Research and data are fundamentals in the modern marketers’ toolkit.

For many marketers, research is primarily functional. It provides incremental insights into campaign activity and brand sentiment – NPS being a common tool.

Sometimes though, research empowers us to tell a story.

With the right approach, research sample and analysis, it’s possible to find themes and narratives that amplify your brand beyond the objectives of the original research.

And when you find those gems, the impact can be amazing, securing press coverage in major publications and changing the way Australians see your brand.

Firstly, it’s about them, not you

The best research stories come from highlighting consumer behaviour.

This seems obvious, but often businesses build research to suit their own needs, validating a product or service for example.

For research to deliver insights than can be amplified, it needs to discover something new or novel about customers and their behaviours. This is what interests people, not products or services.

And to do this, we need to ask questions that are relevant to real people. And asking relevant questions means that you need to know something about your research cohort before you design your research.

Having a good idea of how you think people will behave is good. Testing theories is what research is all about. Using research to confirm and justify what people think they know is where research becomes less effective.

It’s the surprises that deliver

While you may have instincts about what your research may find, some of the most satisfying research insights are also the most surprising.

They’re also the ones that can deliver the biggest impact for organisations and their customers.

Yell recently conducted research on behalf of super provider Russell Investments, seeking to understand Australian super members’ attitudes to how their super is invested.

In particular, we wanted to understand the degree to which super members understood the relationship between making investment choices and their super’s performance.

