Australia has done a great job with slowing the spread of COVID-19. Sure, there have been some bumps along the way (fingers crossed for Victoria at the moment), but on the whole, all of the working from home, catching up with friends over Zoom and exercising in the loungeroom rather than the gym appears to have paid off.

But while the lockdown has been effective in flattening the curve and the changes to the Jobkeeper / Jobseeker seem to be keeping the economy on life-support for the moment, there’s still a lot of uncertainty about what COVID-19 means long-term for economy and therefore the financial services industry.

Is a recession inevitable?

While a recession isn’t inevitable, it seems likely and it may be the worst that Australia has seen for a long time.

Treasurer Josh Frydenberg is on record as saying:

“The economic shock facing the global economy from the coronavirus is far more significant than what was seen during the global financial crisis over a decade ago”

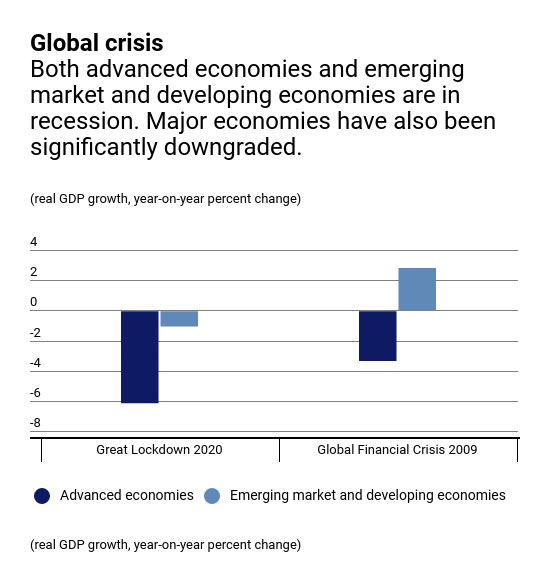

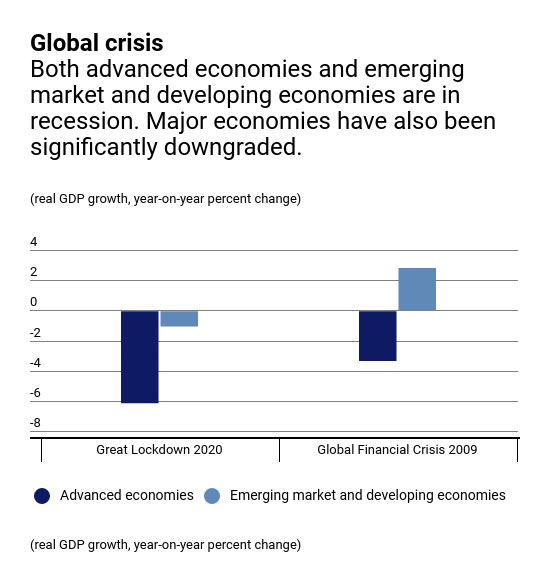

This is backed up by predictions from IMF, which projected global growth in 2020 to fall to 3% percent in their April 2020 World Economic Outlook. This is significantly higher than the In the GFC where emerging markets and developing countries didn’t suffer the same downturn as developed countries which allowed the world to bounce back more quickly.

In 2020, all countries are predicted to suffer:

Source: IMF

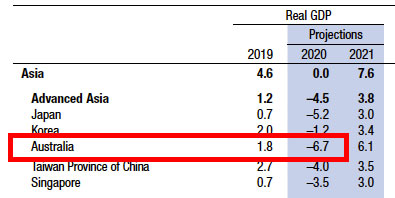

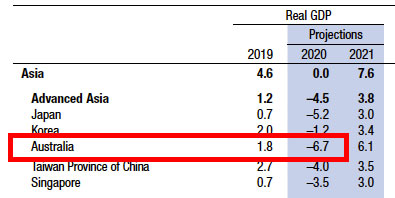

In Australia, IMF is predicting a 6.7% reduction in GDP in 2020 – one of the highest in the APAC region:

Source: World Economic Outlook, April 2020: The Great Lockdown

How will a recession affect your customers?

If a recession occurs, it’s likely that unemployment will rise and discretionary spending will fall, but while there are common impacts from an economic downturn, not everyone reacts in the same way.

In this blog, we’ll look at four consumer reactions to a recession, so you can start to think about how your customers might react.

Shortly after the GFC, Harvard Business School professors John Quelch and Katherine Jocz identified four consumer reactions when times get tough. While these are retail consumer-focused, the thinking behind them could equally be applied to business customers.

1) The ‘slam-on-the-brakes’ segment

This group feels most vulnerable and hardest hit financially. As a result, they reduce all spending by eliminating, postponing or substituting purchases.

