In a mobile-first world, customers now expect a first class digital experience from every organisation they interact with – especially when it comes to financial services. Intuitive interfaces, around-the-clock availability, personalisation and consistency across every device is just a starting point for an excellent digital customer experience.

And although they aren’t aware of it, by changing their expectations of the level of service that they demand, customers are actually forcing a radical overhaul of business processes.

This shift to digitisation undoubtedly offers challenges to established organisations with legacy systems and processes. But when implemented correctly, digitisation will deliver a far superior customer experience and make financial services firms more robust and profitable businesses.

For example, a digitised insurer can use data and smart AI to provide a better initial customer experience. In some cases, it may allow them to use chatbots to enable clients to self-manage claims, enabling insurers to pay a higher proportion of claims at lower risk.

A practical approach

Creating the perfect customer experience (CX) through digitising a whole business can be a long and drawn out process, which will impact the whole organisation. An organisation wide change program is often understandably not appealing or practical to established firms with legacy data issues.

The good news is that improved CX through digitisation doesn’t need to be applied to the whole business at the same time. You choice is not all or nothing. A customer experience methodology can be applied to any point of the value chain and a digital solution developed.

Deciding which parts of the customer experience will be looked at requires a mix of customer insights and business analysis. The aim is to find a program of work that aligns points of high friction for customers, with viable, feasible business priorities.

Once this program of work has been agreed and key pieces of development work identified there are three ways to approach those projects:

- Develop technologies in-house from scratch

- Partner with a tech start-up and build from scratch

- Integrate with existing technologies

Below are three examples from the insurance industry to show how each of these approaches has been successfully applied, although the approaches can be applied to any financial services sector.

1. Develop in-house from scratch

Developing a new technology in-house can be the best way of retaining control of development and roll-out. But it can also be the most expensive way providing a new service to customers.

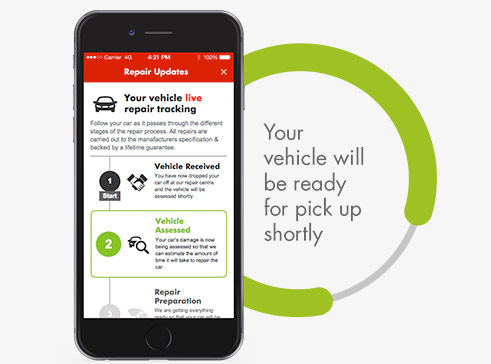

AAMI have developed their own app for their car insurance customers, which incorporates many of the positive attributes that digitisation offers.

- Claims can be made directly through the app, with pictures and accounts of any accident uploaded directly.

- Customers are also able to track the progress of their claim through the app, including the status of any repairs to their vehicle.

- AAMI are also using the app to engage users beyond just ‘purchase’ and ‘claim’ by delivering useful information to customers e.g. notifications of upcoming hailstorms are pushed to customers, to enable them to take measures to protect their car.

The AAMI app is an excellent example of a home-grown app that has taken a CX approach to producing a product that can compete with the best of insuretech start-ups.

2. Integrate with technology provider

With the speed of development of technology, it can be difficult for organisations to develop solutions using in-house resources. Developing and maintaining the capability to do so can be a distraction from the main business of providing your service, whether this is insurance or anything else.

In which case, partnering with an external technology provider can be a shortcut to accessing the latest technology without the high R&D costs associated.

