It’s been another ‘interesting’ year for the Australian finance industry and with industry disruption continuing apace, it seems that 2020 will continue to keep us on our toes.

In this preview of what 2020 is going to bring, we wanted to stay away from the hyped-up new technologies and focus on what we think is really going to make a difference in 2020.

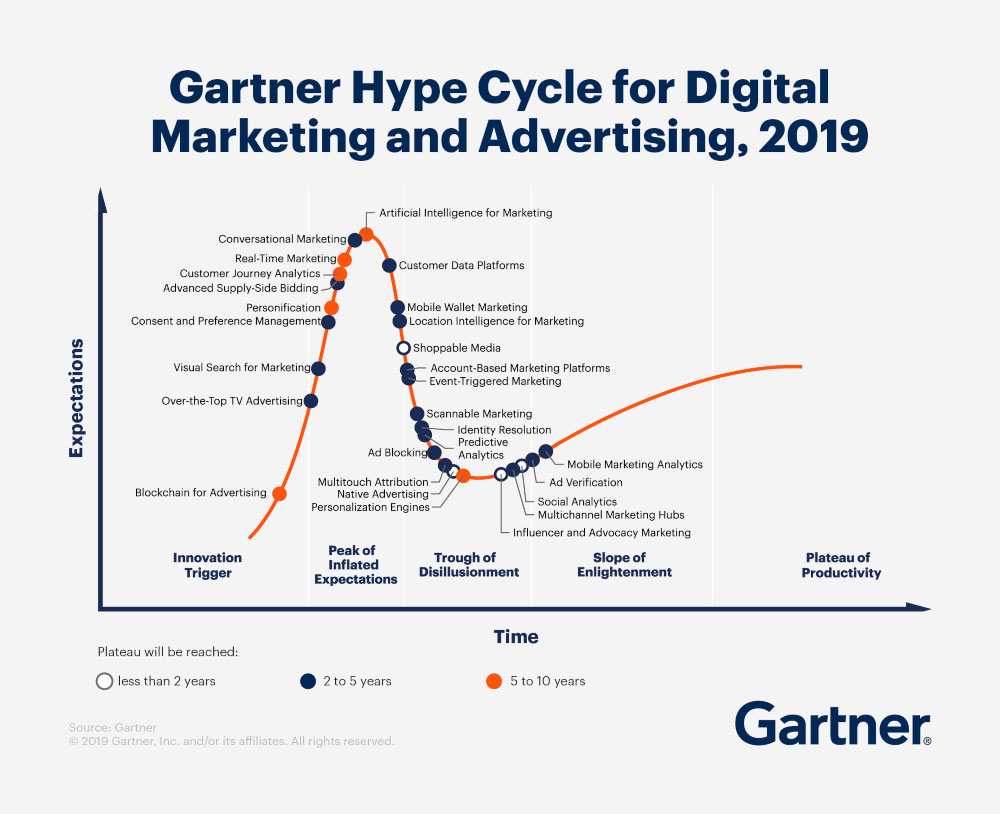

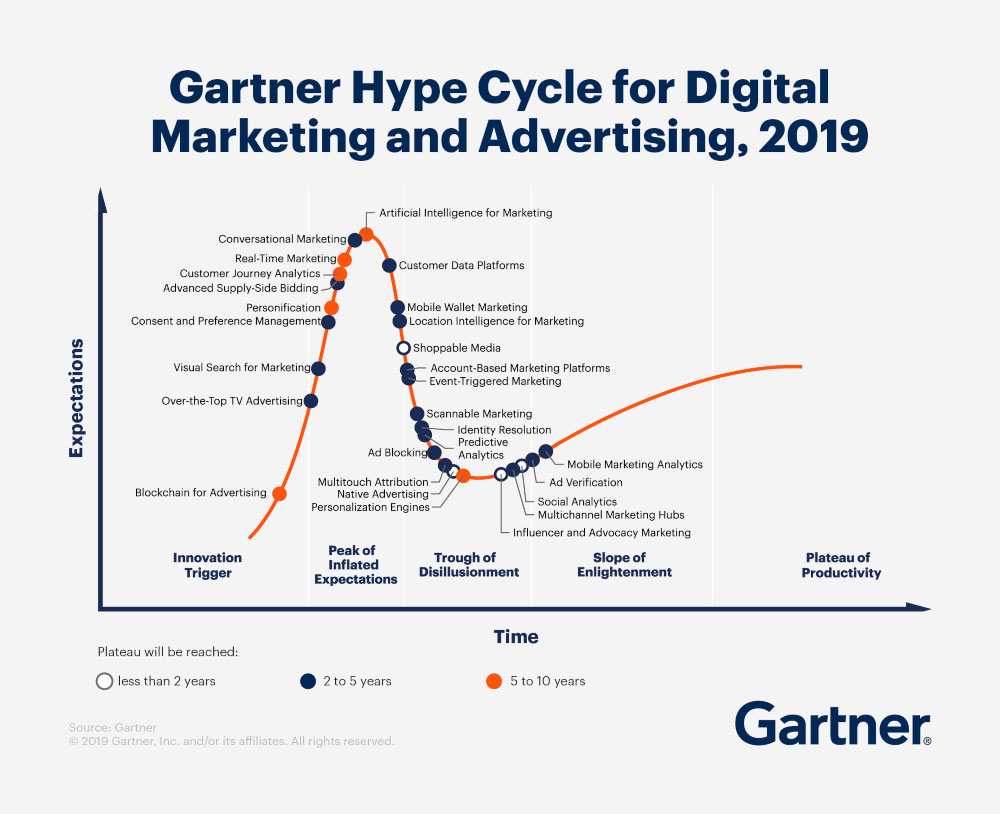

If you do want to know what the pundits will be talking about with breathless excitement over the next year, then we’d encourage you to check out the peak of the Gartner ‘hype cycle’, which is published every year:

In this article we’ve included six wide-ranging predictions on what will be front-of-mind for finance marketers in 2020.

Challenger neo-banks

For several years, fintech-focused challenger banks have been on the horizon and the subject of much hype…and after much delay, we can finally see if and how they will disrupt the current banking market.

Two of the most anticipated – Xinja and 86400 – launched in Australia in September, while Volt is planning a ‘Spring 2019’ launch. For each of these new entrants, 2020 will be about creating engagement with the innovators and early adopters so important for driving uptake of a new product. If they can demonstrate a point of difference and deliver where the established banks lack flexibility and customer focus, they may do well.

But it could be hard going. Our ‘State of Financial Marketing’ surveys has consistently shown that while individuals may not trust ‘banks’, they’re often satisfied with their bank, as their everyday interactions they have with them are generally positive.

Plus, Australia already has challenger banks – from online-only like UBank and ING to ethical options like Bank of Australia. Have those who could be tempted away from the Big 4 already jumped ship?

NeoBanks have seen considerable success in the UK and Europe: Monzo, founded in 2015 has 1 million customers, while Revolut has amassed 3 million. Australian neobanks will be able to learn from their journeys which could provide some shortcuts to success. But with the Big 4 still controlling a huge majority of the banking market, especially mortgages and originations, the digital upstarts may find it difficult to make headway other than a few curious early adopters.

Neobanks do offer something different though: they have been built from the ground up with the customer firmly as the focus. It will be interesting to see whether this is enough to carve out significant market share.

Conversational banking

OK, we’ll include one bit of hyped up technology…

AI-powered chatbots have been on the verge of being the ‘next big thing’ for a few years, but they’re still riding high on the Gartner hype cycle. However, while autonomous chatbots may not completely replace human interactions anytime soon, what they can do is provide a more engaging alternative to some of the less interesting interactions that we provide our customers and prospects, like forms and calculators.