Although lower-income consumers typically fall into this segment, anxious higher-income consumers can as well, particularly if health or income circumstances change for the worse. With the huge unknowns that COVID-19 presents, there may be more consumers in this segment than if we were just facing the prospect of an economic recession.

2) The ‘pained-but-patient’ segment

Resilient and optimistic about the long term, but less confident about their ability to maintain their standard of living in the near term.

Like slam-on-the-brakes consumers, they economise in all areas, though less aggressively. They constitute the largest segment and include the majority of households unscathed by unemployment, representing a wide range of income levels. As recessions deepen, pained-but-patient consumers will migrate into the slam-on-the-brakes segment.

3) The ‘comfortably well-off’ segment

Secure about their ability to ride out current and future bumps in the economy, they consume at near pre-recession levels, though now they tend to be more selective (and less conspicuous) about their purchases.

This segment consists of people in the top income bracket, and those who are less wealthy, but feel confident about the stability of their finances. This might be those who are comfortably retired, investors who got out of the market early, or those who had their money in low-risk investments like corporate bonds.

4) The live-for-today segment

This segment remains unconcerned about savings and carries on as usual. The consumers in this group respond to the recession by simply delaying making major purchases. Typically urban and younger, they are more likely to rent than to own and spend their money on experiences rather than things (apart from gadgets and electronics). They’re unlikely to change their consumption behaviour unless they become unemployed.

With the rise of the gig economy and lower job security than when these four segments were originally coined, it’s likely that this is a smaller segment than it would have been around the time of the GFC.

How a recession affects behaviour

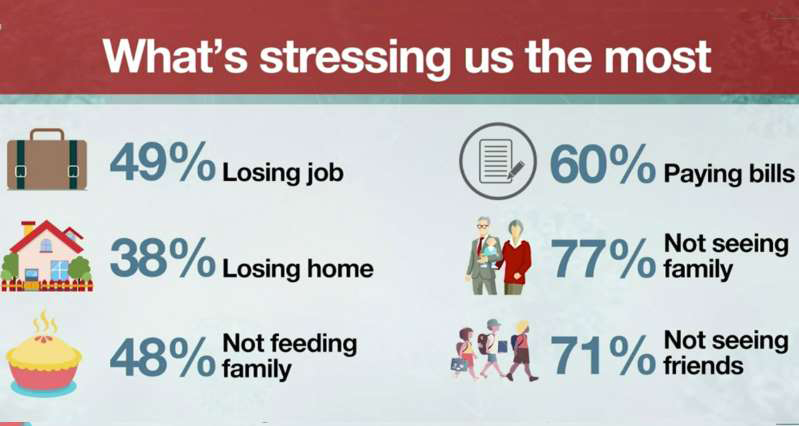

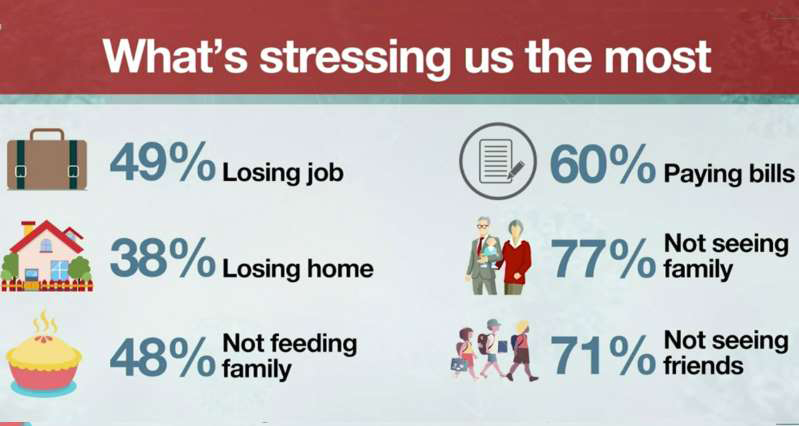

Recent YouGov research shows that a significant proportion of Australians are feeling stressed about whether they will be able to make ends meet:

Source: Channel 9

As a result, it’s likely that all consumers will re-evaluate their priorities, set stricter priorities and reduce their spending.

Products and services that were once a regular purchase (restaurant dining, travel, new clothing etc) can quickly move to becoming irregular treats, things to be postponed or even be eliminated from their budgets all together.

