Digital marketing has revolutionised our ability to target, track and optimise campaigns. Where previously the direct impact of above the line campaigns was once almost impossible to ascertain, we now have transparency (albeit through the sometimes murky lens of digital data).

Whilst digital has delivered increased effectiveness, it’s also generated a culture of short-termism, focused on customer acquisition, rather than on brand and loyalty.

Our businesses demand results, now. But for many, this has this come at the expense of creating and communicating brand stories, which appear to be less effective in driving a return on investment.

However, research has emerged that may prove that this short-term focus is misplaced.

Are marketers’ expectations focused on the wrong metrics?

At Yell, we’re big on data-driven marketing. Our clients demand that we everything we do drives growth through activity can be directly tied back to business-relevant metrics.

A significant part of our campaign planning process is therefore establishing which objectives will really move the needle. Sure, clicks and views are great, but we strive to avoid ‘vanity metrics’ that look good at first glance but don’t deliver for our clients’ bottom line.

We were therefore very interested to read recent research from The Institute of Practitioners in Advertising in the UK. Titled ‘The Long and the Short of it’, the research by Les Binet and Peter Field studied the effectiveness of 1,000 campaigns over 10 years and delivers insights that go against much current marketing practice.

Long-term vs. short-term

Before we continue, it’s worth defining:

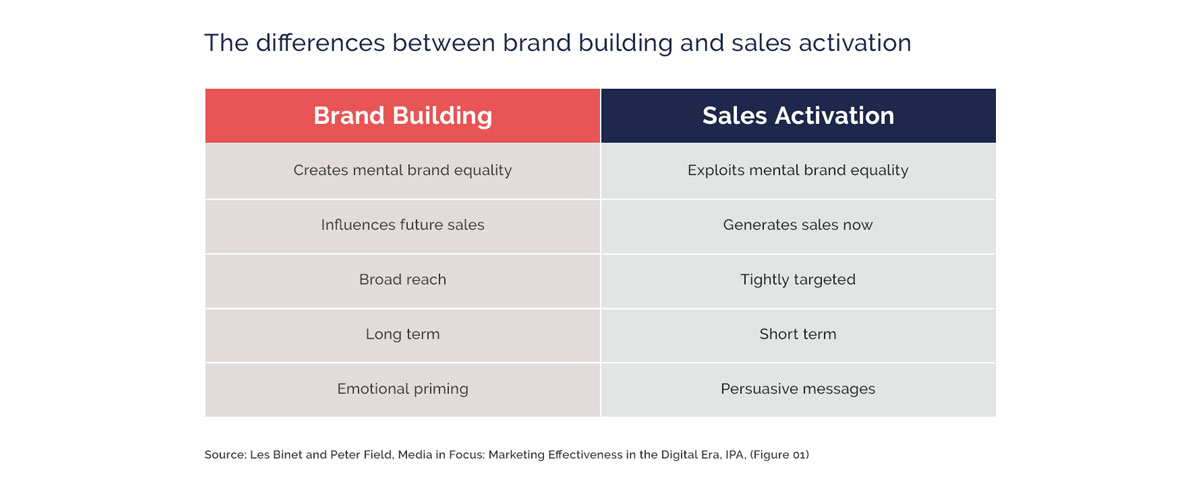

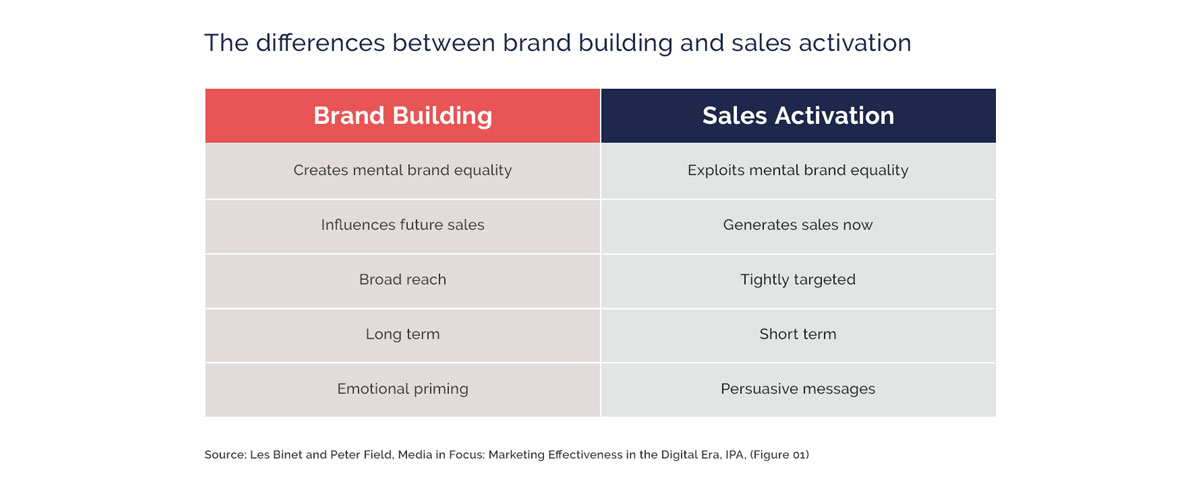

Brand building is activity that is designed to position a business in the mind of customers and prime them to want to actively choose the brand. It takes a long-term view and may have not require an interaction to take place

Sales activation is activity designed to deliver short-term sales uplifts and involves behavioural prompts to encourage consumers to ‘buy now’. It takes a short-term view and is designed to deliver results.

