Open banking is set to unleash a ‘seismic shift’ in the retail banking sector, driven by regulatory changes, changing consumer preferences, and technology-driven innovation. But what actually is open banking? And what does it mean for financial services marketers?

In in this blog, you’ll learn:

- What open banking is

- How it works

- What it means for customers

- What it means for financial services organisatons, both incumbents and start-ups

Firstly, what is closed banking?

Banks, and other financial institutions, have traditionally owned the data they have about their customers. They have collected it, so its theirs to keep, right?

This ownership of data provides incumbent organisations with a competitive advantage over challengers. It allows them to make better decisions on pricing, risk scoring and consumer behaviour than new entrants. And the larger the organisation is, the more data they will have, and the greater the advantage will be.

What is open banking?

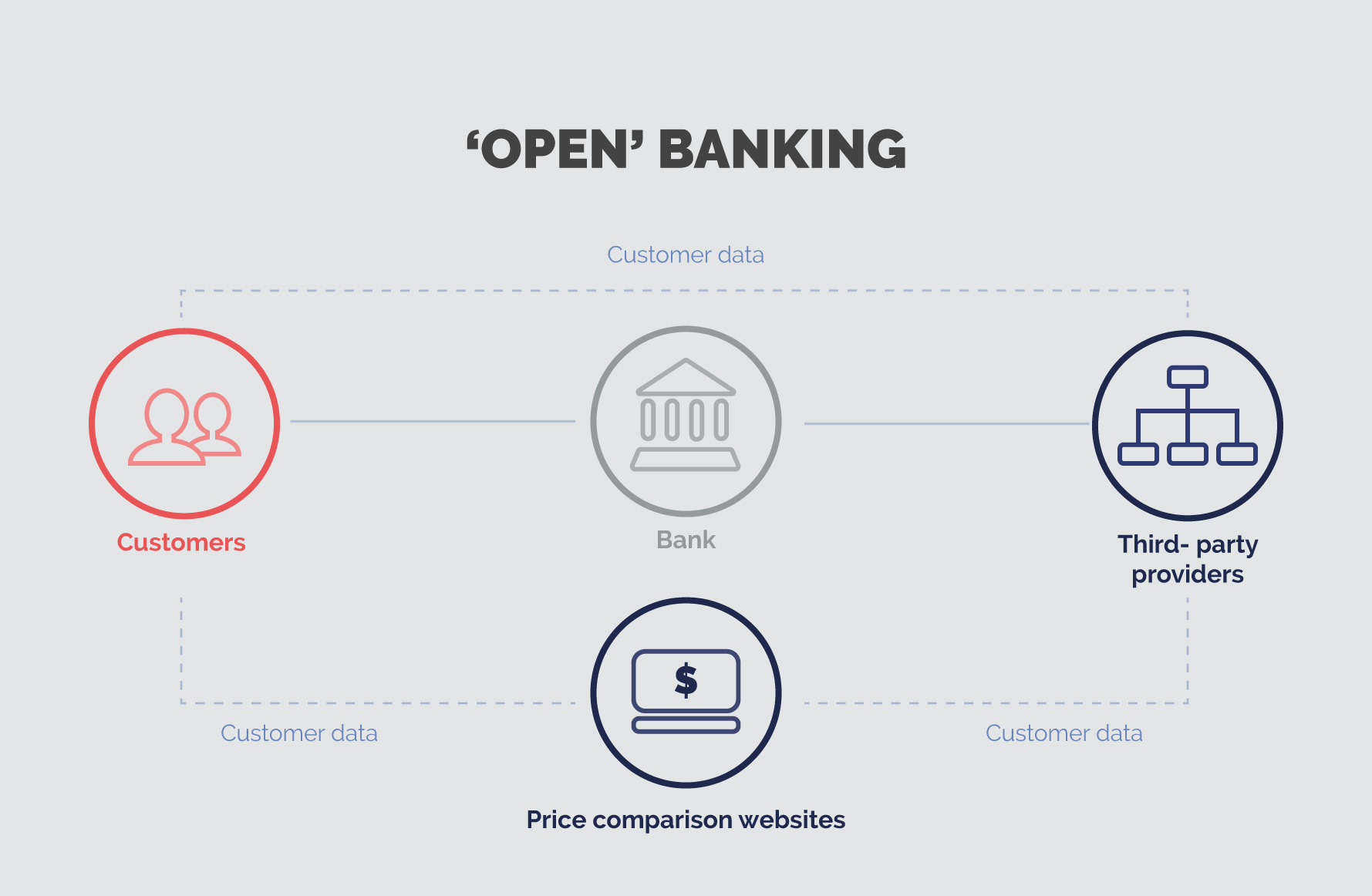

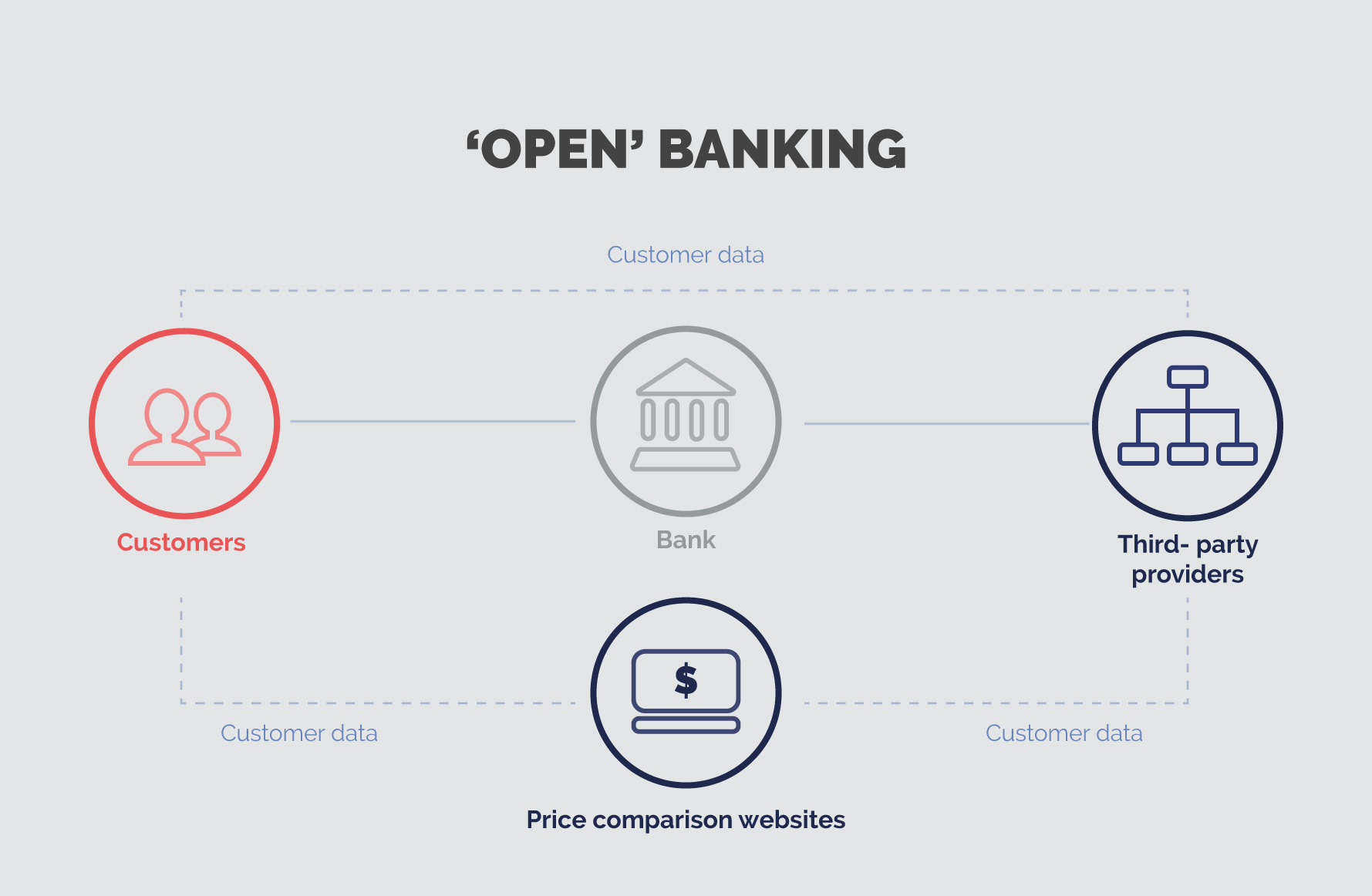

Open banking essentially means that financial institutions must recognise that customers own the data held by that institution and if they want to access their information to use in, say, a budgeting app on their phone, banks are obliged to allow this.