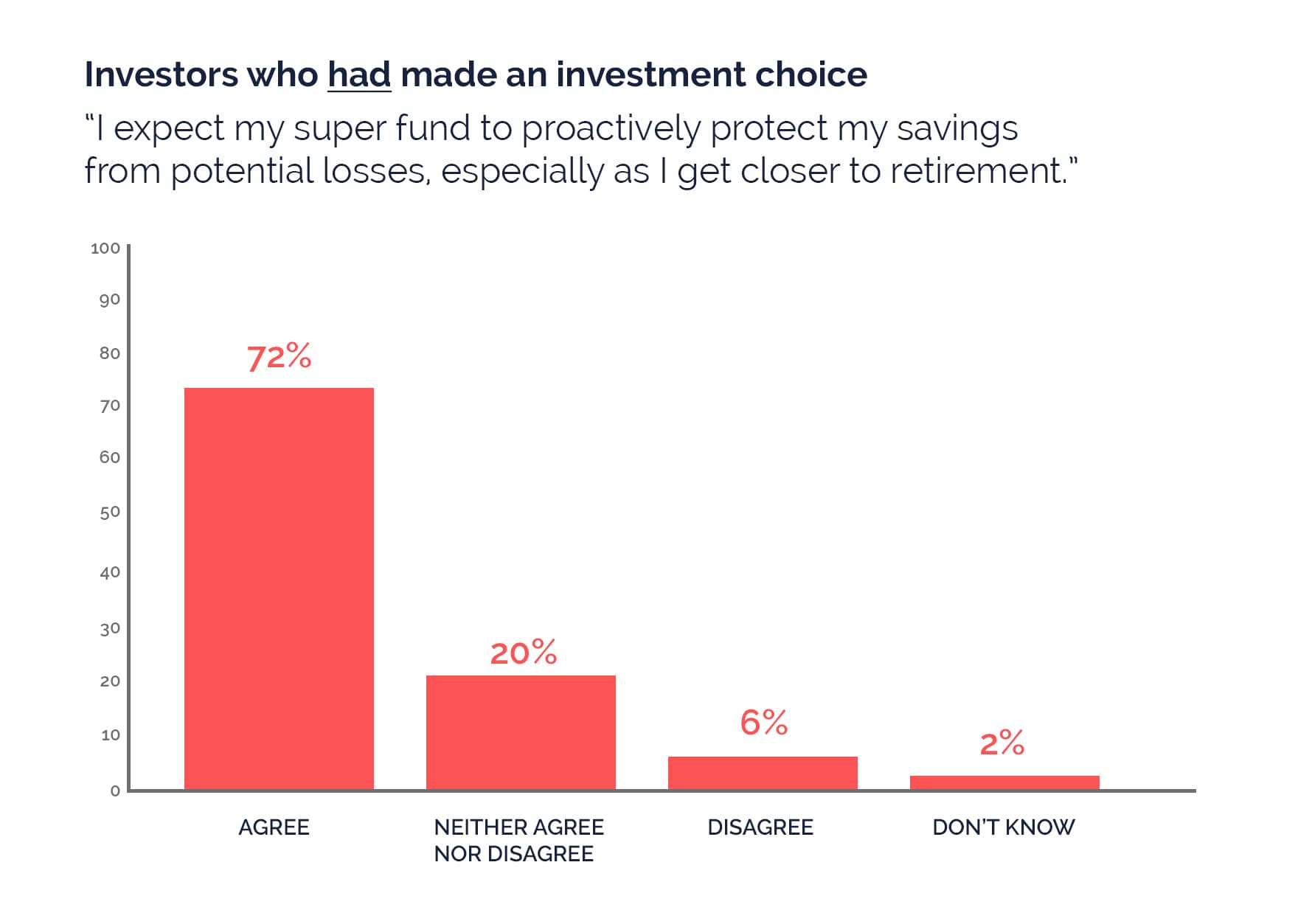

One question asked:

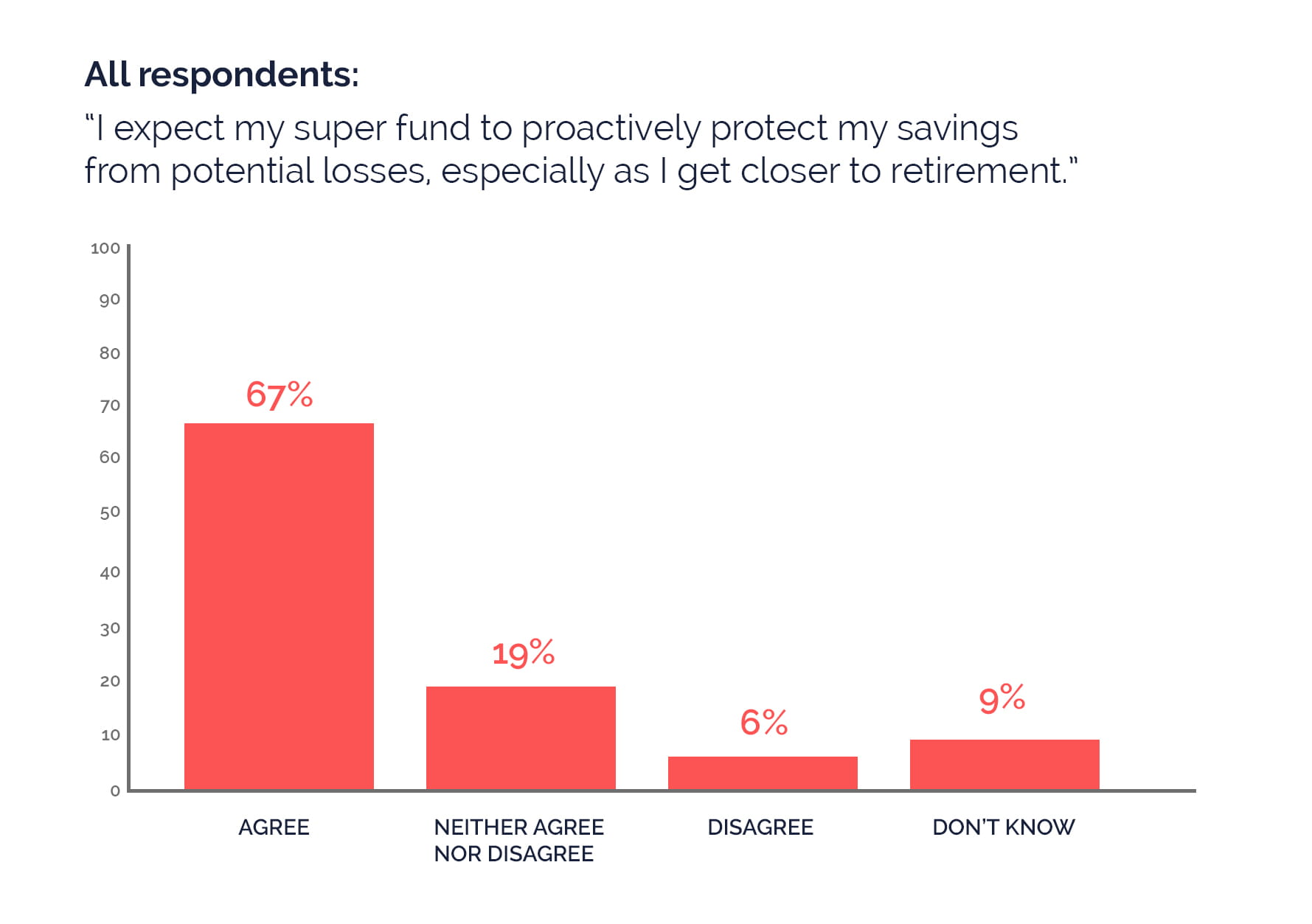

“I expect my super fund to proactively protect my savings from potential losses, especially as I get closer to retirement.”

The answers showed that ⅔ of respondents expect their super fund to proactively protect their savings from any potential losses:

The reality?

Most retail super funds do not proactively protect from losses.

Super funds don’t try to time the market because their investment horizon is so long that the cyclical nature of the investment market shouldn’t affect the overall outcome.

Straight off the bat we discovered that a significant portion of Australians don’t understand how their super fund works.

