The last blog in our series on SEO looked at what SEO is and the benefits that it can bring to your business. SEO offers a valuable source of traffic to a website, which can be turned into leads, customers and revenue.

But SEO can also be a source of frustration for business when it doesn’t deliver on its promise.

In this blog, we’ll look at 6 common reasons why this happens, and what can be done to make sure your SEO delivers.

1. Low traffic volumes

All successful SEO activities are built on the foundations of effective keyword research – identifying the terms your customers are searching for and structuring your website and content to align with those terms.

Ignoring the need for keyword research is the biggest mistake made by many financial services firms. Instead, they build their content and sites around what they think people are searching for, rather than better understanding how their customers behave. This lack of empathy means that many firms optimise their websites for terms that receive low numbers of queries through search engines – because their customers don’t talk about their products and services the same way.

While Australia is a country of many big things – the Big Banana at Coff’s Harbour is my personal fave – a big population isn’t one of them. This means that in any one month, a relatively small number of people may be searching for a financial services term, which means that the potential for organic traffic is also low.

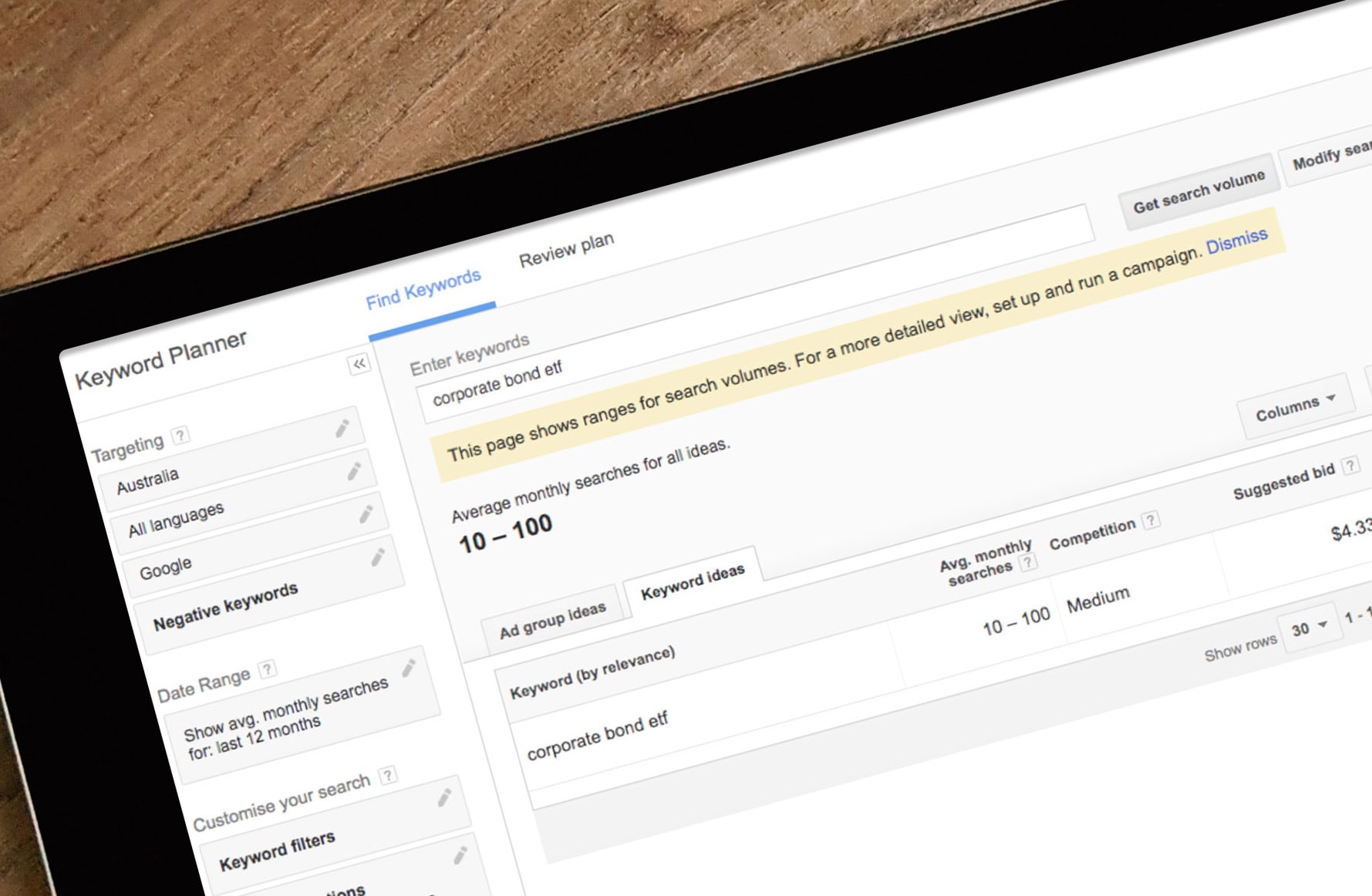

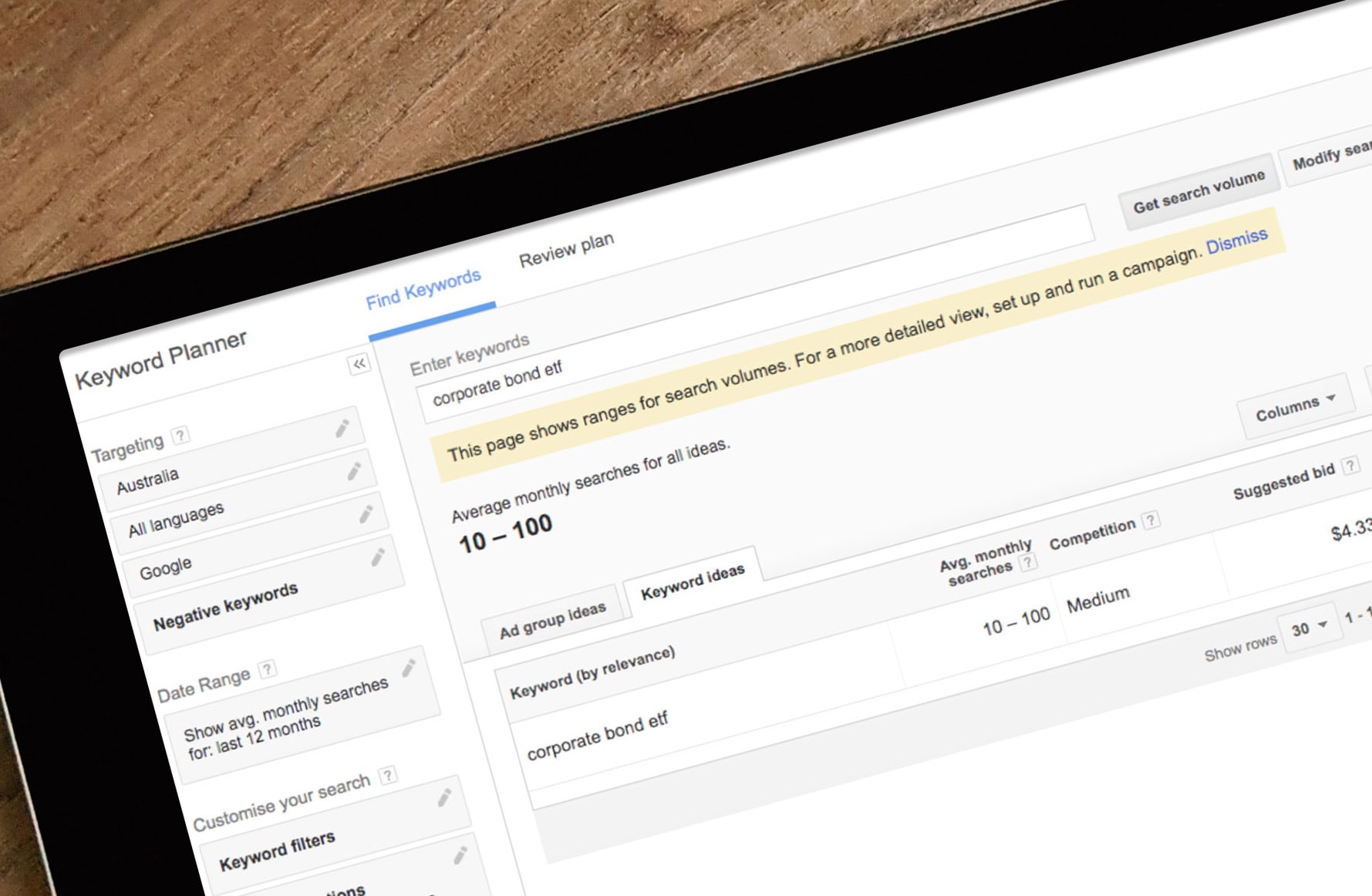

In the example below you can see that the average number of monthly searches for ‘corporate bond ETF’ is between 10 and 100 in Australia in any given month.