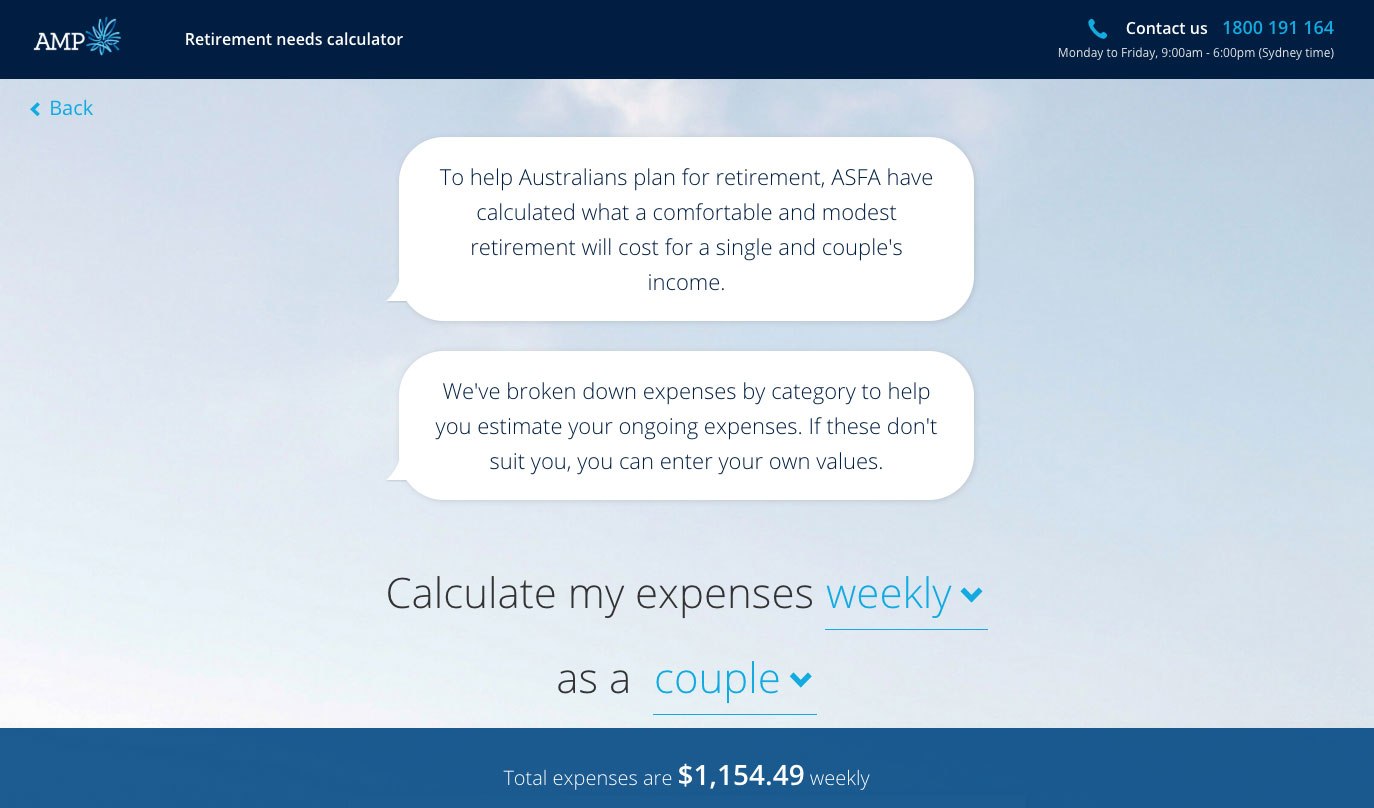

AMP’s conversational Retirement Needs Calculator is a good example of how conversational bots can make entering information feel more like an experience rather than a chore:

It also allows educational, and even product messages, to be woven into the experience, with AI used to tailor the conversation to ensure that the right people receive the right message at the right time.

