Why some traditional Financial Services marketing methods are still relevant in a digital first world

Yell’s recent ‘State of Financial Marketing 2016’ survey generated some interesting insights around marketers’ budget choices, telling us a great deal about the direction that effective Financial Services marketing is heading.

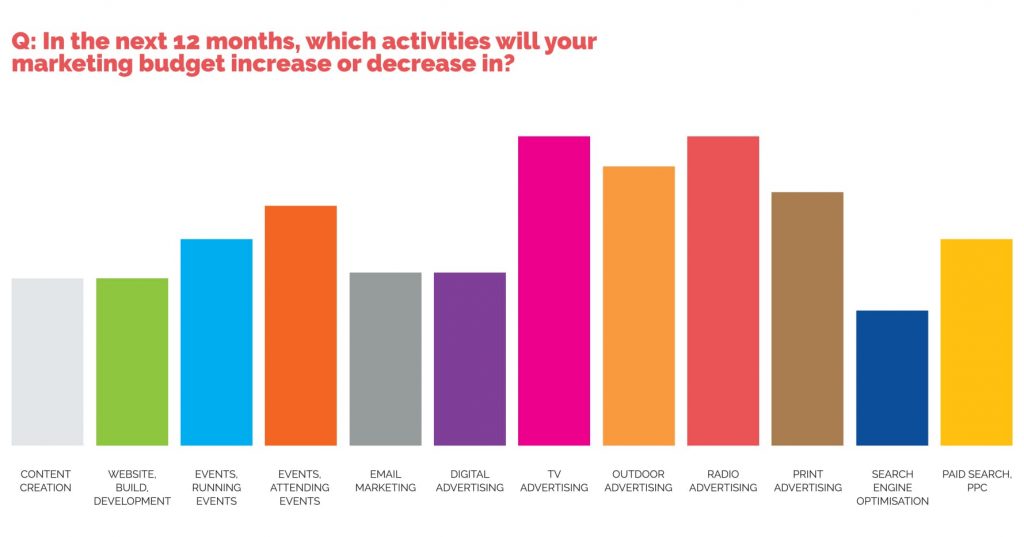

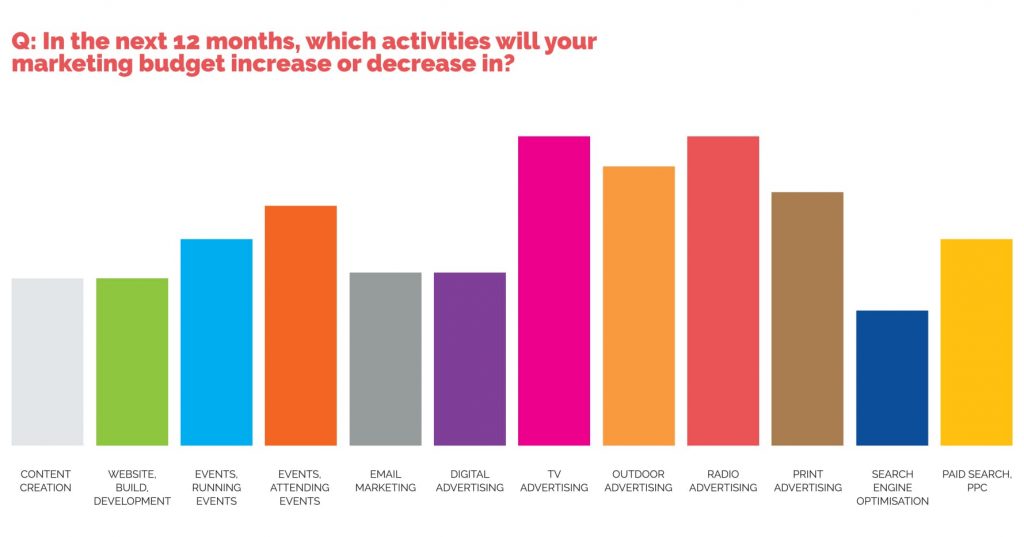

Question 12. Of the Yell ‘State of Financial Services Marketing 2016’ asked marketers:

‘In the next 12 months, which activities will your budget increase or decrease in?’