Binet and Field’s study focused on the relative importance of short-term ‘sales activation’ and long-term ‘brand building’ activity in delivering effective business results. They basically examined which approach delivers the best commercial return.

The new 60/40 rule

After examining 1,000 campaigns over 10 years, Binet and Field found that neither brand building nor sales activation is necessarily ‘better’. Each has their part to play in delivering sustainable business growth.

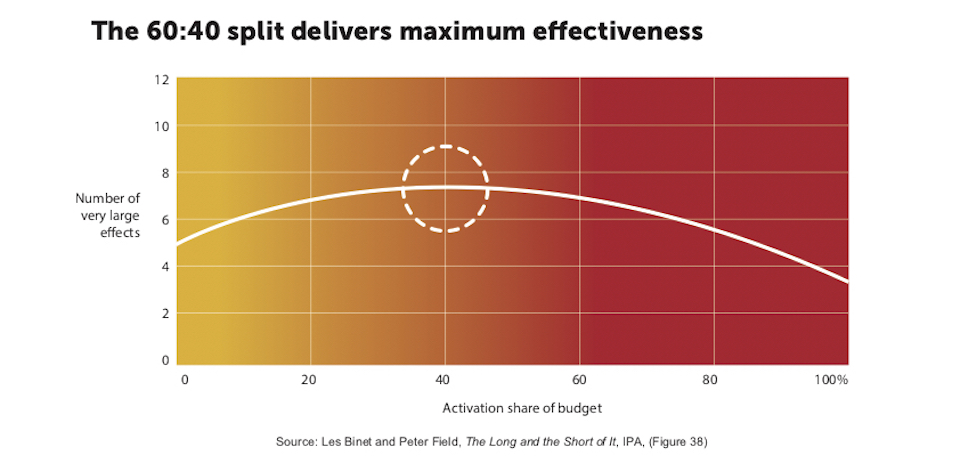

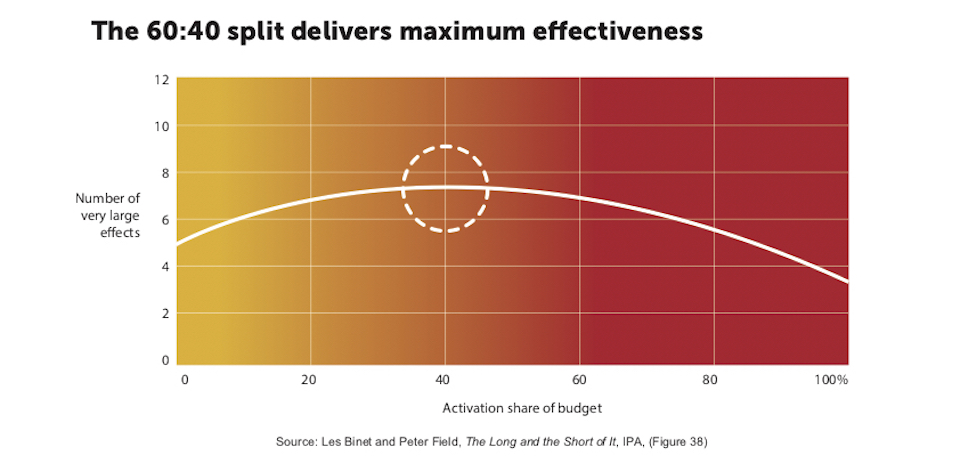

But what they did find about the relative importance of the two may be counterintuitive. The optimum balance for delivering maximum effectiveness is spending 40% of budget on sales activation, with the remaining 60% dedicated to brand building:

Which means that contrary to most of your businesses’ demands on delivering short-term outcomes, you should be spending more than 50% of your budget and effort on long-term brand building.

Why investing in brand brings its rewards

In today’s world of budget cycles and quarterly targets, it’s unquestionable that sales activation is ‘winning’ at the expense of brand building in Australian finance marketing. Everyone wants to make their numbers.

