If banking is the new Trump, will it ever be great again?

Donald Trump once famously claimed “I could stand in the middle of 5th Avenue and shoot someone and not lose any voters.” And he’s probably right.

Back in the day, we thought that this sort of statement was ‘unusual’. The sort of bluster designed to get page impressions and column inches, but which would disappear’ once he had his feet under the Resolute Desk in the Oval Office.

How wrong we were.

And yet, Trump has not just maintained the support of his base throughout his tenure, he’s actually improved his approval ratings, with Republicans backing their man, despite his obvious character flaws.

The reason he’s kept the support of the GOP is because he gives them what they want; a conservative, pro-life Supreme Court, tighter immigration controls and tax cuts, lovely tax-cuts.

What does this prove? It’s proves that regardless of what’s been said or done, some (but not all) people will continue to support someone or something that makes their life easier, gives them what they want and/or removes the need to think about other choices.

Are our banks the new Trump?

What does this have to do with Australian banks you may ask?

Everything, considering the apparently minimal drop in consumer trust since the revelations emerged of bank misdeeds from the Royal Commission.

The banking revelations were just part of an industry-wide series of issues that should, in theory, have had a significantly negative impact on consumer trust.

The behavior of our biggest financial institutions has been shown to be systematically designed to deliver shareholder value to the detriment of customers. What we’ve seen is a deliberate culture of using the opaque nature of financial services communications and apathy of the customer base to make hay while the sun shines, in an industry where it’s seemingly always daytime.

Surely, having seen these stories reach mainstream media outlets, Australian consumers would be up in arms, demanding heads roll and looking at alternatives to the established institutions?

I don’t know about you, but I’ve not exactly seen hordes of consumers taking to the streets, flaming torches and pitchforks in hand, demanding action. In fact, I’ve only seen one online petition asking for clients of one of the big 4 to move their accounts, which flopped.

