Trust and financial services is a big topic for us at Yell.

For finance companies, trust is the bedrock that everything else should stand upon, it’s the most important brand asset you have.

Without trust, it’s difficult to get prospects, clients, employees or stakeholders to engage with you in any way, much less become paying customers.

The challenge with trust is that it cannot be bought and you can’t force customers to believe your organisation is trustworthy.

Think of all those times someone has said to you “trust me” and ask yourself, did it work?

Your brand must work to earn trust, every interaction is an opportunity to build relationships and nurture trust. It’s the ultimate example of ‘show, don’t tell’.

In this post we’ll look at how some industry sectors have begun to repai reputations by doing exactly that in 2020, and how you can do the same in 2021.

Measuring perceptions of trust

For the last four years, consumer trust in financial services has been firmly at the heart of our finance marketing survey.

While the trustworthiness of our industry may have been overshadowed on the front pages this year, we were determined to keep measuring consumer sentiment, to aid our understanding of what influences perceptions of trust.

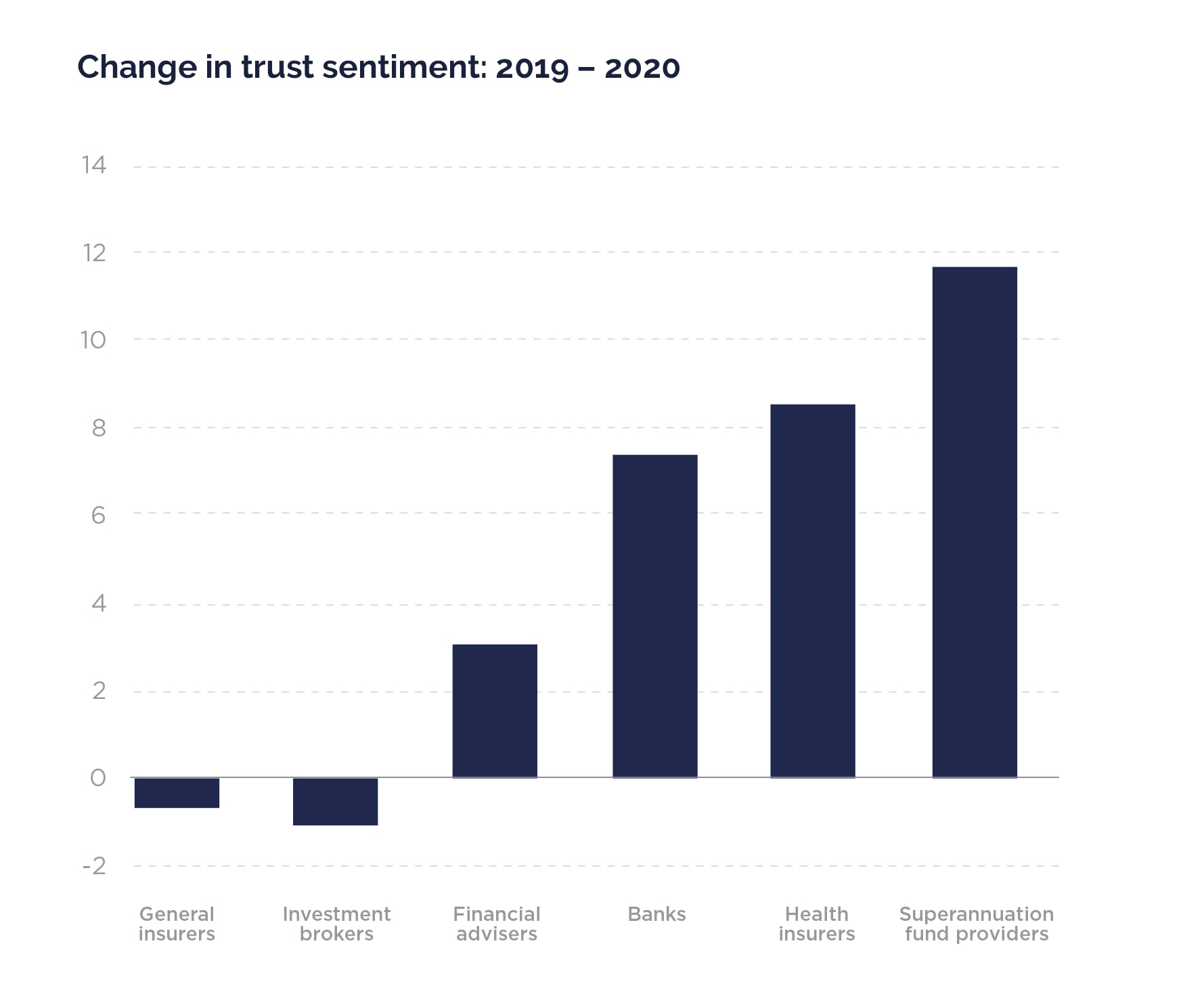

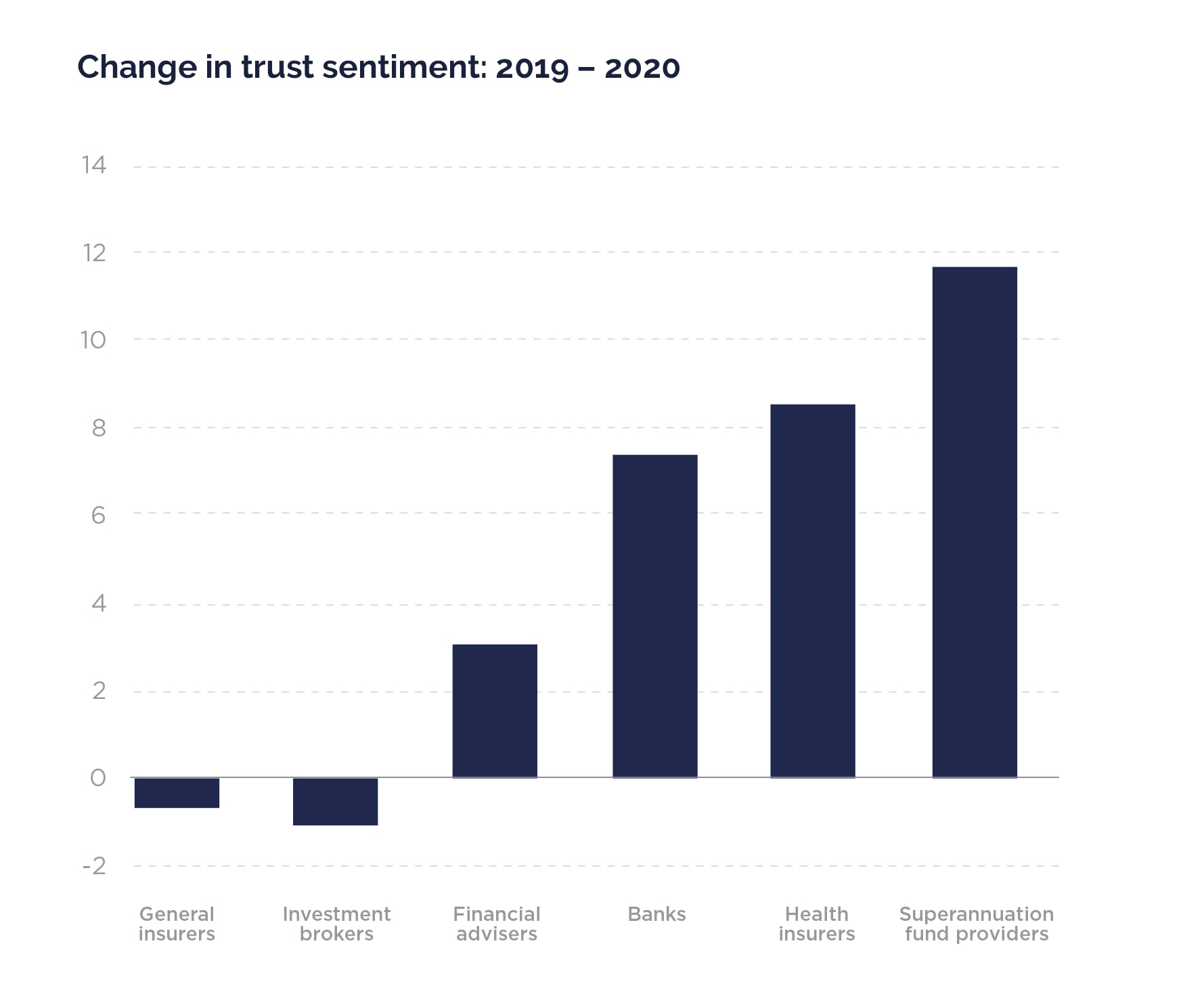

What we found is that there was an overall improvement in trust across financial services, with some sectors performing significantly exceeding expectations .