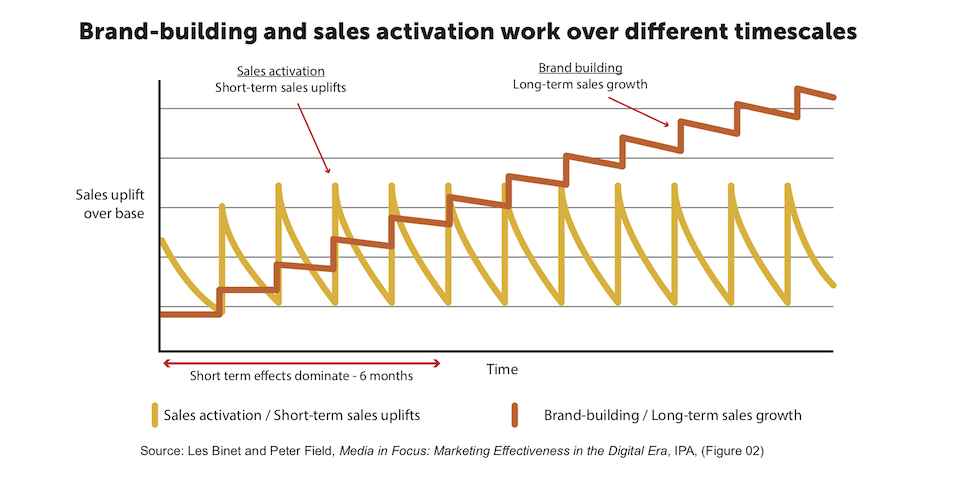

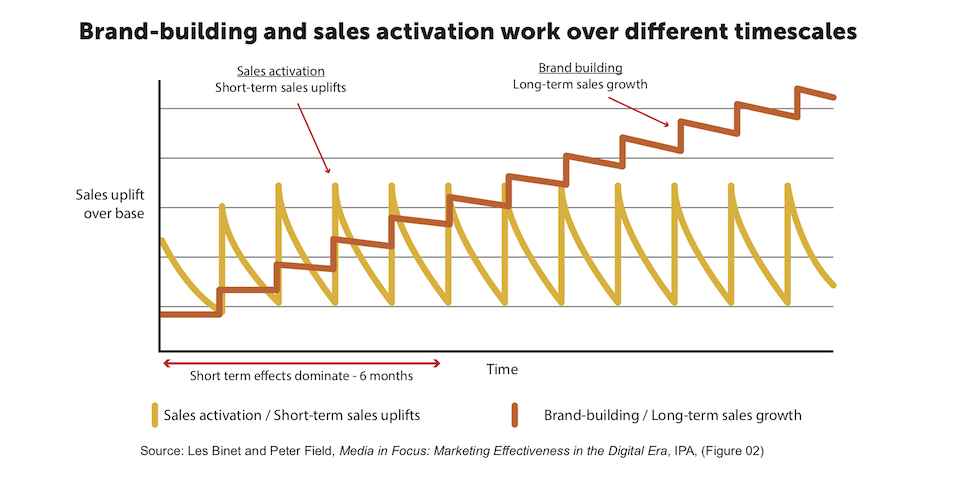

The issue comes from the fact that the effects of brand building and sales activation are not generated by campaigns in the same way across time:

Focusing on just short-term results may deliver the sugar-hit of sales uplifts, but they do not contribute to sales growth in the long-term. Plus, when the tap of short-term sales activation is turned off, so too are the leads and sales.

However, the good news is that Binet and Field have demonstrated that, over time, an ongoing investment in brand outperforms short-term activation, driving not just sales, but growth.

This growth comes from loyalty, created by emotional connections. Loyalty creates retention and retained customers are far more profitable than those you need to acquire.

More watering, less plucking

One way to think about this is to picture your brand as a tree.

Building a brand is like watering the tree. Not something that will pay immediate dividends, but an activity that will pay off in the future.

Sales activation activity is picking the fruit from the tree. Instant results and gratification, but it doesn’t contribute to future growth.

As we’ve seen in Yell’s 2019 marketing survey results, there is a distinct split between rational and emotional needs when making choices about financial providers.

Short-term campaigns tend to talk to those rational needs, while brand campaigns tell stories that trigger an emotional reaction – which creative behavioural and cognitive change. Brand talks to our subconscious, sales to our conscious.

How you can leverage this insight

Firstly, it’s clear from Binet and Field’s research that brand campaigns deliver reach and create emotional impact. They’ve demonstrated that an investment in brand is the main driver of long-term growth and without it, sales activation will be weaker, pricing power will not improve and profitability will be severely reduced.

Equally, all brands need sales activation. Activation campaigns are product-based, more granular and targeted at specific audiences. They’re designed to deliver short-term sales uplifts and are essential is identifying efficiency and demonstrating and delivering more effective marketing.

But it’s important to remember that the effectiveness of sales activation is boosted by brand building.

Where emotional consideration is high, brand building is easier. Where rational consideration is high, activation is easier.

The optimum balance between brand building and activation that is right for your business will depend on your exact market. Where emotional consideration is high, brand building is easier. Where rational consideration is high, activation is easier. Key factors to consider include the relative levels of emotional and rational consideration your consumers’ choice.

We talked a lot about the relative focus of rational vs. emotional drivers in the 2019 Financial Marketing Survey, with consumer insights from Ipsos

If you’d like to understand more about the rational and emotional factors that drive your customers’ decisions, we’d love to help. Our Emotional Positioning Audit helps financial services organisations like yours understand their customers’ emotional needs and how they can be met, helping you build more secure and more profitable relationships. If you’d like to know more, send Nigel an email to discuss.