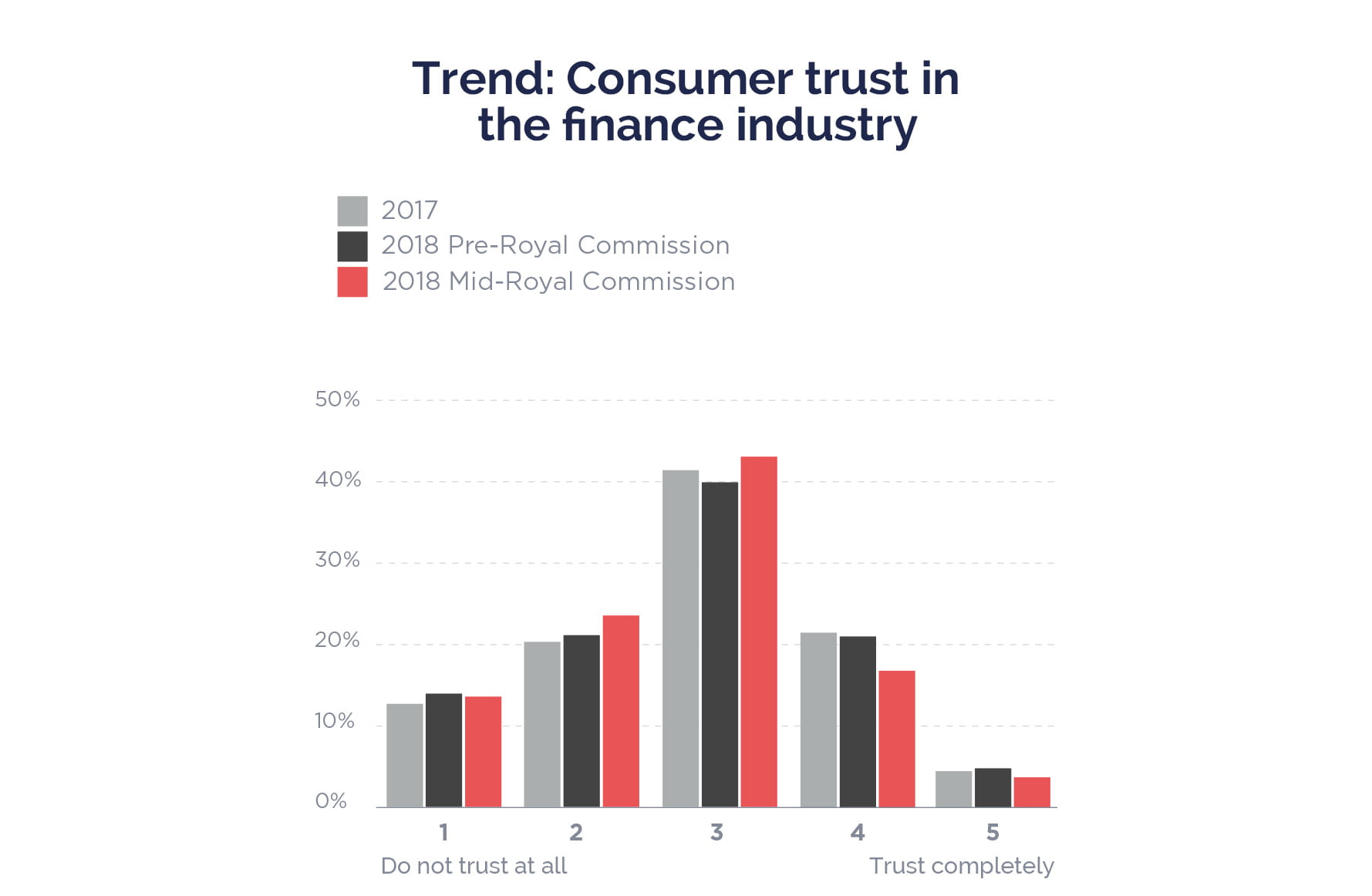

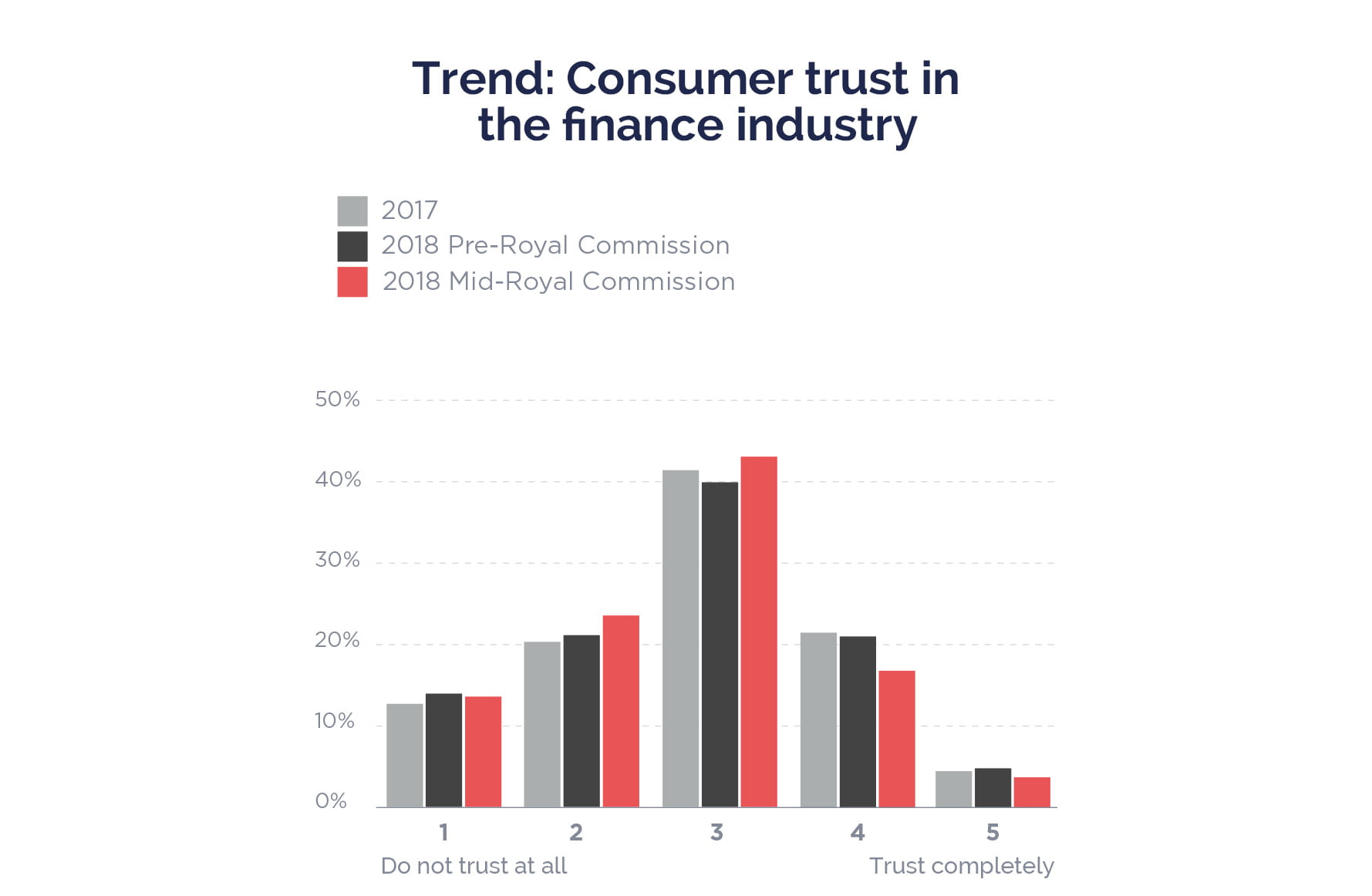

More than that, our research has shown that as a whole, consumers’ trust in financial services firms hasn’t seen a significant dip over the last 12 months.

While there has been a slight shift to indicate decreasing trust, it’s not been a fundamental one. Overall consumer trust feels relatively neutral.

Do the banks have a ‘base’?

These insights came from Ipsos research conducted as part of Yell’s 2018 Finance Marketing Survey, showing that over the last two years, consumers have maintained a level of trust in financial services firms (specifically banking), that belies the constant stream of horror stories coming out of the commission.

So, is it the case that the banks have a base, like Trump? And, if so, why?

To clarify; when we talk of Trump’s base, we mean a core group of supporters that stick with his ‘Make America Great Again’ brand, regardless of the policies that lie behind it.

Backed up by this year’s better than expected annual financial results for CBA and others, it seems that our banks also have a base of consumers that has stayed with them. When we asked consumers to rank different types of financial institution by how much they trusted them, banks remained resolutely in the top half of the table:

But is this loyalty based on loyalty to brand, aligned interests, or something else?

Sentiment, with a dash of apathy

The answer to any question of trust needs to be considered in the context of the relationship that consumers have with that organisation.

For the vast majority of us, our relationships with our banks have evolved to become an online-only experience, focused around apps and to a lesser extent, desktop sites.

The day-to-day digital experience we’re provided by the Big 4 particularly is amongst the best in the world. It has changed our lives for the better, reduced friction and brought clarity to our everyday banking.

It’s through this lens that we must consider the matter of trust. If we see trust as a measure of sentiment, then it’s no surprise that Australians generally have high levels of trust in their banks. They trust their bank because their day-to-day experience is a good one.

The lack of reaction may also derive from that other great staple of behavior when it comes to fin services – apathy. Faced with an industry whose products are difficult to understand and which has traditionally made it hard to move providers, most of us frankly can’t be bothered to get too worked up.