Super funds continue to be super trusted

When we compare perceptions of trust in 2019 and 2020, we can see that the biggest increase in trust in 2020 was for super funds.

We’ve long held the view that customer perceptions of trust are derived from direct (or perceived) experience of a brand.

When it comes to super, our hypothesis has always been that most peoples’ experiences with their super are overwhelmingly positive. The few interactions we have with our super funds are a line item on a payslip, or opening infrequent statements that tell us that our balance has grown. A pleasant experience.

This year was different – over 600,000 Australians accessed their super through the Government’s relaxation of withdrawal rules.

For those who withdrew, their experience of super became more tangible as they could directly benefit from savings they had previously been unable to access.

Those who didn’t need to access their super also saw the positive effect this was having on others’ lives.

This positive impact on Australians’ lives resulted in a bounce in trust levels and secured the position of most trusted financial services category for another year.

Is the Royal Commission in the rearview mirror for banks?

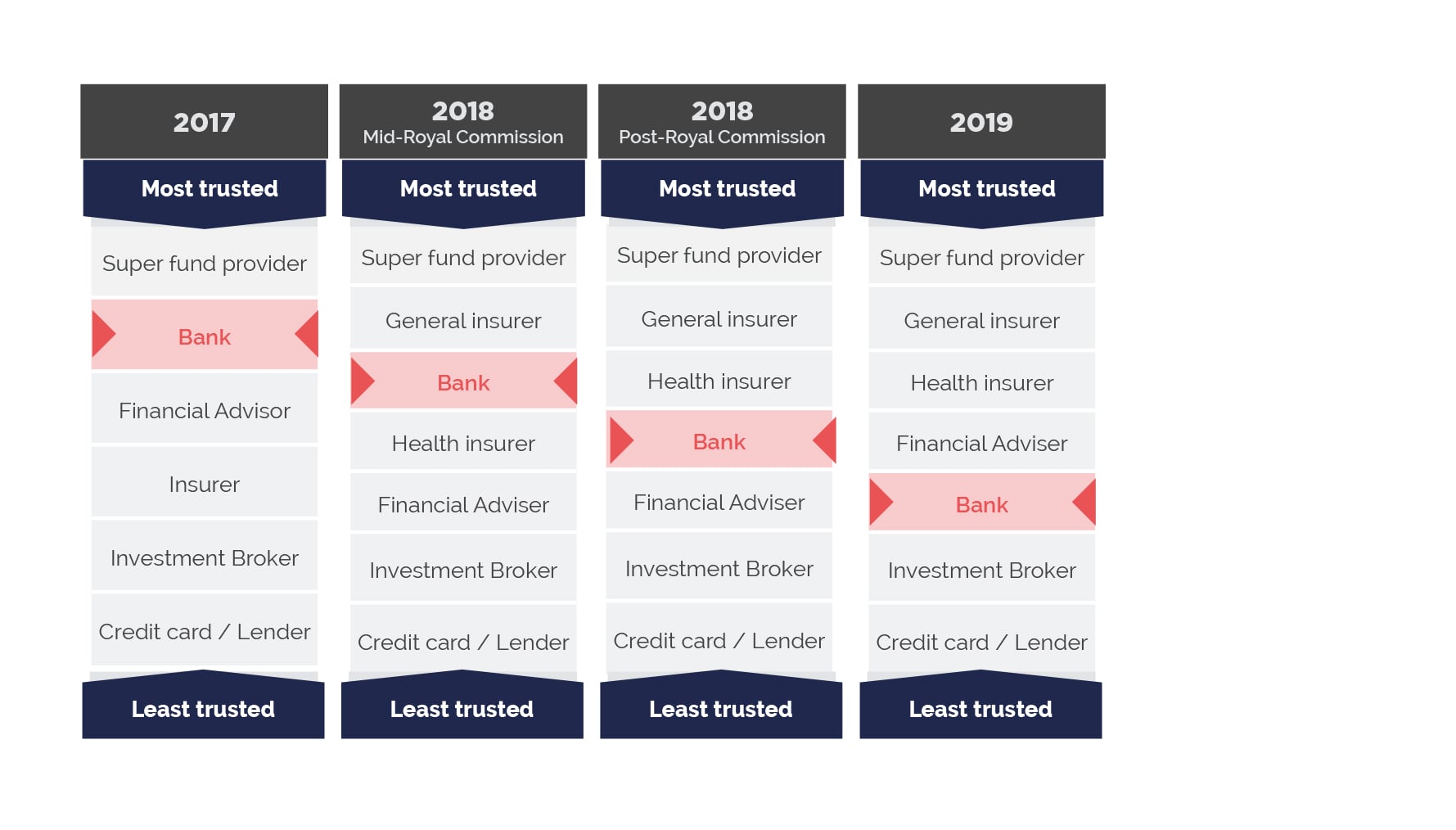

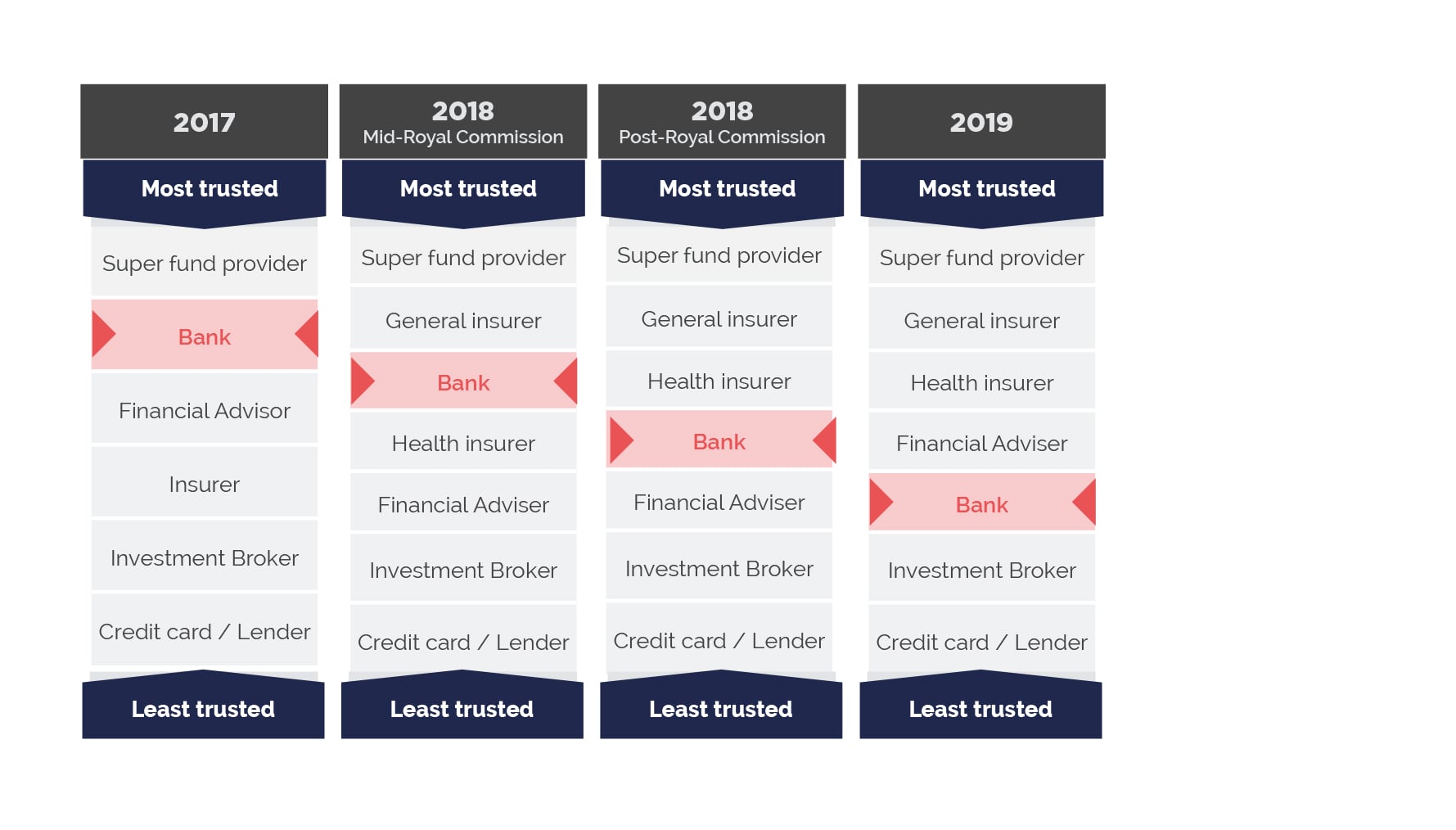

Over the past few years, we have seen the banking sector consistently slip down our trust rankings.

