it may have a performance aspect. Many podcasts will share a personal URL for listeners to receive a bonus when signing up with a service.

How to find the right financial influencer for you

The examples here should have shown you the diversity of channels and audiences that can be reached by small-scale content creators. But finding the right audience requires the same level of strategic thinking as any campaign. These tips should help:

1. Understand what you want to achieve

Do you want to build brand awareness, attract a new target market or facilitate lead generation? Each objective will affect how you choose the influencer to partner with, which channel to focus on and how you reward them.

2. Understand where your audience lives

Knowing which channels your target personas use is key to shortlisting potential partners and maximising the effectiveness of an influencer campaign. Even an finfluencer with a relatively small audience can deliver large results if they are a perfect fit for your audience.

3. Ensure your offer is a good fit for the influencer’s audience

Unlike traditional media sponsorships, most influencers won’t have a media pack which details their demographics, etc. However, u how does this point conclude?

4. Understand how the remuneration model works within your sector

While referral schemes can be a great way to drive leads, some content creators are more comfortable with the guarantee offered by sponsorship.

5. Encourage them to try your product or service

The best type of testimonial is from someone who actually uses your product and can talk confidently about it, rather than just rehashing supplied content. By encouraging them to become a user, you’ll ensure that their recommendation feels authentic because it is authentic.

While the influencers and channels featured may not be right for every brand, the principles behind working with people who have built an audience through creating high quality content can be applied to almost any organisation. A key factor for success is looking for a triple-win – where the creator’s audience, the creator themselves and your organisation all come out ahead.