Purchase decisions can be broken down into four groups:

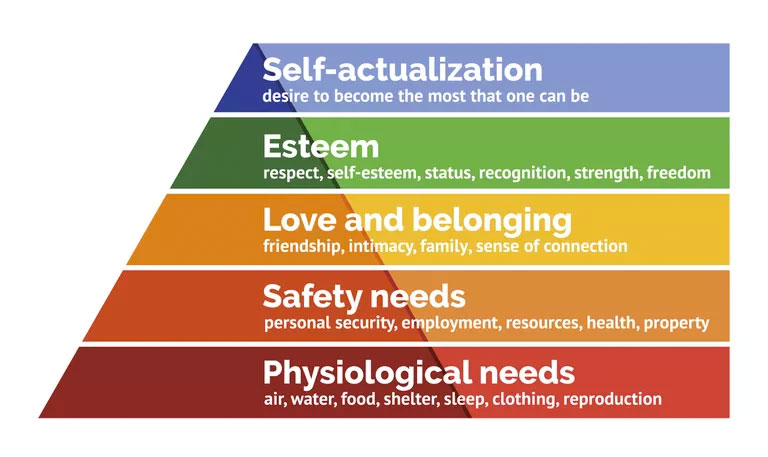

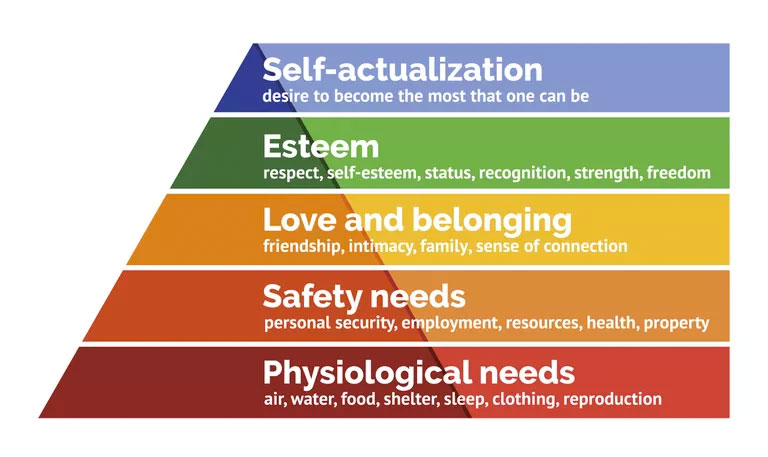

- Essentials are necessary for survival or perceived as central to well-being. This covers many financial products such as existing home loans, insurance and banking.

- Treats are indulgences whose immediate purchase is considered justifiable. While more applicable to segments of the economy other than financial services, a reduction on higher priced ‘treat’ items will have a knock-on effect on credit cards and ‘buy now, pay later’ services like Afterpay or Zip Money.

- Postponables are needed or desired items whose purchase can be reasonably put off. This is likely to cover large financial commitments such as home loans or car loans.

- Expendables are perceived as unnecessary or unjustifiable. Financial products relating to travel will be hard hit here.

Ultimately it relates back to the classic hierarchy of needs – in times of uncertainty, people will ensure that they are looking after those needs at the base of the pyramid:

Putting your best foot forward

It’s a good time to sit down and think about your customers and how your products or services fit into this model. Are the current customers that you are targeting likely to be in the ‘slam-on-the-brakes’ segment? If so, what does this mean for how you support them?

Ensuring that you are meeting a genuine customer need is more important now than ever, and what that customer need is may be very different right now than it was at the beginning of the month. And it’s likely that in three month’s time, that need will be very different again.

Brand is still important

With cashflow reduced, it may be that perceptions of value become more important than ever.

The balance between sales promotion and brand is always a delicate one, and in order to keep the lights on it may be tempting to just focus on price, rather than more brand-led messaging.

But in times of uncertainty, more than any other, customers need reassurance that they are safe and secure. Demonstrating empathy and building an emotional connection e.g. by communicating that “we’re going to get through this together” is still the best way to differentiate from competitors and show that you are supporting customers in their times of need.

But these empathetic messages must be backed up by actions that actually show that your company is on the customer’s side – it can’t just be messaging.

What can you do?

It’s likely that you’ve already changed your marketing and messaging to cater to the lockdown period that we’ll hopefully emerge from shortly.

Now it’s time for starting to think about the next stage. When Australia opens back up, it’s unlikely that we’ll bounce straight back to where we were at the beginning of the year.

While recession is not a certainty, it appears likely.

As marketers, we should all be thinking about how our customers are likely to be affected by a recession and how our organisations can meet their needs if it happens.

To begin with, this may be by thinking about which of the four segments we’ve discussed here your customers are likely to fall into.

Then, assess your current product mix and marketing messaging. Do they feel like they are focused on the needs that customers are likely to have in a recession? If not, what can be done?

While there may be limits to how much marketers can steer the ship of an organisation, what we can do is be customer advocates and start the conversations needed to ensure we are supporting customers as well as we can. If we don’t, then another organisation surely will.

As they say: hope for the best, plan for the worst. The time to start thinking about how can you support your customers if the worst does happen is now.