While we’re still bearish on chatbots delivering satisfactory open-ended conversations that replace human operators in the foreseeable future, we think there will be an increasing number of ai-powered chat-like experiences making our digital interactions more engaging in 2020.

Increased focus on data security

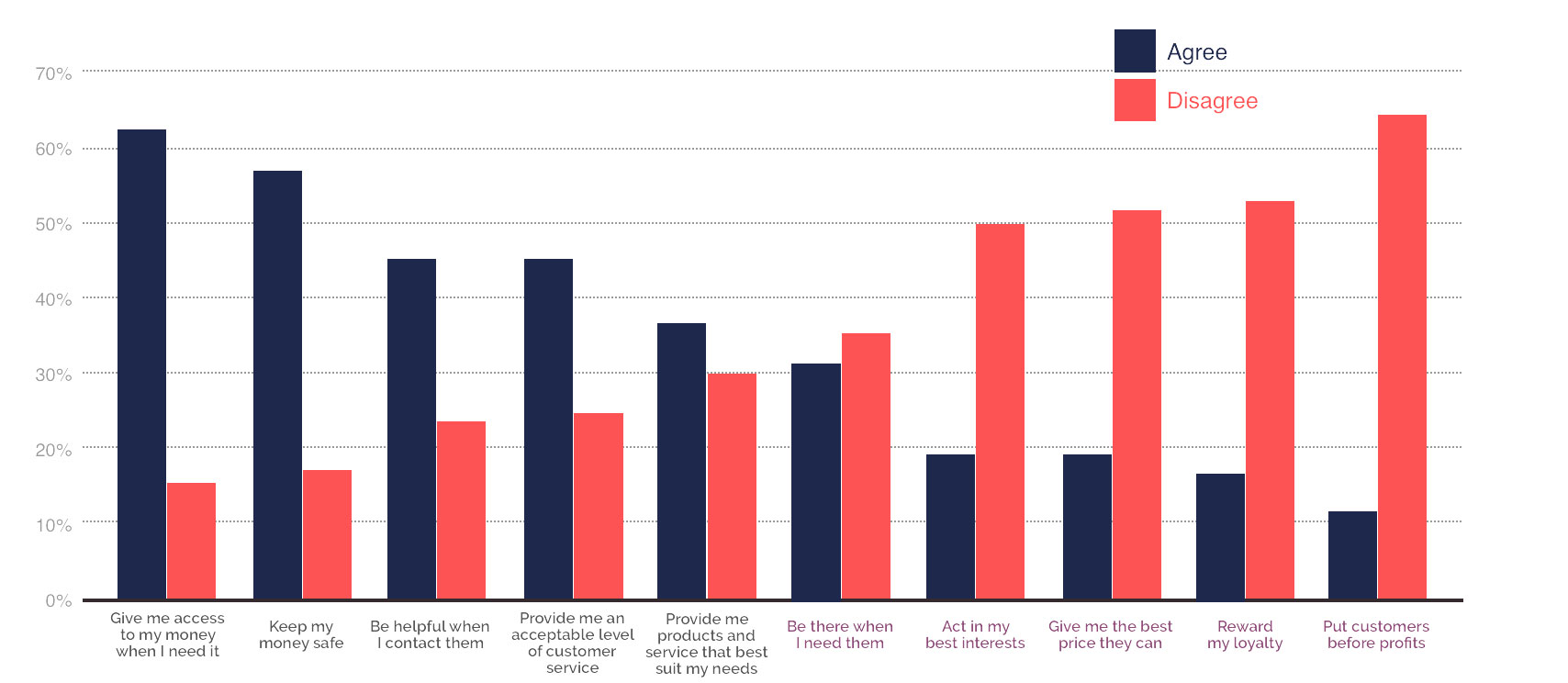

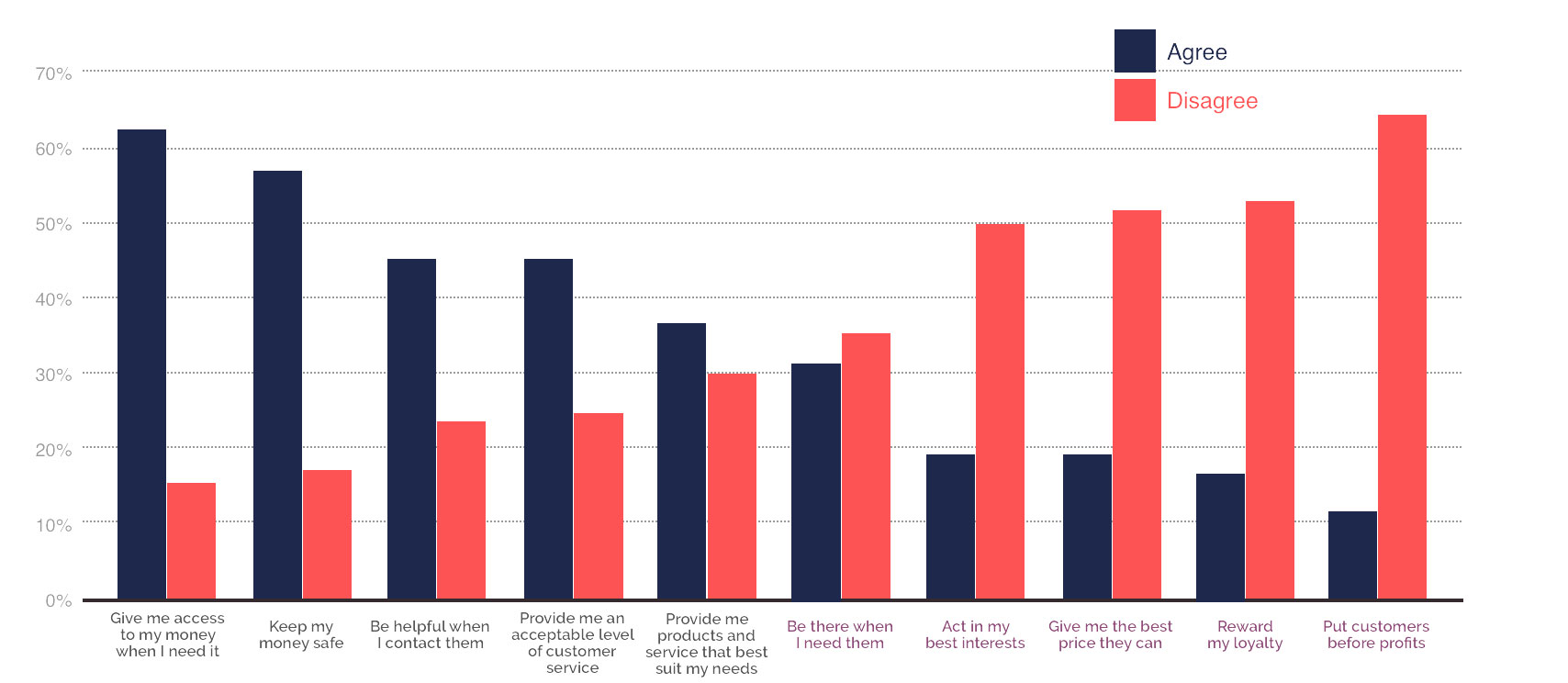

Yell’s 2019 State of Financial Marketing Survey revealed that customers trust banks of all sizes to meet their rational needs – keeping their money safe, giving access to them when they need it, etc.

Where trust in the Big 4 fell down was on more emotional factors. Customers didn’t trust large banks to put the customer’s interests before the banks, for example.

But recent developments like Westpac’s high-profile breach of money-laundering laws may mean that consumers’ levels of trust in banks falls, even for the more rational trust factors.

To counter this, we expect that data security will be an increased focus in 2020, which has very real implications for marketers. How customer information is obtained, stored and secured will all be the subject of review, with both voice and non-voice data needs to be monitored and managed.

