THE PROBLEM WITH FEMALE FINANCIAL LITERACY

2017 was a big year for women’s rights and welfare. Women (and men) around the globe united and fought sexual harassment on a huge scale with movements like #MeToo and #Timesup, and the gender pay gap topic exploded. Already this year, Iceland has become the first country to make it illegal to pay men more than women – a gigantic leap forward and confirmation that change is coming. BUT we’re missing a problem just as mammoth that’s within our grasp to change right now – financial illiteracy in women.

If 2017 was the year that highlighted women’s rights and welfare, then we see 2018 as the year that women should feel empowered to take control of another area of equality – their finances and specifically their super.

Over the next few months, we’ll be creating a series of content pieces focusing on the challenge of improving financial literacy and capability in women, with a focus on their super. It’s a lofty aim, but if we can change the life of one woman through our team’s passion for financial empowerment, then 2018 will have been a great year for Yell.

Education leads to independence

It could be argued that financial inequality is the reason for financial illiteracy. Finance, as a profession and topic, is a stereotypically male domain. Historic gender roles, where men are the breadwinners responsible for household wealth while women look after household spending may be changing, but this change is slow to take effect.

Financial resilience is also declining due to increasing debt for young adults, continued lower earnings and reduced home ownership. Women face issues rooted in the past, with a seemingly bleak future as well.

The reality is that financial literacy and empowerment are theoretically in women’s own hands – albeit within the context of their personal circumstances. It can be incredibly hard to empower yourself if you’re not able to connect with support, or aware that it exists.

The good news is that, unlike many equality issues facing women in 2018, as individuals you can control your level of financial education and capability and as marketers, you can influence how your business connects with your female audience.

What are the challenges to achieving financial independence?

Financial independence may be the difference between living at home far too long, or renting a shared home with flatmates who have no concept of personal space. Or more seriously, it could be the difference between staying in an abusive relationship or a job that makes you desperately unhappy.

We can all contribute to creating independence for ourselves, or as marketers, for our customers, but we do have some obstacles to overcome.

Women face greater financial challenges than the average man. We all know about the pay gap, but did you know that women who take a career break, on average, retire with $283k less in their super than men? Not ideal when women generally live longer than men.

Even when seeking advice, we also struggle to find women financial planners – as of 2017, only 28% of FPA members were women. If we’re struggling to see women giving other women financial advice, no wonder we have a problem.

HOW CAN YOU HELP EMPOWER CHANGE?

As marketers, there are some steps you can take to influence how your organisation addresses the issue of female financial literacy. We’ll be discussing some of those in future blog posts.

As individuals, we can all do more to change how we see our financial circumstances. It’s a matter of opportunity and choice. All of us now have the opportunity, but not all of us make the choice to take advantage of that opportunity.

So, we’re going to challenge you to choose to carve out time to create the opportunity to learn and to understand what resources are out there for women. While we’re all busy, you can make time if you consciously choosing to – spend 12 minutes watching Laura Vanderkam’s TED talk on this topic and learn how you can regain control of your free time.

DISCOVER THE COMMUNITY AND RESOURCES

Once you’ve made the time to get started, you might want to find some help without necessarily seeking advice. There are plenty of communities and smaller organisations out there providing a forum for women. We’ve highlighted a few of them below to give you inspiration for your own life, or for initiatives that you could bring to your firm.

