There’s a lot of excitement in the marketing world at the moment about chatbots, with Microsoft CEO Satya Nadella even declaring ‘bots are the new apps’.

Much of the buzz is around chatbots’ potential to revolutionise how organisations interact with consumers through ‘conversational commerce’ – a term coined by Chris Messina, the User Experience Lead at Uber.

Conversational commerce occurs when a user interacts with a brand and completes a transaction using ‘natural language’ through a chat or messenger application e.g. within Whatsapp or Facebook Messenger. The idea is it will make completing a transaction as easy and natural as texting a friend.

It’s undeniably a cool and intriguing application of technology, and one that Uber itself is at the forefront of. Facebook Messenger users in the US can now hail an Uber directly from Messenger by clicking an address in a conversation and interacting directly with an Uber AI bot.

The amount of coverage and buzz could give the impression that conversational commerce is the solution to all marketing problems and something all organisations should be looking to introduce.

In this blog, we’ll look at why conversational commerce has become such a hot topic, the implications for financial services and what the barriers to introducing it in our industry could be.

Why is conversational commerce important?

The rise of conversational commerce is due to two factors – the exploding popularity of mobile messaging apps and advances in artificial intelligence.

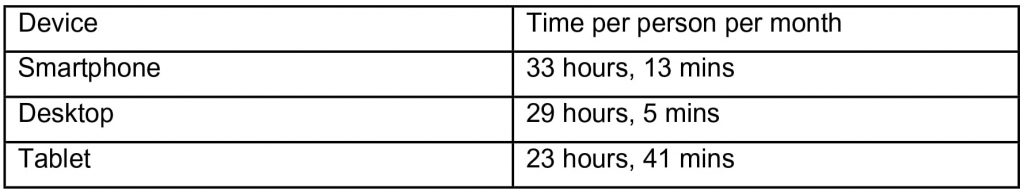

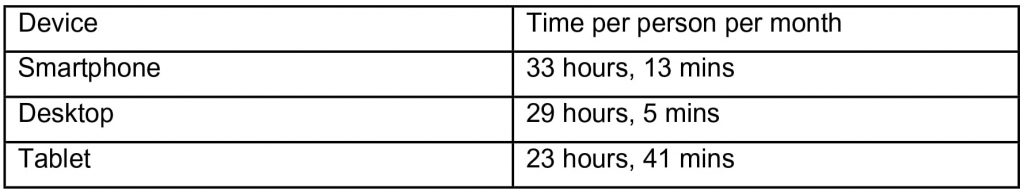

The IAB Nielsen’s Mobile Ratings Report 2015 confirmed something that had long been suspected – Australians live in a mobile-first world. We spend more time on smartphones than any other digital device, at just over 33 hours per person, per month.