Financial services organisations need to ensure that they are recording the information they need to identify customers but not storing needlessly storing highly sensitive data that could be subject to a breach. A tricky balance, which will be aided by the investment in AI tools which can monitor content (including speech) to ensure sensitive details are not recorded, limiting the chance of a breach occurring.

While marketers may not be the ones implementing the tools directly or be responsible for ensuring compliance, changes to data security will affect what can be gathered and how it can be deployed in our campaigns.

Content that is truly useful

Content marketing is now well-established and has evolved as the initial hype has died down. Organisations now rightly demand that content delivers a return on investment.

In the past, content marketers have been tempted to weave more product-focused sales messages into their content, usually resulting in content that doesn’t satisfy readers or search engines.

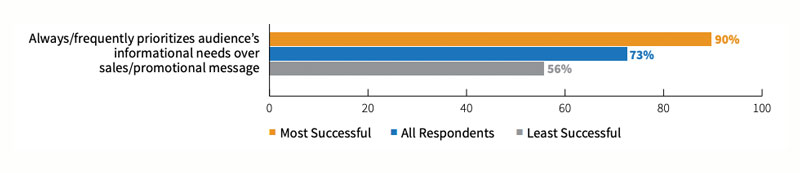

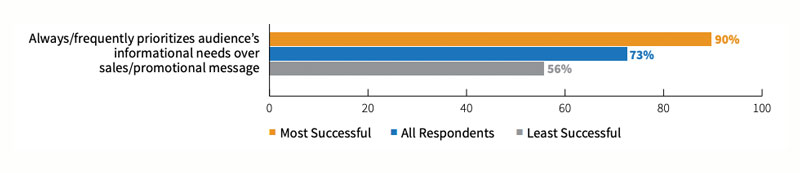

However, the Content Marketing Institute’s latest report shows that an overwhelming majority of the most successful content marketers (90%) prioritise the audience’s informational needs over their sales/promotional message, compared with 56% of the least successful.

Why is this important? Because customer-focused content is key to win with readers and with search engines.

Building trust with audiences begins with offering guidance without a catch, while content that hits the user’s needs dead-one is the type that will rank #1 with Google.

Key to delivering on this is really understanding the informational needs of your prospects – researching, asking questions and engaging with them will mean that you can create content ultra-targeted content.

And by helping readers with their search intent, Google will reward and prioritise your content to ensure that you have a regular flow of prospects to achieve your sales targets.

Purpose-based positioning

Over the last year we have seen some of Australia’s largest financial firms under close scrutiny, with their ethics and value they’re contributing to society being questioned.

On the other side, we’ve seen smaller financial firms lead with purpose-based positioning to great success – Bank of Australia and ‘The Bank Australia needs’ comes to mind.

What we have started to see, but not enough for our liking, is businesses that are looking to build a deeper emotional connection with customers through a shared purpose.

What’s a purpose?

At its most basic, it’s the motivations and ideals of your organisation and how it can contribute to society. Staying away from jargon, it’s the reason that customers would choose you over competitors and the reason that employees will look forward to going to work every day.

Being purpose-led makes sense for the bottom-line too. Former P&G global marketing director Jim Stengel collected 10 years of data across 50,000 brands, where he identified that brands aligned with serving a higher purpose delivered stronger financial outcomes.

Those firms with ‘higher ideals’ – with a purpose focused on improving people’s lives – grew three times faster than their competitors. Stengel even claimed that investing in his resulting ‘Stengel 50’ over that decade would have outperformed the S&P 500 by 400%.

In 2020, we feel that we’re going to see more brands leveraging purpose to differentiate and dominate.

Return of the brand

Related to this will be a renewed focus on brand-campaigns, rather than the single-minded focus on tactical digital campaigns which have been ubiquitous over the last five years.