Research that challenges beliefs

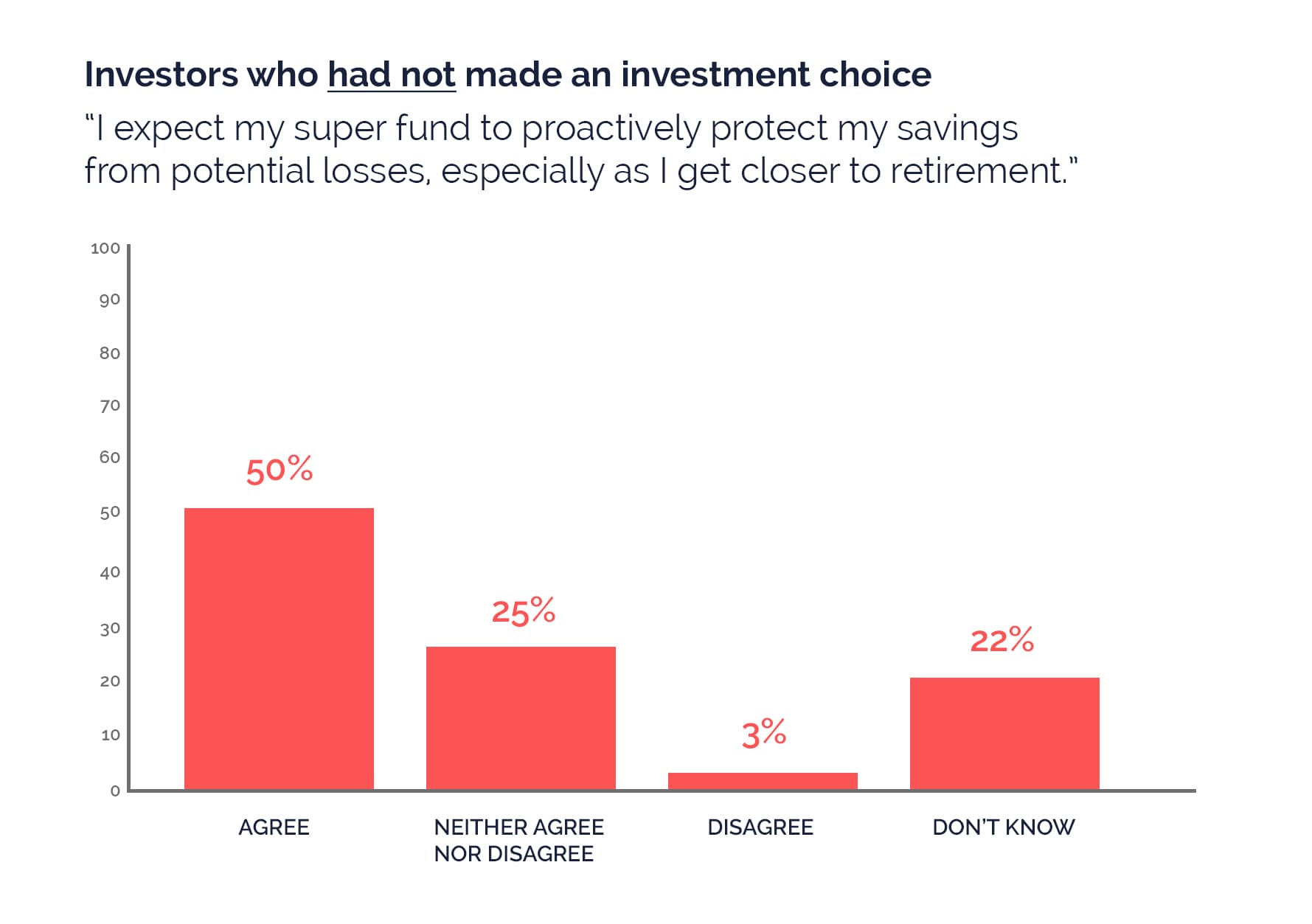

While this misconception across the broad sample was interesting, it was when the results were cross-referenced with other questions that an even more useful insight was found.