Can’t people already share their financial info with apps?

Some apps can already access consumer’s data to provide information, but they rely on a customer entering their usernames and passwords for each account – a security risk.

Open banking will make information much more accessible, transparent and secure.

How does open banking work?

Open banking uses an open application programmable interface (API), which is the key that unlocks customers’ transactional data, allowing it to be transferred between systems and institutions. Open banking basically boils down to legislation requiring banks to have a working API that can securely send data.

In Europe, this is known as ‘The Revised Payment Services Directive’ (PSD2), and while there isn’t yet such a widespread equivalent in Australia, it’s on its way.

Will open banking just affect banks?

Open banking is part of a wider movement towards giving consumers more control over their data, including who can have it and who can use it, known as Consumer Data Right (CDR). Banking is the first sector of the Australian economy to which CDR will be applied, but other sectors will follow suit – energy and telecoms have already been announced.

What does open banking mean for customers?

The ability to share their data more easily will help customers use it more effectively. This could be as simple as opening their banking app and being able to see a list of all of their accounts across all institutions, not just a single bank – known as “account aggregation”.

Or it could use data to help customers make more accurate financial decisions. An open banking app for customers who want to buy a home could automatically calculate what they can afford based on all the information in their accounts – providing a more reliable picture than current mortgage lending guidelines do.

At the very least it will make moving financial services providers much easier, with less paperwork needed for customers to move their accounts. This may finally mean that we can stop using the oft-quoted statistic that ‘Australians change their spouse more frequently than their bank’. Apparently, the average relationship with a bank lasts 16 years, compared to nine with a spouse.

What does open banking mean for the Australian financial services industry?

As the name implies, open banking is expected to open up the industry, with new opportunities for both start-ups and established businesses.

Start-ups are expected to develop products and services that can leverage the new access to data – embracing and defining the opportunity for change and transformation. As with many start-ups, the focus will be on using the data to provide a better customer experience than incumbents. And, as with many start-ups, the potential stumbling block will be combining this innovation with scale and actually delivering on their potential.

For incumbent organisations, the challenge will be to see off the upstarts, and take advantage of the opportunities that open banking provides – making it work with existing technology and existing plans for the future.

What does open banking mean for marketers?

Open banking is something that will affect all aspects of retail banking in Australia, and as such it’s not just ‘marketing’ that will be affected, but rather then complete customer experience. As with all CX, the implementation is layered:

1.System layer:

The underlying IT architectures that that make up an organisation’s core banking system, key customer and billing systems, proprietary databases etc.

2. Process layer

The underlying business processes that interact with, shape and use this data.

3. Experience layer:

This is the layer that marketers and CX practitioners will be working on. Customers will be interacting with more services and interfaces provided by third parties, rather than banks themselves. These new experiences will have been built from the ground up to deliver excellent user experiences and help customers achieve what they need to do.

As such, all financial institutions will need to up their game in terms of the quality of user experience. If they don’t, open banking will make it much easier to take their business elsewhere.

When is open banking coming into effect?

The first stage of it is already here!

The first component of open banking, Comprehensive Credit Reporting (CCR) was introduced on 1 July 2018. CCR allows credit providers to provide positive credit information on individuals, such as loan repayment history, which will make it easier for consumers to use their existing credit history to secure loans.

Wider open banking regulations are coming soon through. The Government’s official review (the Farrell Review) into open banking was published in December 2017. It made recommendations on data security, privacy and fairness. Financial institutions (both incumbents and start-ups) have now submitted their responses and recommendations following it.

There’s no fixed date for industry-wide open banking regulations yet, although they are expected in 2018, with open banking likely to come into effect in late 2019.

How can financial institutions win with open banking?

The Farrell review’s recommendations are for open banking to:

- Be customer-focused

- Encourage competition

- Create opportunities for new ideas and businesses

- Be efficient and fair, with security and privacy in mind

With this in mind, the extent to which organisations embrace the spirit of open banking will affect the degree to which they thrive, rather than just survive. By treating open banking as an opportunity to re-define and prioritise the value they add to customers, organisations will win, both in the short- and long-term.