Putting it simply, it seems that for Australians, if it hasn’t directly affected them, and they’re happy with their experience, they don’t really care what their bank does.

What can we learn?

The biggest take-out from the research on trust is the importance of a delivering a great experience.

When looking at individual sectors within finance, the research shows that super is consistently rated well and credit cards poorly rated. This reflects the emotional experience for each product. The experience of super is generally positive, focusing on an annual statement that tells us we have more money than we did 12 months ago. Credit cards do the opposite. Highlighting the spending, fees and fines that deliver an emotional low, long after the high of making the purchase has faded.

This is where the banks have excelled. Their investment in the digital experience means they’ve smoothed friction points, clarified the thinking around our day-to-day finances and removed the issues around the traditional experience; we don’t even need to talk to anyone throughout our banking relationship if we choose not to,

Not many organisations have the resources to deliver to the macro level of the banks, but every organisation can focus on delivering exceptional micro experiences. By making it easy to complete the day-to-day tasks, you will make a positive difference to the lives and sentiments of your customers.

What’s next?

What will be interesting to observe in the next 12 months is the emergence of the neo-banks. In the UK, Starling, Monzo and Atom are steadily disrupting the market. They deliver an exceptional experience and have differentiated themselves from established banks.

In Australia, we have Xinja, Volt, 86400 and Tyro. All are in the process of obtaining banking licenses – the first step to becoming fully-fledged banks.

With a focus on CX, new approaches to product and open banking-powered integration of customer financial data, these new players will look to match or improve on existing banking experiences.

If they can deliver and sit apart from the tainted incumbents in the minds of consumers, we may see a rise in levels of trust in banks. This may mean, in future research, we will need to split out our research to consider ‘old’ versus ‘new’ banks to see where consumer trust really lies.

Which poses an interesting new question: would you trust your money with a new bank? That’s a question of trust I’ll consider another time.