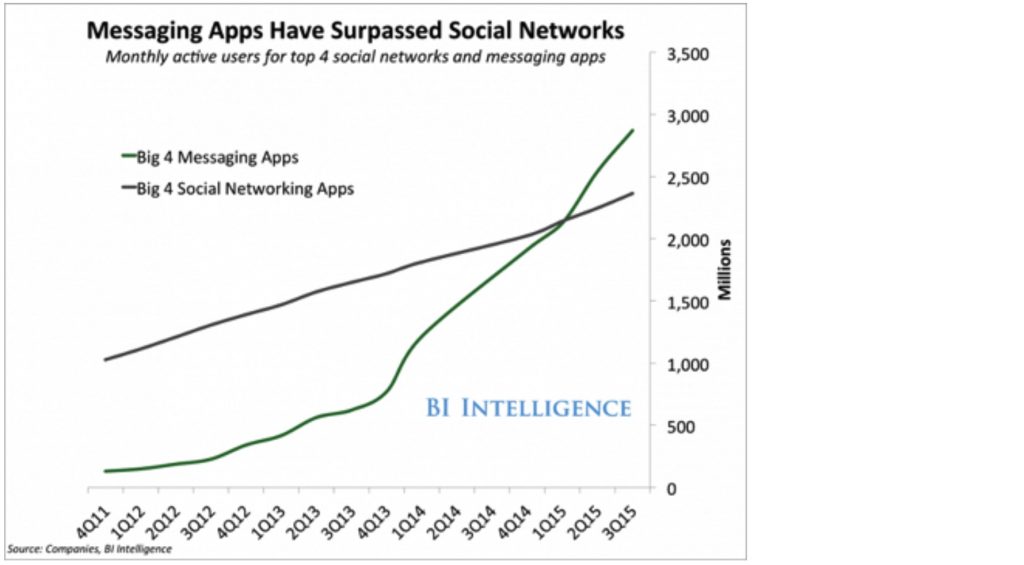

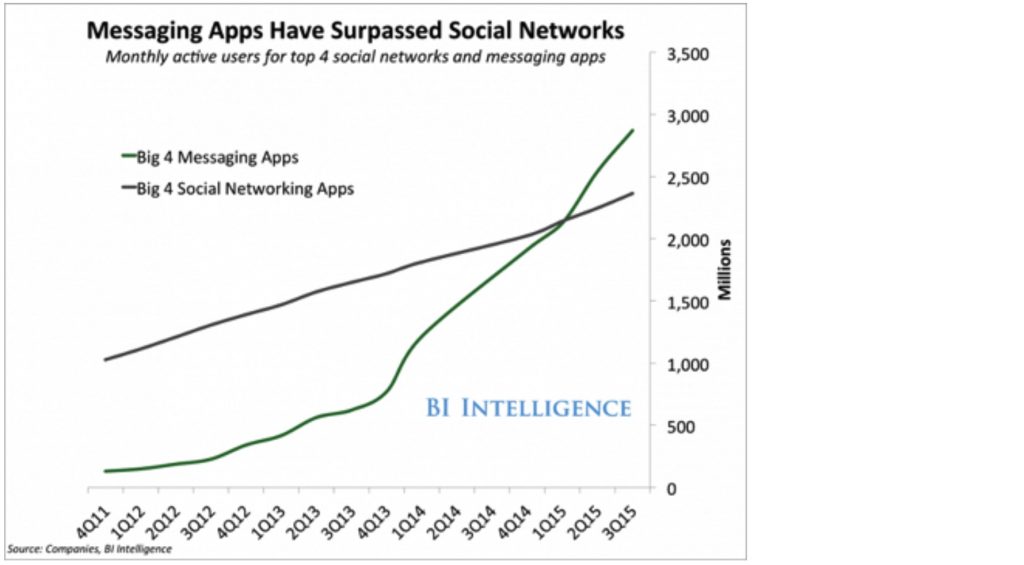

So more Australians are spending more time on mobile than ever before. But what are they doing? Data from BI Intelligence indicates they are increasingly using messaging apps, rather than social networks:

The ‘Big 4 messaging apps’ covers WhatsApp, Facebook Messenger, WeChat, and Viber, which between them have 2.125 billion users worldwide.

While WeChat isn’t widely known in Australia, it’s the largest mobile messaging app in China with over 700 million active users. China has been an early adopter of conversational commerce, and WeChat’s estimated in-app revenue is US$500billion (AU$728 billion) per year, almost double that of PayPal.

Consumer adoption in the West has been slower, but Facebook reports there are now over 34,000 chatbots active in Facebook messenger, allowing users to perform tasks such as make e-commerce purchases, ask health questions or read reviews of products or services. So far though, chatbot uptake from financial services organisations has been slow. This may be due to the possible security and privacy issues that could arise from sharing financial information over what could be seen as a less secure platform than most banks’ native apps.

However, that could change soon with the launch of Mastercard’s Facebook messenger app, which may show whether conversational commerce can be made to work for FS.