This began when the Royal Commission was first announced and banks continued their downward slide until they were ranked third from bottom in 2019:

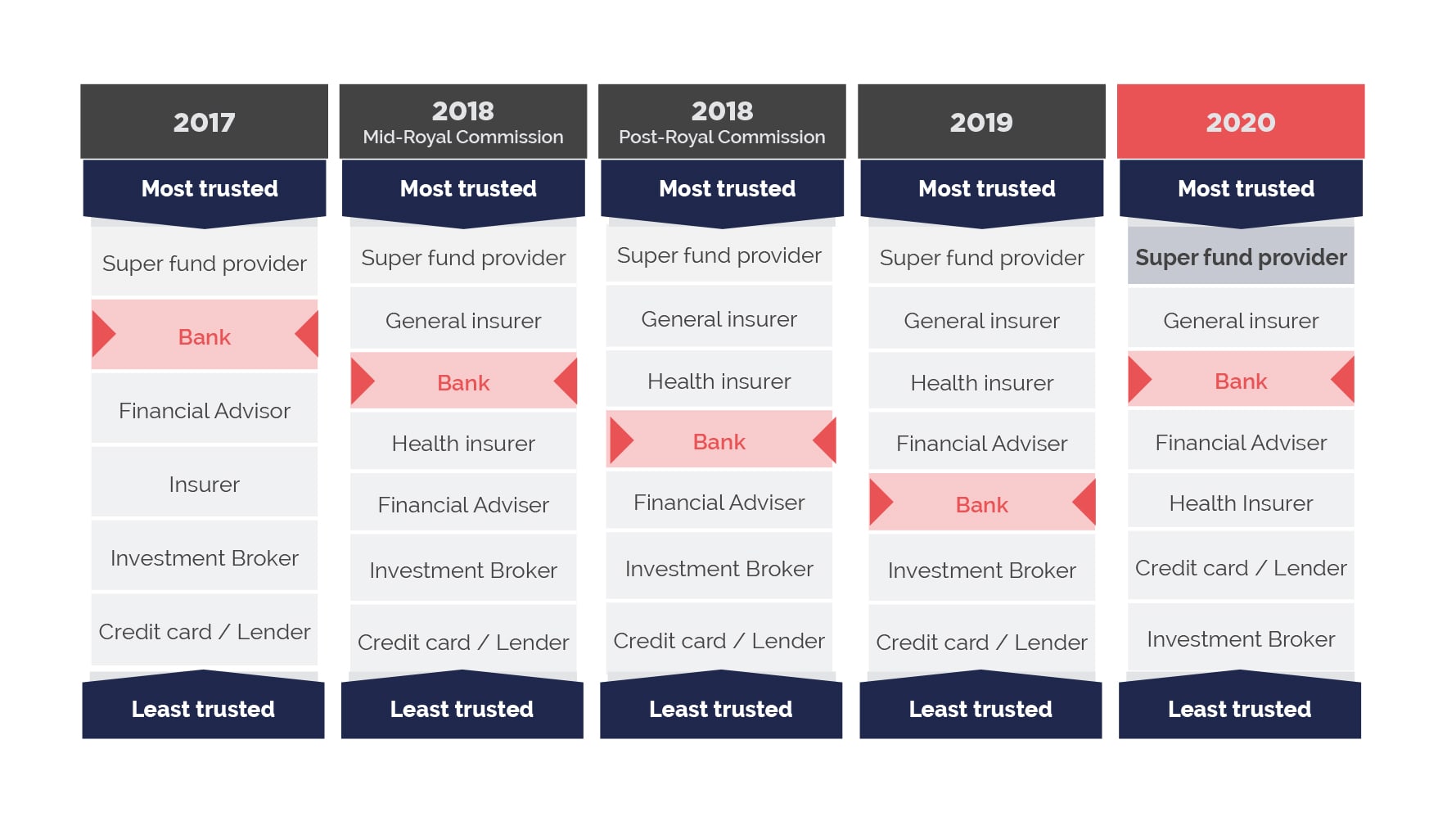

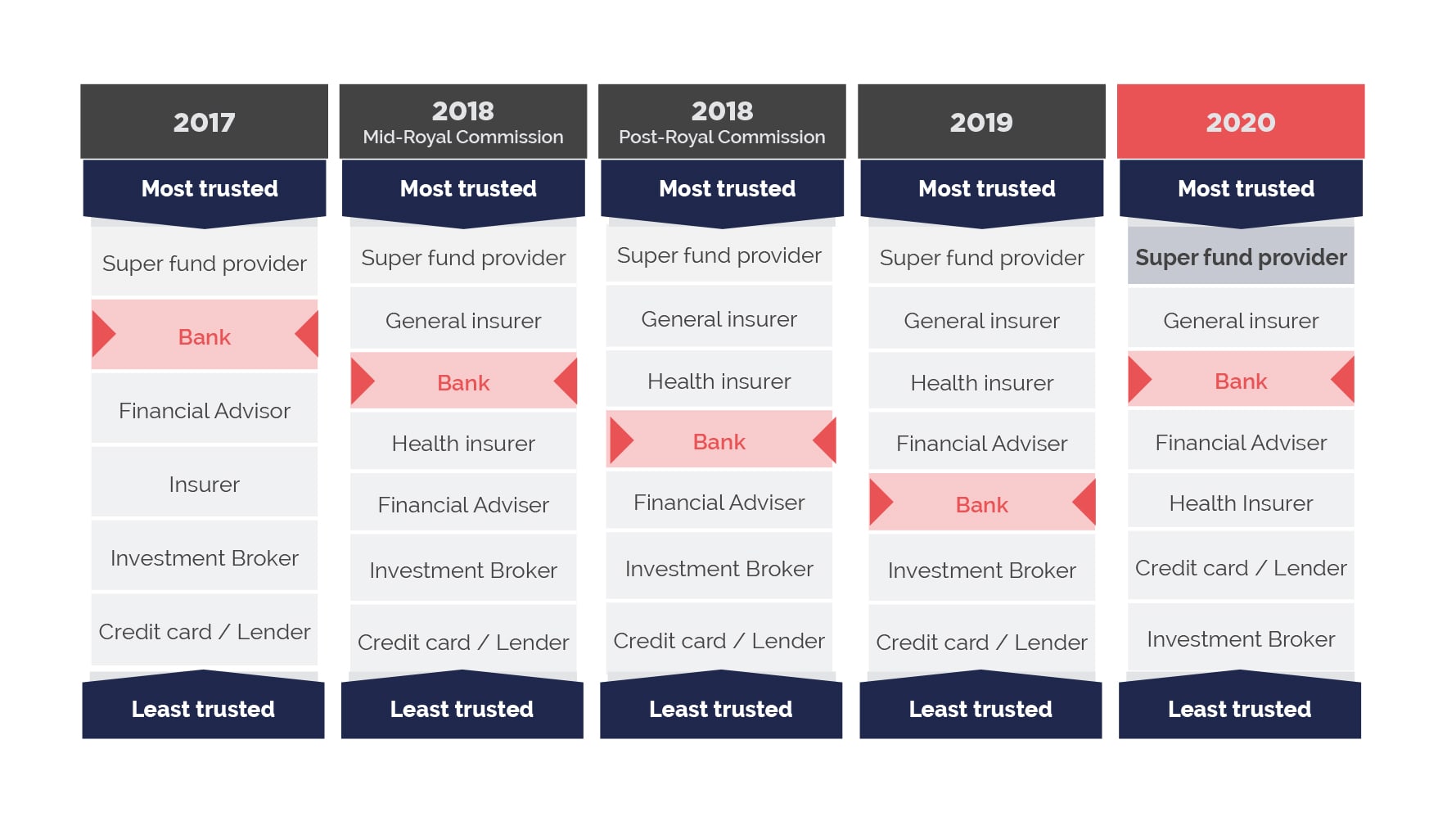

It appeared that Australia’s banking industry had a lot of work to do to regain the public’s trust. And based on this year’s survey, it looks like they did.

Banks saw a significant bounceback in 2020:

While not back to their 2017 position, banks can be buoyed by stepping a couple of places up the ladder.

This can be attributed to two things:

1. Consumers have short memories

Our world is full of noise, most of us are overwhelmed by the amount of information we need to process, especially during the pandemic. The news cycle is full, and it feels like the Royal Commission is so 2019.

2. The experience delivered by our banks

At the beginning of the year, banks delivered mortgage relief to people affected by bush fires, and then when COVID hit, this was broadened significantly. In total, banks provided mortgage relief to nearly 500,000 Australians in 2020 – a huge number. Combined with mortgage rates being at record lows, many people are feeling the benefit in their hip pocket and are attributing this to the banks.