The results show that FS marketers will increase their budgets across all digital marketing, while decreasing it in some, but not all, traditional channels. In this blog, we look at which traditional channels are still finding favour and how they are used to complement an increasingly digital-first strategy.

Increase in digital

The advent of digital has brought with it many opportunities. Savvy Financial Services marketers are carefully choosing their digital tactics to complement traditional methods of brand building and demand generation.

Core to effective digital marketing is a website that attracts prospects, educates them and either generates qualified sales leads or converts directly. Our survey results showed that the majority of Australian Financial Services marketers are increasing their investment in all areas that enable their websites to perform these functions:

- 62% of Australian Financial Services marketers are increasing their investment in digital advertising

- 78% will increase their spend in SEO to make sure that their website can be found online

- 68% are increasing their investment in content creation to ensure that prospects receive education on the benefits of their products or services and;

- 61% are increasing their spend in email marketing to nurture prospects towards a conversion.

Decrease in some traditional channels

Newton’s third law tells us that for every action, there is an equal and opposite reaction. It’s therefore inevitable that (in the absence of endlessly-increasing budgets) the increase in investment in digital means that there will need to be a decrease in investment in other areas.

The survey answers show an overwhelming decrease in spend on one-way ‘broadcast’ channels. Amongst those who use it, 35% of respondents are planning on reducing their spend on print, 36% will reduce spend on TV and 21% will reduce their spend on outdoor.

These are the channels that financial services brands would traditionally have used to spread the world and build their brand. In the days before digital, above the line media was undoubtedly the best way to get a message in front of a large number of eyeballs.

And, while targeting through these traditional media channels is possible, above the line channels have always suffered from two major flaws:

- A high level of ‘wastage’ as messages are broadcast to readers or viewers who sit outside the target audience.

- Little in the way of performance tracking, making demonstrating effectiveness and optimisation of campaigns extremely difficult.

A full page ad in a national paper or a prominent billboard may look impressive, but for effective brand building digital channels have far surpassed above the line as a way to target customers efficiently and effectively.

But that’s not to say that all traditional methods are being abandoned.

Traditional tactics still standing strong

The survey showed that two tactics that Financial Services marketers have traditionally employed stand out as still hugely relevant.

The first is PR. 53.2% of respondents said that they would be increasing their PR spend, with a further 31.9% of respondents keeping a consistent level of spend.

As well as directly building a brand through positive mentions in the press, amongst the biggest benefit of PR now is its effect on the visibility of a website in search engines.

PR can also result in positive ‘backlinks’ to a website, demonstrating to search engines that the website offers valuable content and increasing the likelihood that a website will be returned on the first page of a search engine’s results.

The second traditional tactic that Australian Financial Services marketers are continuing to invest in is events.

Building relationships through face-to-face contact has always been an important cornerstone of financial services marketing and the survey results demonstrate its continued importance. 87.2% of survey respondents run their own customer events, with over 50% of that number increasing their investment over the next 12 months.

Events continue to be popular because they are still the best way to build trust. For sectors like Financial Advice or Funds Management, customers want to know the person providing the advice or making investment decisions on their behalf.

Events therefore provide an extremely effective way to convert prospects as a late stage in a well-planned sales funnel. Smart marketers can use digital channels to target their audience, online content to educate and nurture prospects and then use events and interaction with the sales team to close the sale. For prospects who may be difficult to convert through purely online channels, ebents are the perfect partnership for digital demand generation marketing. The increase in investment over the next 12 months indicates that this is a trend, which will continue.

Why are some traditional methods flourishing and some floundering?

We can see then, that the divide in investment is not necessarily between traditional and ‘new’ marketing channels.

It’s not between online and offline.

Rather, it’s between active and passive marketing, with financial services marketers using digital tools to build and grow relationships with prospects and combining this with PR and events to build their brand, encourage action and deliver a conversion.

Active marketing channels certainly require more effort than passive ones – they’re not ‘set and forget’. However, the benefits in targeting, reporting and optimisation that active channels offer over passive means that they will continue to be the most effective way to build your brand, generate leads and deliver value to your organisation.