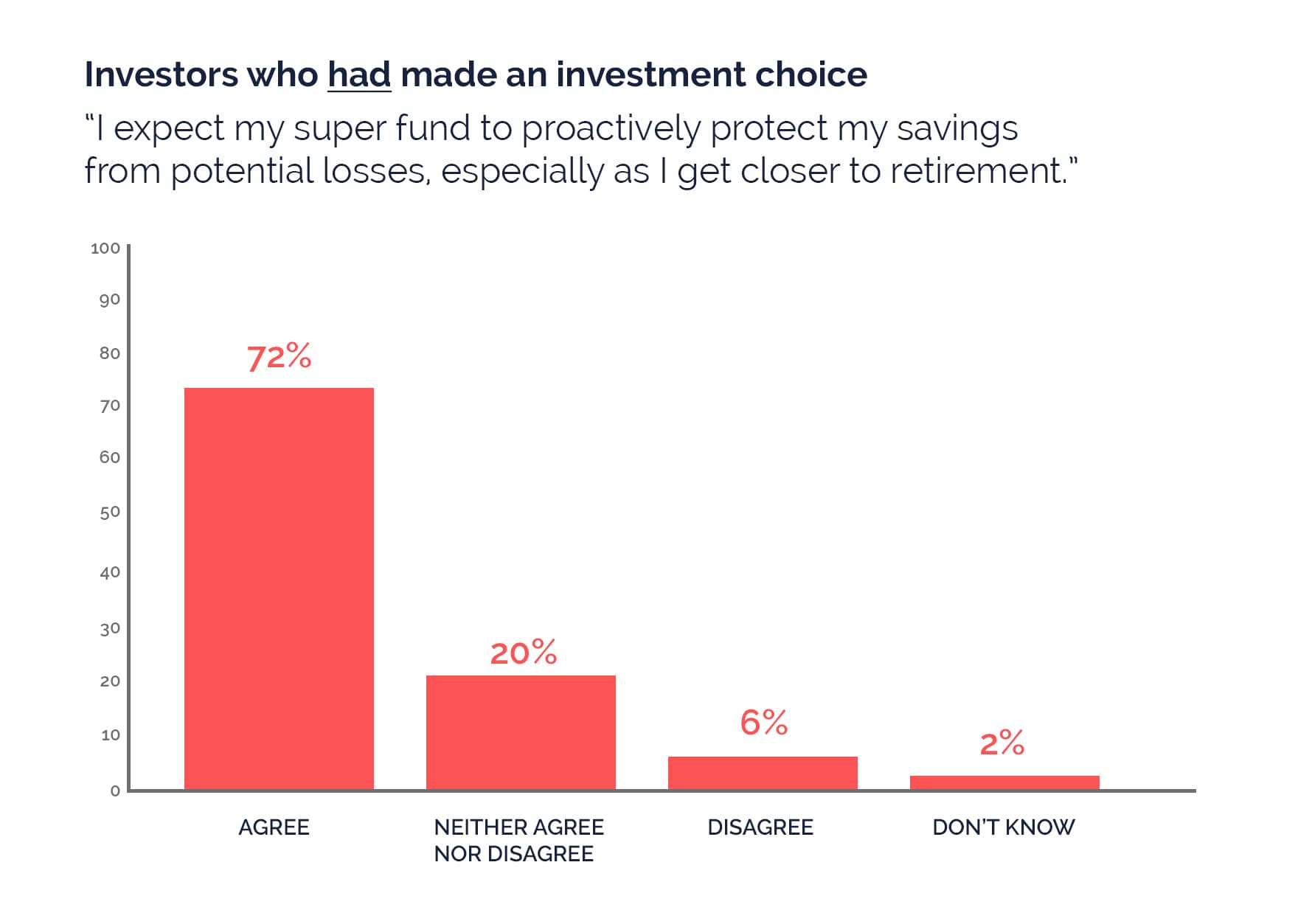

We segmented the answers to this question into groups, depending on whether the respondents had set a savings goal for their super or not.

In theory, those who had set a savings goal were more engaged with their super, and were also more likely to be more knowledgeable about how it works.

What we found was that investors who had set a savings goal for their super were:

- more likely to answer this question incorrectly

- less likely to answer that they didn’t know the answer:

Their overconfidence meant that they were more likely to get it wrong.