A website for a provider of corporate bond ETFs could only expect to receive between 10 and 100 visitors to a content page optimised for this term a month, and that would be after working hard to climb to number one on Google’s results page.

The solution here is to conduct keyword research to discover the terms that have good search volumes but low competition. Then creating content optimised to cater to these terms. This might not be directly related to your product, but can be a topic that you could then relate to your product.

2. Tough competition

Even financial heavyweights like the big 4 banks can struggle to compete against other sites that Google has judged to be more useful to users. This could be comparison websites or an article on the AFR about your category.

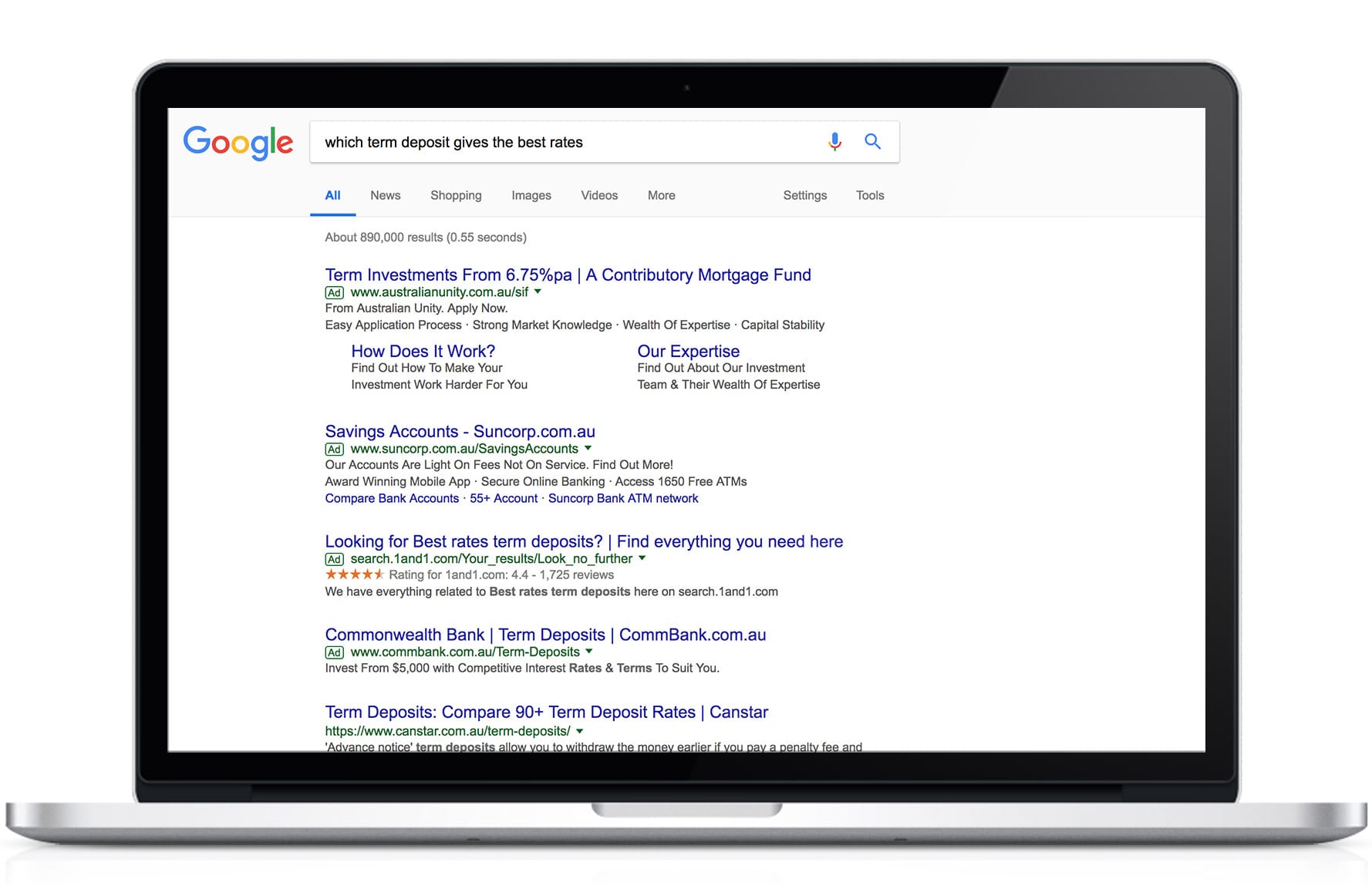

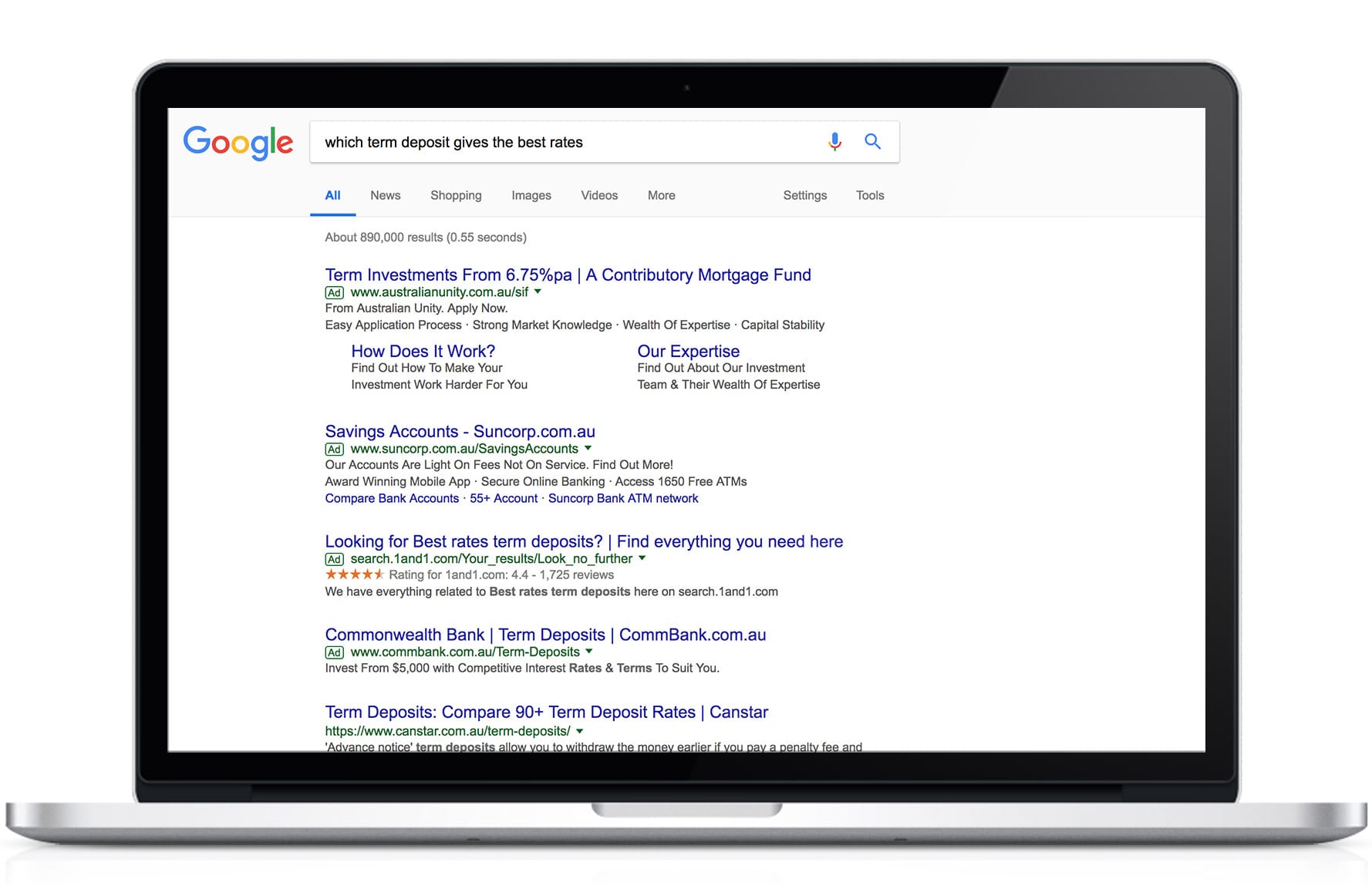

In the example below, for the query ‘which term deposit gives the best rates’, NAB is number 9 on Google’s results page.