Mastercard for Messenger

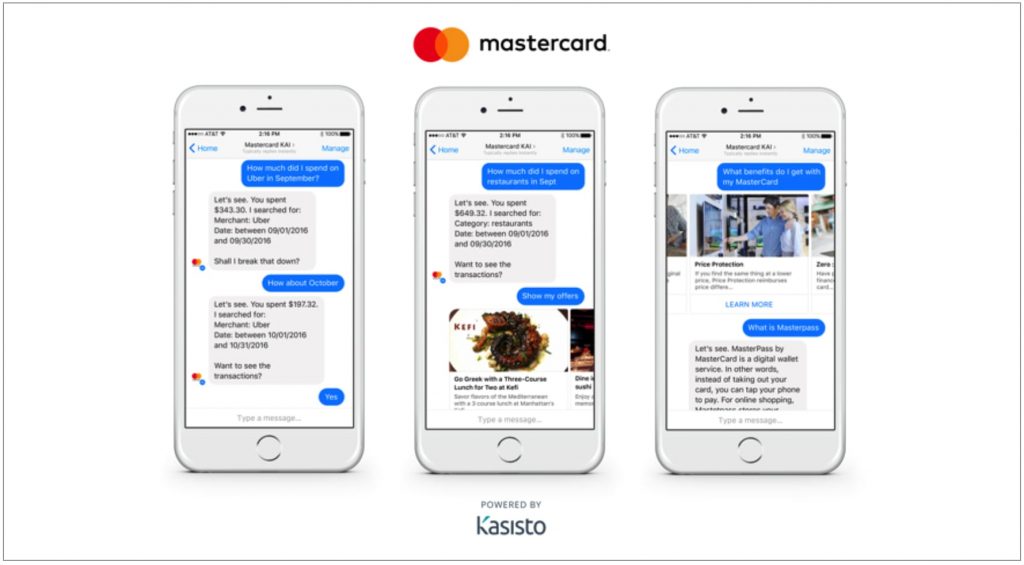

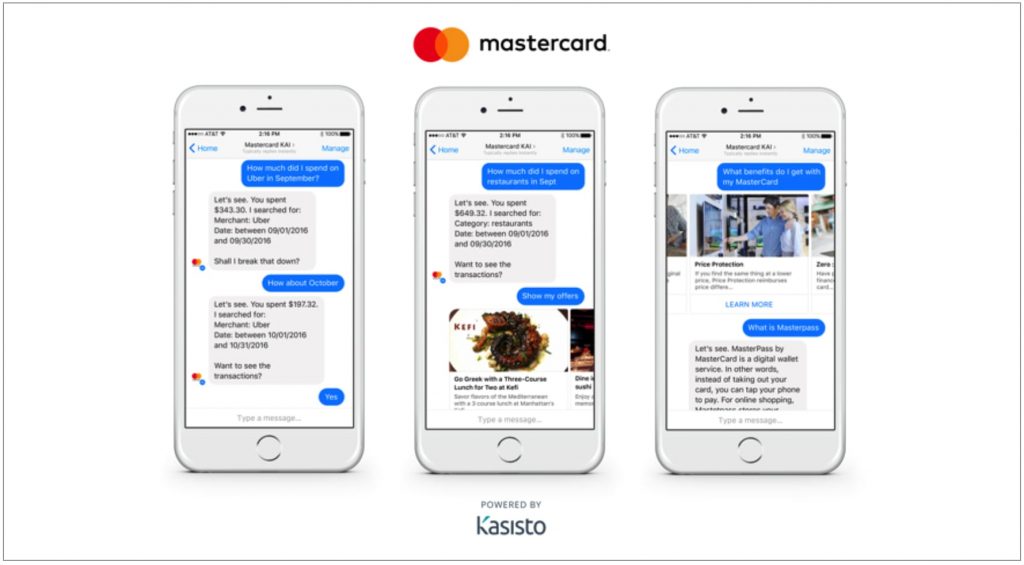

MasterCard’s chatbot will allow customers to “transact, manage finances, and shop via messaging platforms.”

Users will be able to chat with the bot to ask questions about their account, look at purchase history, monitor spending levels, receive assistance with financial literacy, and more.

Mastercard’s conversational commerce platform will be powered by third party technology – Kasisto’s KAI Banking AI platform. With this type of interaction, users are a step removed from interacting with the service provider – while they will be interacting with Mastercard, with will be doing so through Facebook Messenger. So what could this type of interaction mean for loyalty to financial services organisations?

Effect of messenger-based interactions.

Financial Services conversational commerce like this could potentially have large negative effects for Financial Services brands and their relationships with customers.

Users who primarily interact through a messenger may start to see institutions as just a back-end service provider, resulting in a lack of loyalty to their financial services organisation. The end result? The old saying that consumers are more likely to change partners than their banks may no longer hold true.

If messenger platforms own the relationship with users, this could leave financial services open to further disruption if technology companies decide to move into Financial Services. According to the Millennial Disruption Index, a third of Millennials believe they will not need a bank at all in the near future, while 73% claim they would be more excited about a new financial services offering from Apple, Amazon, Google or PayPal than from their bank.

An overstated threat?

The appeal of the chatbots is that users can interact with organisations in the channel of their choice and the simplicity of the interaction.

However, the field of AI is still maturing and currently the capability of AI to usefully answer queries can be limited, which can result in a frustrating user experience. No one wants a repeat of Clippy – Microsoft’s eager but infuriating assistant, which featured in Microsoft office ’97, before being quietly retired in the next version.

Organisations need to be careful that they don’t apply AI to situations where they aren’t appropriate, or where the technology isn’t ready to handle the complexity of the queries that will be asked of it.

If users have a poor experience, they may choose not to interact with bots at all, ending the use of a promising technology before it has even started.

Effective use of chatbots for FS

For financial services, the way AI chatbots could be effectively used right now is to field enquiries and help users with simple tasks, while being smart enough to redirect to other channels for interactions that are too complex for them.

Chatbots could be used to process transactions, handle payments and provide simple customer service to frequently asked questions. In time, as technology develops, more complicated transactions can be automated with human intervention required only under exceptional circumstances.

The question remains though where this should happen for Financial Services organisations – in a messenger platform or in a Financial Services organisation’s own app. Due to the sensitive nature of the data, Yell’s opinion is that if chatbots and conversational commerce are going to be deployed, they should be within an app owned by the organisation. This will enable businesses to have far greater control over information security and ensure that the privacy and security of their customers is preserved.

A technology to watch, for the moment

Conversational commerce is an exciting development. It will be interesting to see how quickly effective AI technology can be developed to provide a service to users which is truly more useful than current ways of transacting.

If AI continues to develop and conversational commerce can be integrated into messenger apps, it could enable financial institutions to create entirely new consumer experiences – ones that are as easy and natural as texting a friend.

But, marketers and organisations need to ensure they are not distracted by ‘shiny object syndrome’ and resist the temptation to be ‘cool’ at the expense of effectiveness. Businesses must adopt a customer-first approach as they research and build conversational commerce applications to ensure that they are genuinely useful for their customers.