1. Soak up nuggets of insights, whenever and wherever you can

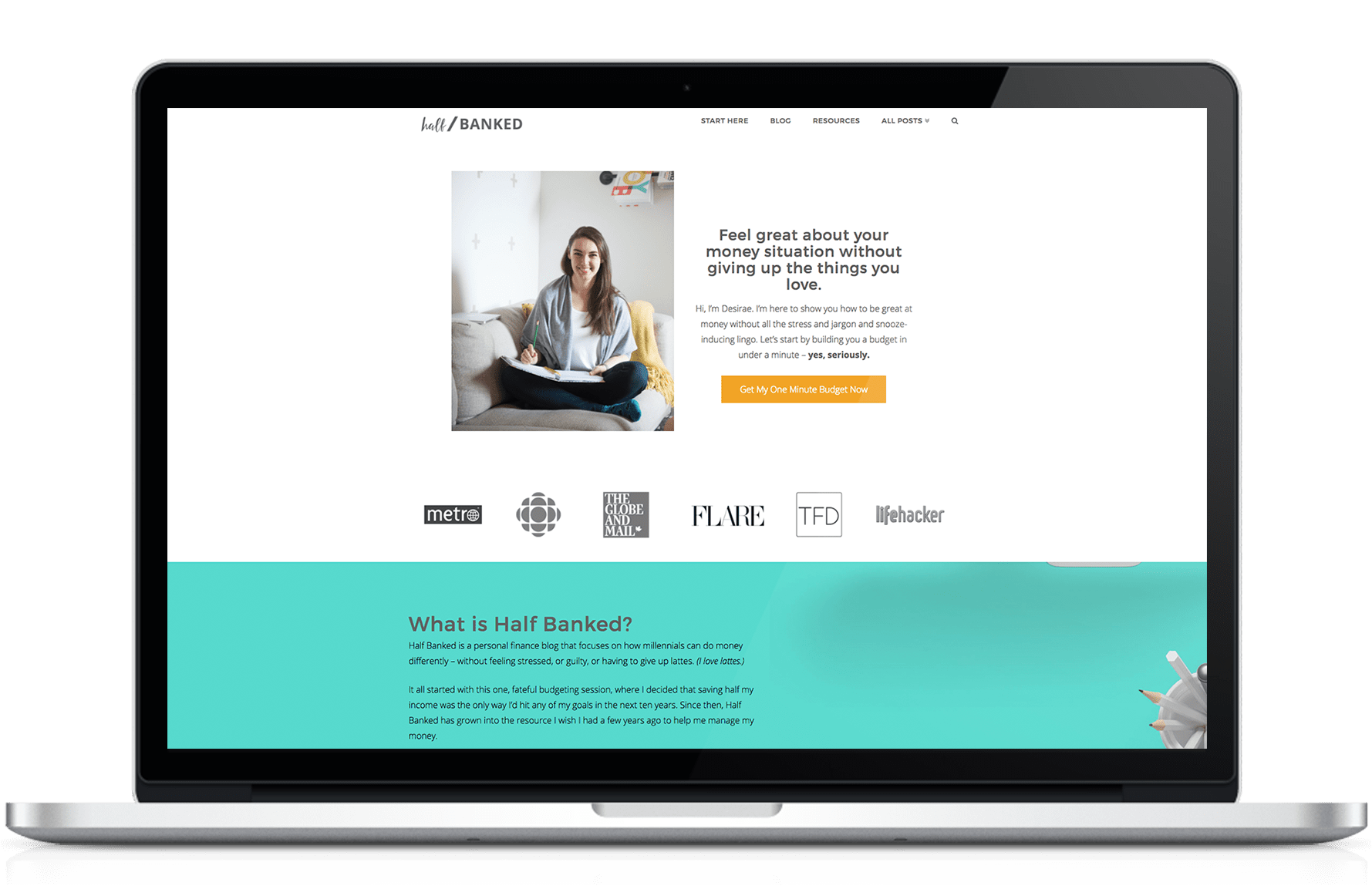

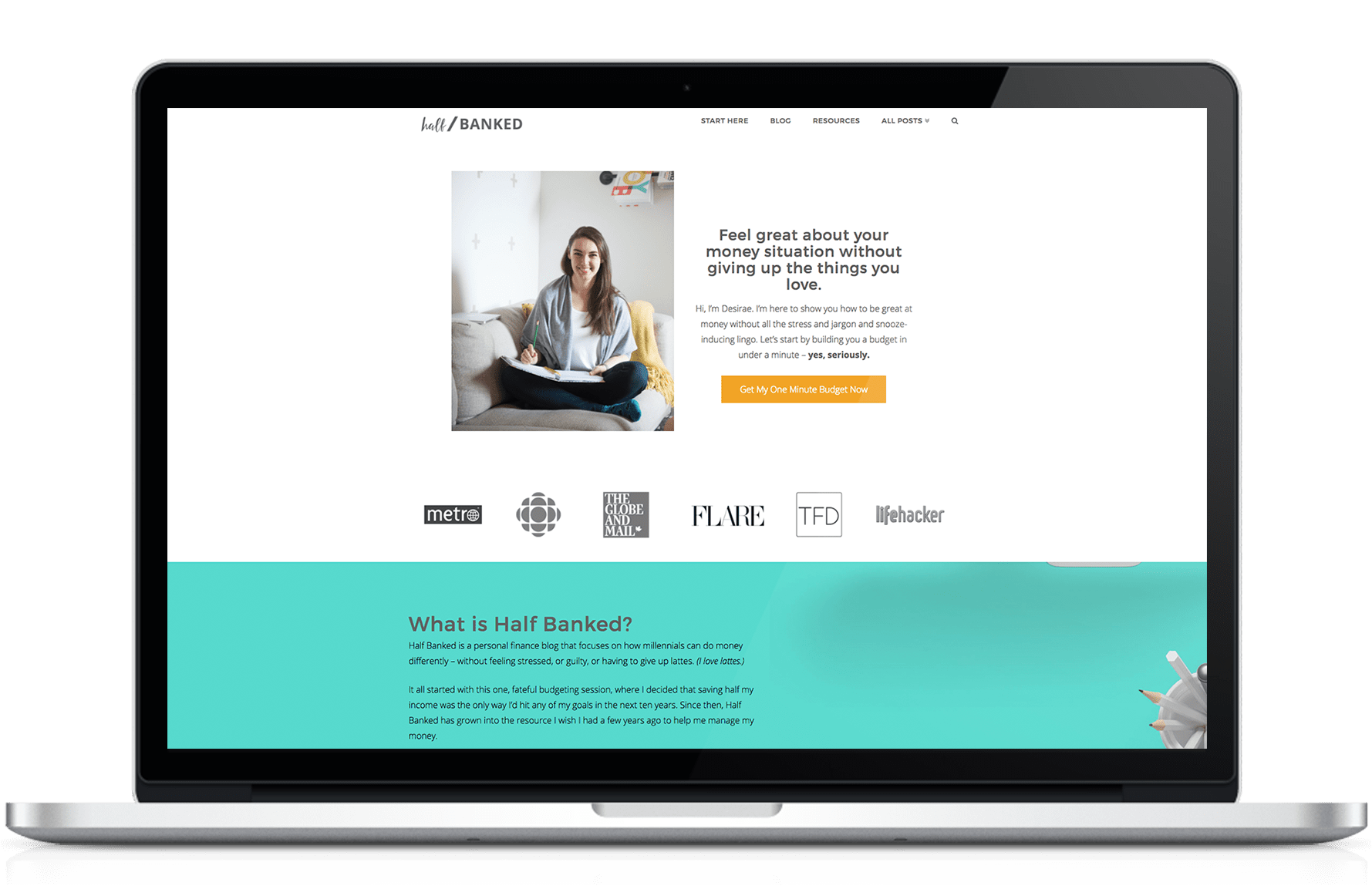

There are many women blogging and vlogging about finance, you just need to find someone that approaches it with personality and talks your language. Sign-up to newsletters or follow them on Instagram and you’ll get bite-sized chunks of information to read at your leisure. Half Banked and Mixed up Money are just a couple of blogs to sign up to, and podcasts like The Fairer Cents or Mo’ Money are easy to listen to on your commute or morning run.

2. Join a community

Countless fantastic communities of women are doing great things to try and offer digestible information to you in a range of ways. Bravely is a great example, it’s American so you might not physically be able to join in but you can be part of the conversation, it’s pretty inspiring, plus there are some great resources on their website.

3. Kill two birds with one stone

Find a course or a meet-up that allows you to have fun, meet people or benefit another area of your life, like this money workshop by Lumix Wealth, or the Rich & Fit bootcamp, which addresses a different principle each week that can be applied to both finance and fitness.

What’s next?

Keep an eye out for the next article in our series, which will look at great examples of how our industry has been supporting female financial literacy and how these initiatives can align well with your brand’s values and your businesses’ goals.