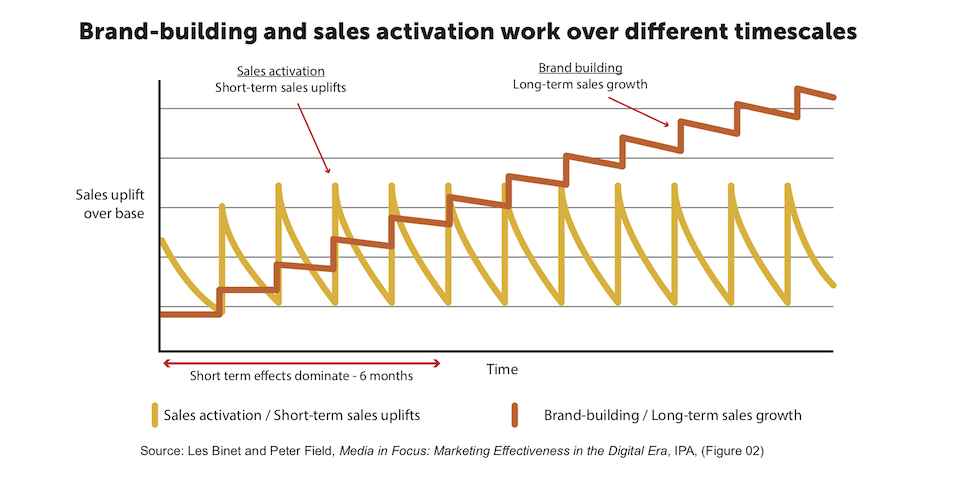

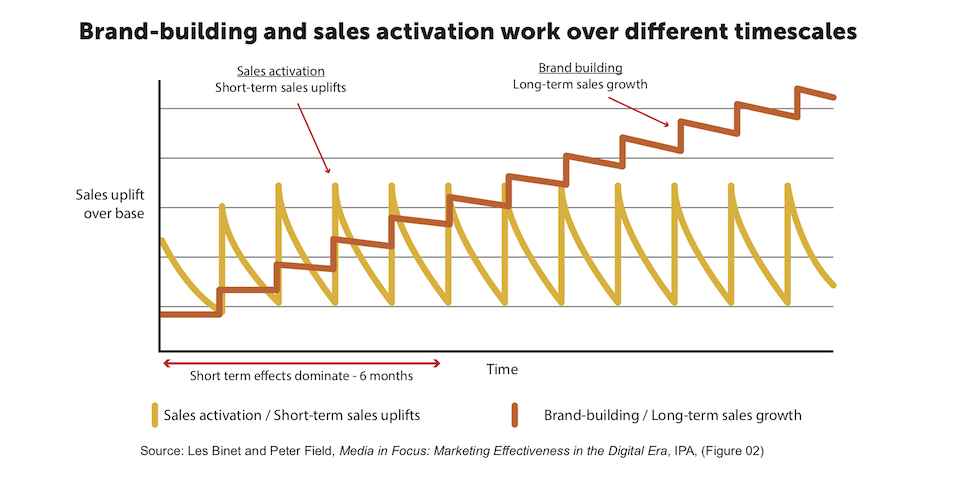

One of the most eye-opening pieces of research we’ve seen was the Binet & Field study of marketing effectiveness, which determined that the optimum split between spend was 60% on brand building and 40% on sales activation:

As brands seek to build deeper connections with customers, we’re going to see more brand campaigns that amplify the business’s differentiators and seek to build an emotional bond.

This has already started with the Big 4.

So those are our six trends:

- Challenger neo-banks being the ones to watch.

- Conversational interactions making even the smallest interactions more engaging.

- Increased focus on data security which will affect what data marketers can collect and how it can be deployed.

- Content continuing the shift towards being truly useful to readers rather than to push product, resulting in better reader engagement and better performance in search engines.

- Organisations ensuring that they have a deeper purpose – rather than just profit – with purpose-based marketing used to align messaging with what their customers truly care about.

- The resurgence of the brand campaign which will deliver long-term benefits to the bottom line, even after the campaign has ended.