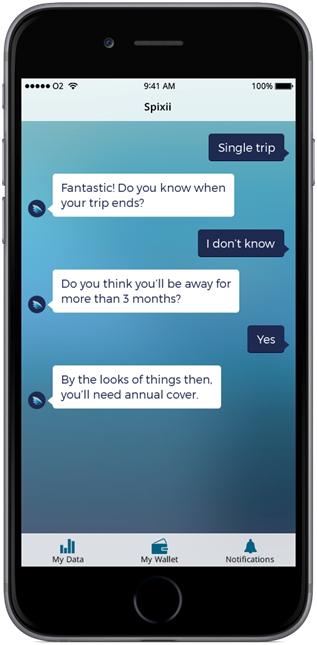

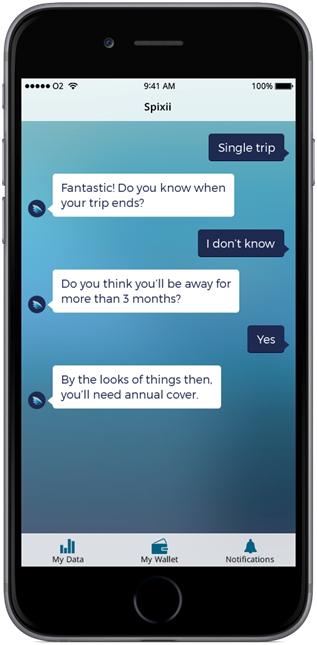

Spixii is a B2B insuretech start-up that offers a chatbot for B2C insurance companies. Spixii’s bot uses Artificial Intelligence (AI) to engage with customers – a much more engaging experience than filling out an online form.

If Spixii detects that a user is travelling abroad and the app detects that they may be doing an activity not covered by their current insurance policy e.g. scuba diving, the app will offer to tailor the insurance to cover the activity.

Artificial intelligence and chatbots like Spixii may not completely replace customer service agents, but can be used to profile and segment sales enquiries or policyholders to the most appropriate solution e.g. low value policy holders to self-service tools, high value holders to agents.

By partnering with providers like Spixii, insurance companies can ensure that they are providing optimal experiences for their customers through technology, without the need to incur the costs of developing that technology themselves.

3. Partner with a tech start-up and build from scratch

According to Gartner research, about 80% of general and life insurers worldwide will have either partnered with or acquired insurtechs by the end of 2018*.

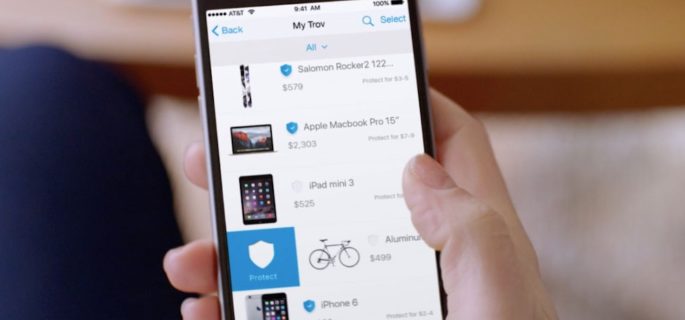

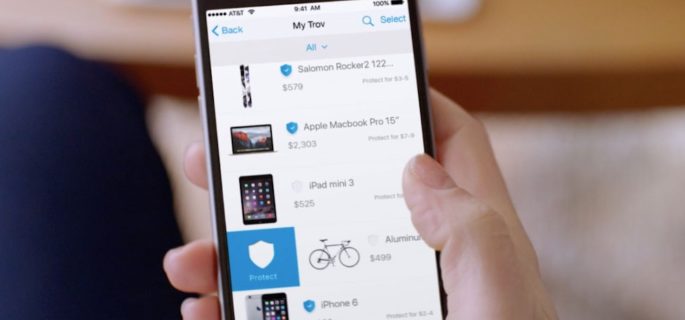

Allianz has taken this approach with its partnership with start-up Trōv, which reimagines the way customers interact with their policy.

Users can add items to their policy through the Trōv app and adjust the excess on a per-item basis, allowing them to tailor the experience to meet their individual needs.

Offering this level of flexibility may be next-to-impossible for an established insurance organisation, with legacy systems and approvals processes to contend with.

But by partnering with Trōv, Allianz has gained access to a platform that offers industry-leading customer experience, without the need to disrupt their core business and processes.

Which is right for your organisation?

Before deciding which technology approach is most appropriate to your business, a thorough audit needs to be conducted to assess your organisation’s digital maturity. This should not only examine the technology currently used, but also your organisation’s appetite for change and a review of how customers really want to engage with your business digitally.

By considering each of these factors, a practical approach can be developed to determine where digitisation should be focused to provide the best experience possible for customers, balanced with the realities of your organisation.