Financial marketers are becoming increasingly responsible for the delivery of an exceptional experience. For marketers in established organisations, this can be a significant challenge, with the realities of delivering CX often sitting with service, systems and process engineering functions within the business.

This ‘back-end’ approach has merit, but more often than not is focused on process transformation and culture change in an effort to improve customer NPS. Rarely do brand interactions feature, making it hard for for marketers and their partner agencies to improve their customer’s brand experience or truly delight customers.

Customer interactions are treated as transactional processes, with CX focusing on making each interaction as friction-free as possible.

The understanding that CX is organisational (macro) and user experience (UX) is transactional (micro), led to Yell identifying a gap in capturing the true experience most customers have with your brand. Defined as ‘Interaction experience’, iX focuses on understanding your customers’ emotional and rational needs and planning and building a set of interactions to meet those needs.

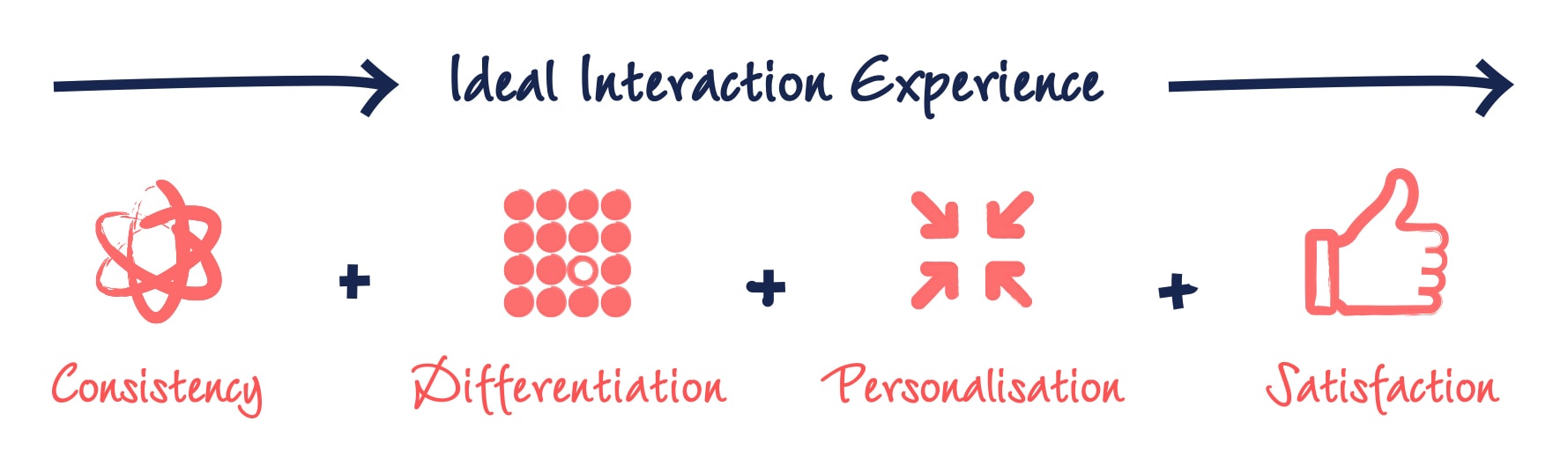

An ideal iX should deliver consistency, personalisation, differentiation and satisfaction. Our aim is to work with our clients to produce an actionable plan that aligns with your business’s capabilities and objectives that seeks to create this most effective iX.

The key to an exceptional iX is to truly understand your audiences. Using qualitative and quantitative research, we identify your target personas, then build out interaction journeys which map their emotional and rational need states at each stage of the journey.

Our experience has led to the identification of a common set of need states that can be applied across user journeys for every business within the finance sector. By mapping your current user journeys and the emotional and rational need state at each stage, we can create a program of interactions that shift your audiences towards the state that aligns with them engaging with your brand, product or service.

For example, if a customer calls their insurance provider in a state of distress following a major road traffic accident, they have both rational and emotional needs:

Yell’s iX process ensures that each interaction is tailored to deliver the best possible experience to meet both customers rational and emotional needs.

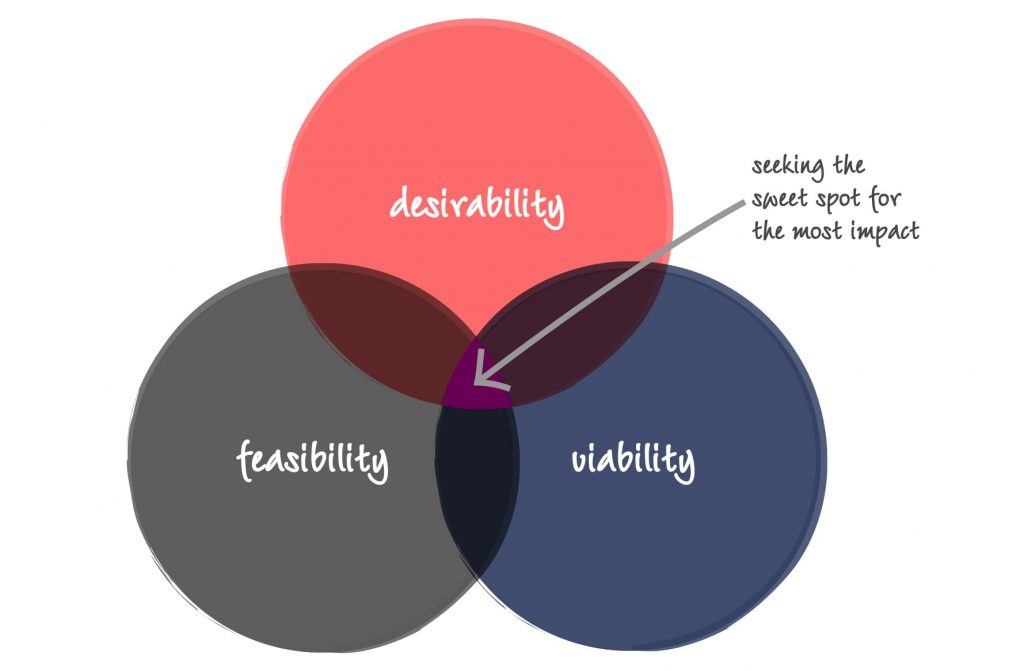

Defining and planning the ideal iX is not done in isolation. Recommending the perfect set of interactions only has value if it’s feasible (your business is capable) or viable (it aligns with your goals/priorities).

This is why it’s essential to closely collaborate and factor in business considerations when developing an iX strategy and plan. However, it’s also essential to ensure that the demands and capabilities of your business do not outweigh the needs of your audiences. This is where Yell delivers additional value. We are the voice of your customer, working with you to build an actionable plan that meets customer needs and delivers accountable outcomes that will transform your iX.

Collaborative brand building to connect with your customers.

Beautiful customer-focused experiences that tell your story.

The right content at the right time to engage, inform and convert.