As we look ahead to 2017, we’ve picked out the ’12 Trends for Christmas’ across four of the key areas of Yell Creative’s strengths:

- Technology

- Design

- Marketing

- Financial Services

Three tech trends for 2017

1. Everything is Intelligent

Much has been made of the potential of chatbots, with tech luminaries such as Microsoft CEO Satya Nadella claiming that ““Bots are the new apps” and that they will “fundamentally revolutionise how computing is experienced by everybody”.

Chatbots advanced in leaps and bounds in 2016, with Facebook opening its Messenger application to developers, resulting in some 30,000 bots now within its ecosystem. Apple provided third party developers access to Siri, so now you can verbally instruct Siri to send a payment via the Venmo app.

However, even with rapid development chatbots are – at best – still imperfect. They can be slow, have difficulty understanding questions, and don’t always interact using conversational language. We’ve seen a lot of chatbot failures, which have alienated some customers from certain brands. Earlier this year, Microsoft’s Twitter chatbot – known as Tay – ran into some problems and was taken down.

While examples within the Financial Services world are limited at present (mainly due to the conservative nature of the industry), in 2017 we’ll see large leaps in the capabilities of bots. We’ll see Artificial Intelligence and Machine Learning combine to facilitate the development of systems that can learn from information they receive and adapt themselves accordingly, compared to traditional systems that have a set range of scenarios they can revert to based on the information.

2. Digital twins

A digital ‘twin’ is a digital replication of a physical “thing” in the real world, which uses dynamic software and sensor technology to recreate that “thing” in the digital world.

For example, a bank may create digital twins of each ATM in its network, with each digital twin replicating everything about the machine’s operation history, from how many times it is used a day, to the average size of a withdrawal to the time that each and every withdrawal that has ever taken place happened.

These digital twins allow organisations to run simulations, stress test their network, diagnose failures, test solutions, and even create new products without requiring workers to be in the same room, postcode, country, or continent as the item they’re interacting with.

3. Adaptive Security Architecture

All this intelligence can, of course, be used for good and evil. In October a massive cyber attack brought down sites such as Amazon, Twitter, Netflix, Etsy, Github and Spotify and affected millions of customers across the US.

Adaptive Security Architecture is an information security approach that employs the latest tactics and tools to thwart cybercriminals, and in 2017 we’ll see computers and devices that will be able to use Machine Learning to adapt to better protect themselves.

By using the latest AI to deliver flexible security measures, organisations are aiming to use the same technology that cybercriminals are already using to circumvent traditional cyber defence methods. It’s estimated the Adaptive Security Architecture industry will become a $70US billion industry by 2021.

Three design trends for 2017

4. Gradients and vivid colours

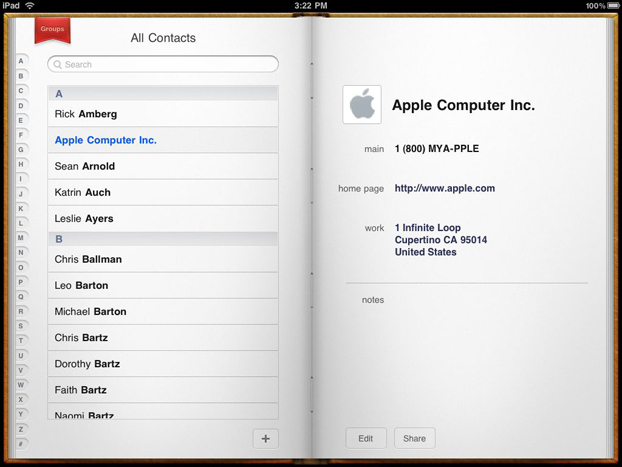

2013 brought flat design, which spread like wildfire through the design community, muting colours and removing all superfluous elements in its wake.