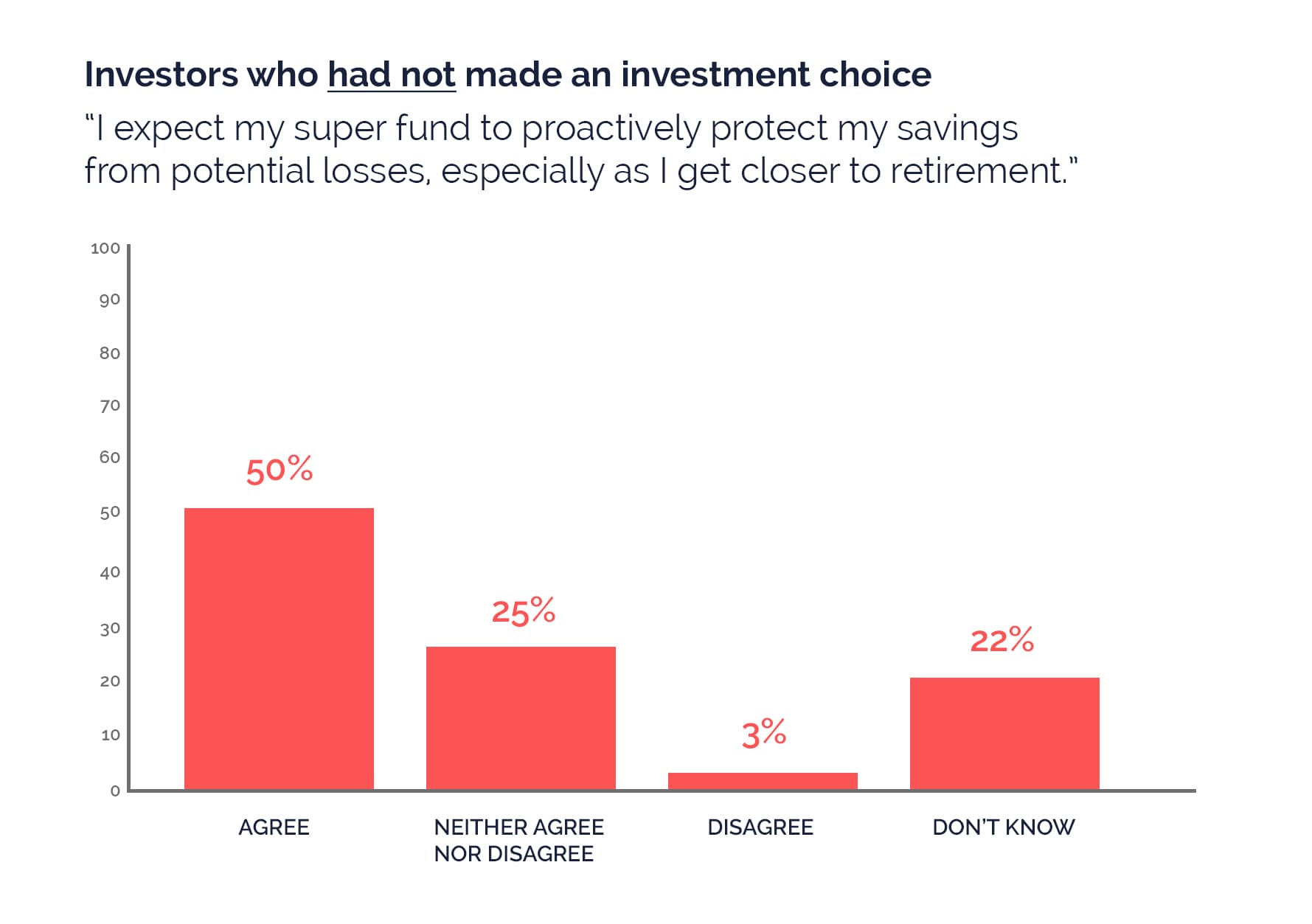

Super fund members who hadn’t made a choice with their super fund investment mix were:

- far more likely to admit that they didn’t know the answer to the question;

- therefore less likely to get the answer wrong.

For our client, these insights have helped them understand the scale of the user need around a basic lack of understanding, but also shown them how and where they should prioritise their education efforts. Those who thought they knew more, actually need more help to stop them making bad decisions.

Great research tells a story that can be shared

The research uncovered many other surprising facts about our respondents, and working Australians as a whole:

- 67% didn’t know how their super was invested or had left it to their super fund’s investment approach.

- 20% of working Australians didn’t know they could choose how their super fund was invested.

- Of those who had made a choice about their investments, only 30% felt that they really had the experience and knowledge needed to pick their investments effectively.

- 69% of respondents had no idea whether their superannuation was on track to support them in their life after work.

These findings are relevant to more than just our client.

They uncovered a lack of understanding of some of the basic tenets of superfunds and, with super being the second largest asset for most Australians after property, they were insights that deserved to be shared and discussed

While it wasn’t the original aim of the research, the insights were crafted into a series of stories that were highly relevant to the current situation. 1.35 million people have applied to access their super early, and it’s likely that a significant majority of them have a limited understanding of the long-term effects of that decision.

The stories from the research resulted in coverage in a significant number of publications – both consumer facing and trade media:

One piece of research, multiple benefits

This research delivered several outputs which will ultimately feed into better outcomes for our client and its customers:

- It provided input into the development of a digital tool to meet user needs.

- It segmented customers to allow content and education to be effectively targeted.

- It resulted in stories that got national press coverage to build their brand.

It also challenged our client’s previously held beliefs about their customers’ levels of financial knowledge and how it affected their behaviour. Sometimes what we think we know about our customers and hold as ‘self-evident truths’ aren’t actually the case.

Research as a campaign tool

If we see research as a multi-use tool, it allows us to approach how we seek insights as a not just hard data, but as a series of stories that can be drawn out by drilling down into the data.

When designing research program that can be amplified, it’s important to consider these key questions:

- Is your research panel large enough for you to segment into cohorts that can give you insights into multiple demographics?

- Have you defined themes and hypotheses throughout your research that you can test with your questions?

- Are your research objectives to prove something you think, or to discover something you don’t know?

- Are your research objectives designed to suit your businesses goals, or are they about uncovering something that will benefit the community as a whole?

- Do the actions you want to drive from your research findings focus on the best interest of your customers rather than what you need?

How you answer these questions will determine if you’re building a research program to support a business case, or an essential set of insights that can change perceptions.