On Google, you aren’t just competing with your direct business competitors, you’re also competing with every other website in the world that has written on your topic, or used your keywords. While Google does its best to determine the meaning of the search based on the user and their past search history, it can still get confused.

Typing ‘Best bond’ into Google won’t just return results about which government-issued fixed income deposits are currently returning the highest yield, it will also give you the consensus on whether Sean Connery really was better than Roger Moore. So, you’re not just competing with other finance sites, but film websites too (the answer’s Connery of course).

The solution to this intense competition comes from focusing on ‘long-tail’ keywords. A long-tail keyword is a three or four word keyword that is very specific to your product.

Adding up the search volumes of several long-tail keywords for which you can achieve a higher ranking, can be a good way to equal the search volume of one ‘glamour’ term that is very hard to rank for.

Again, the key to success here is keyword research to identify terms that are relevant to your business, have search volumes that make it worth catering to and that have low enough competition that your site will be able to compete.

3. Outdated SEO practices

SEO is a complicated beast – a many-headed-hydra that is constantly evolving. Google considers around 200 data sources when factoring which websites to display in its results. These criteria are constantly evolving as Google tries to stay one step ahead of SEO-practitioners who learn how to game the system.

What this means is that what worked last year, may not necessarily work now.

There are two parts to the solution to this:

- Work with someone who stays up to date with best practices and what Google’s ever-changing algorithm is currently doing.

- Do the basics right and ensure that you are creating high quality content that answers users’ queries, and earns inbound links from reputable websites.

4. Visitors aren’t converting

Building traffic to a website shouldn’t be the goal of SEO. Many businesses become too concerned with improving the numbers of unique visits to their site, and showing an upward graph of website traffic can be a good way to demonstrate to senior management that SEO is ‘working’.

However, the goal of SEO should be to build relevant traffic amongst targeted potential customers who will convert, and the best way to measure this is through meaningful conversions. This could be opt-ins that allow you to nurture qualified leads towards a sale, or it could be an actual sale itself.

By focusing on goals that are both measurable and meaningful to the business, you can structure your SEO approach to ensure that you are attracting valuable visitors who convert.

5. Not understanding the value of pay-per-click (PPC)

As we’ve seen, financial services is a particularly competitive industry when it comes to core keywords.

Many organisations are competing for the same key terms, which means that climbing the climbing to Google rankings to the #1 spot is the equivalent of scaling Everest. Or at the very least climbing Mount Kosciuszko on a cold July day wearing thongs. Not the easiest.

By augmenting your SEO strategy with targeted PPC, you can ensure your financial firm can compete for visitors using search engines, without the effort, expense and unpredictability of SEO.

The key here is to use PPC for terms that are at the bottom of the sales funnel. Organic SEO is great for casting the net wide and capturing the attention of people who are just beginning to source information on a topic. But to capture those who are ready to buy, it can be more effective and a better investment of resources to capture the traffic through PPC.

6. Expecting instant results

You’ve made it to the end of the article, which shows you have some patience, but a key reason SEO is often not seen to be working is that you have simply not waited long enough.

It can be relatively fast to move a site from ranking 50th on Google search results for a term (page 4) to ranking 15th (page 2), but often things will slow down from there. It may really slow down once you get into the first page of results. Additionally, it may take a top three listing a while to start really generating clicks and even further still for those clicks to convert.

Ensure you can measure progress with your SEO efforts to ensure that there is consistent movement towards goals your goals, but realise you may need to achieve ‘top three’ visibility before this movement provides real business benefits.

How long SEO takes to be effective can depend on the objectives, but technical and citation clean-ups can take over six months to start to produce results while establishing yourself as an authority in your niche can take longer still. This is just an estimate – SEO is a moving target but if you would like to discuss your SEO requirements and the timescale to deliver results then please get in touch.