What will be interesting to observe is the impact on sentiment next year – when customers are no longer feeling the immediate benefit of the mortgage relief.

H2: When it comes to trust, actions have consequences

Like many elements of a good reputation, trust is difficult to win and easy to lose. An individual’s trust in an organisation is often only as good as their last experience, or last media mention.

From 2017 to 2019, we saw banks slip through the relative trust rankings, as scandals and the Royal Commission tarnished their image and reputation.

This year though, there has been minimal negative press and a lot of positive feedback for the actions that banks have taken, which have genuinely helped those in need.

While the banks have hogged the headlines (for good reasons) this year, plenty of other Marketers can build on this sentiment and focus on the societal good their organisations are doing to help customers and employees in their time of need.

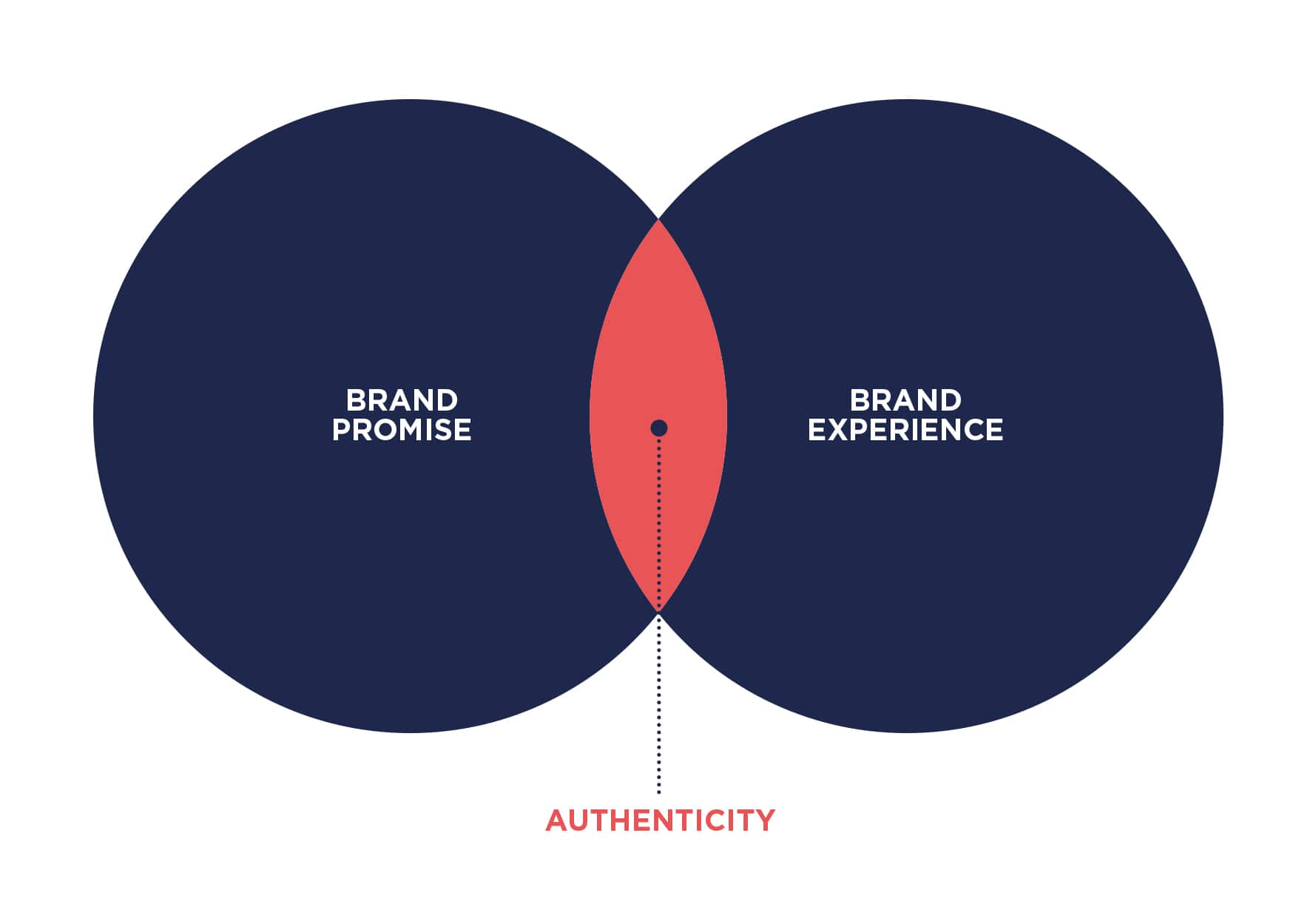

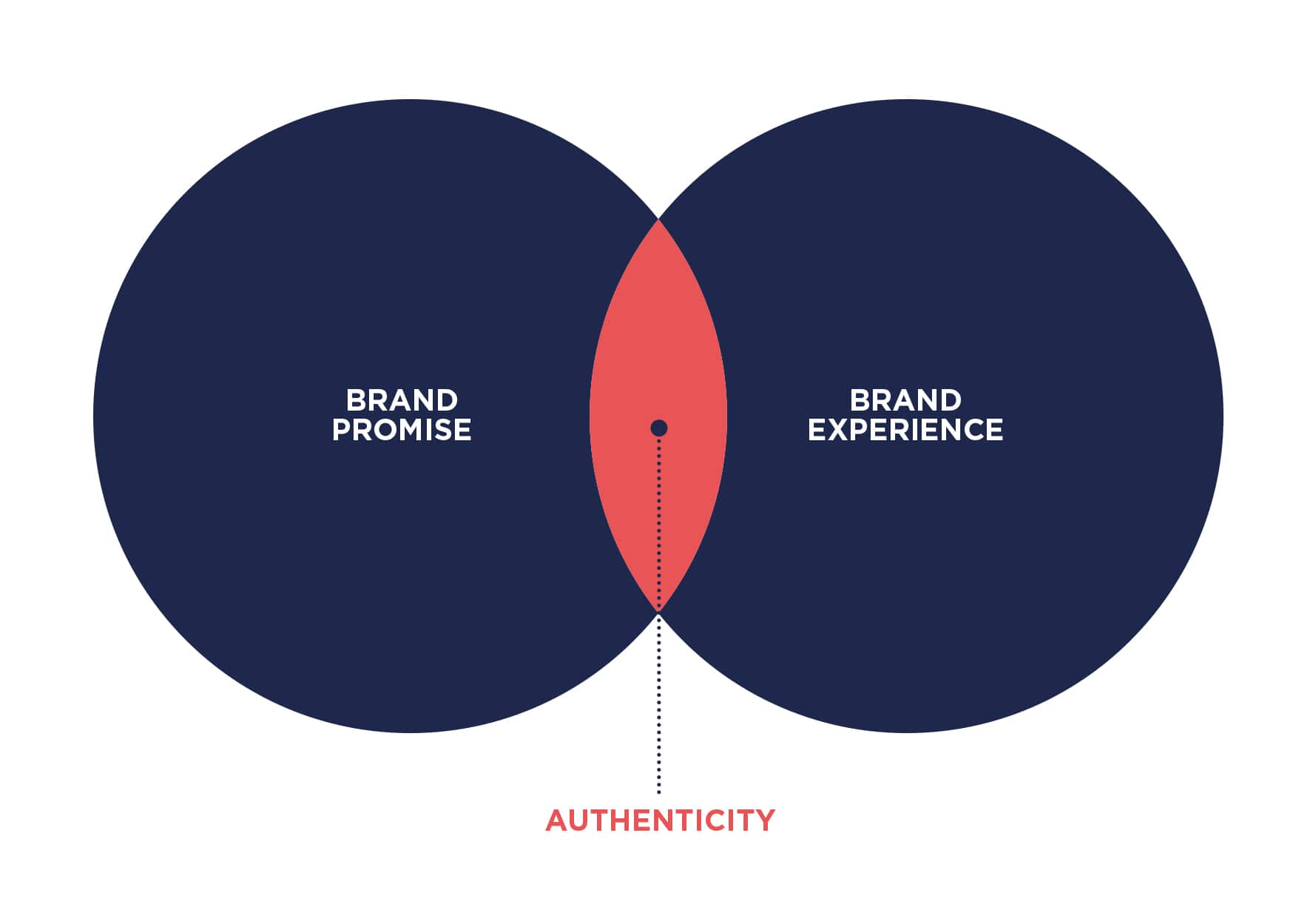

Delivering a brand experience that matches the brand promise is the best way to create an authentic and trustworthy experience for customers:

By continuing to highlight how your company has acted in the interests of the wider community you continue to reposition our industry away from the dark days of the Royal Commission, and toward a more positive, customer-centric future.