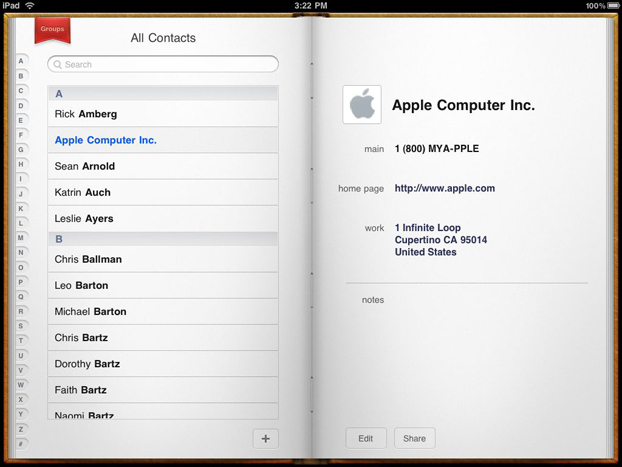

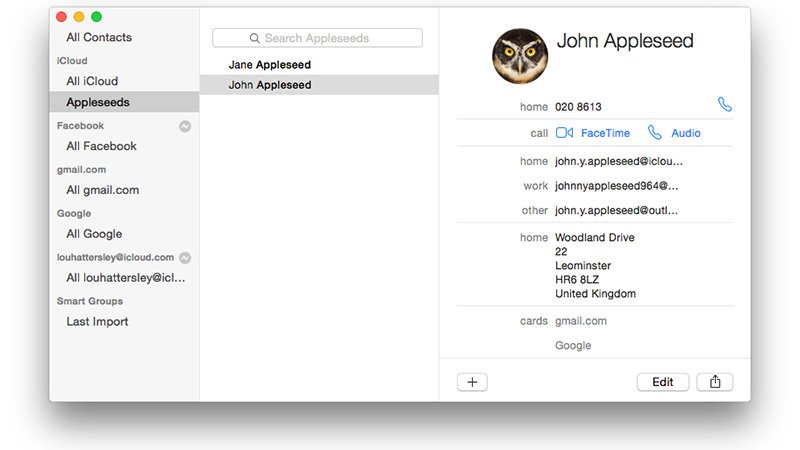

It was the trend that meant items like Apple’s ‘skeumorphic’ literal representation of an address book changed from this:

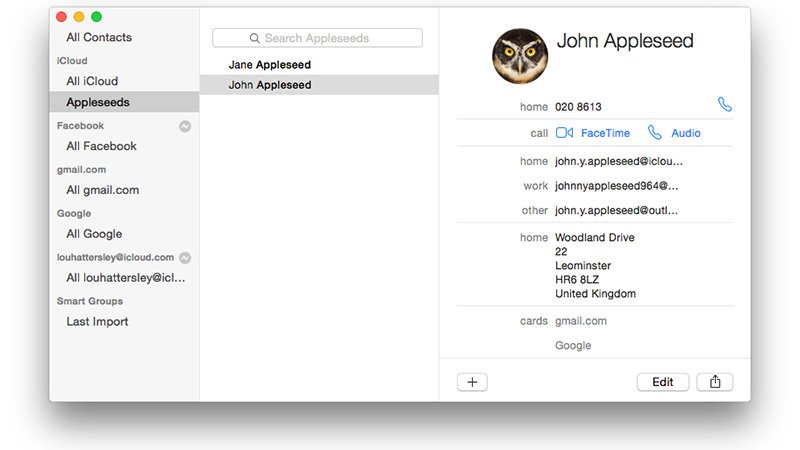

To this:

Flat design is all about simplifying user interfaces to their most core, functional elements to achieve a more efficient user-experience.

One side-effect of flat design is that as designers moved towards its simplicity, websites and apps were designed and built which lacked a distinct personality.

2016 saw the shackles of flat design start to loosen as more brands and designers began to once more focus on personality, experimenting with vivid colour palettes and gradients in place of the simple, but muted, tones used previously. View an example here

Vivid colours and gradients are great for injecting energy, warmth and dynamism into a project to make it stand out from the crowd and we expect this trend to grow in 2017 as the world pushes for personality!

5. Authentic images

While not every project has the budget available for a custom photoshoot, financial services organisations have often been guilty of using clichéd, but safe, stock images.

In 2017, customers will continue to demand authenticity in marketing, and engaging images that portray real world situations with real people are now easily available from stock imagery websites.

In 2017, we’ll also see an increase in the use of images from new perspectives as camera technology becomes more uniquitous – selfies, drone footage and head-on camera pictures and videos.

A trend that looks set to continue is full-screen images, showing off beautiful photography and helping to deliver a simple and clear message.

6. Micro-interactions

Micro-interactions, typically in the form of small, on-screen animations are playing a vital role in UI and UX design today, especially on mobile and smaller screen devices.

View an example here

From a user-experience perspective, micro-interactions are not only small, entertaining on-screen animations or transitions, but are forms of visual feedback for the user and their actions. Micro-interactions let users know what is happening, what has happened, and what will happen next as they interact with the UI.

The aim is to reduce ‘interstitial anxiety’ – the momentary state of tension a user experiences between an action (e.g. clicking a button) and a response (moving to the next page). Animated micro-interactions provide feedback to let users know what to do and what’s happening, in a thoughtful and entertaining way.

Clever designers are able to put the ‘fun’ into ‘functional’ too, by entertaining users as well as informing them. From playful loading animations, to slick icon transitions, effective micro-interactions engage and inform at the same time.

Three marketing trends for 2017

7. Native advertising will explode in popularity

While native advertising is a well established-technique, its popularity in the digital marketing mix looks set to hugely increase in 2017 as the proportion of consumers who block or ignore most forms of conventional advertising continues to increase.

Native advertising’s strength is its ability to get consumers’ attentions and circumvent their resistance to traditional advertising, while delivering value to the reader.

The rise in native advertising also ties in with organisation’s need to get the most value from their investment in content marketing. While many financial services organisations have been proactive in this area, developing educational content, interactive assessments or calculators, these are often buried deep within a website meaning that they aren’t delivering value for users or for the organisation. The increase in native advertising will mean that financial services organisations will be able to share their tools with an audience and start the conversation with them where they already are, without the need to for the user to visit the organisation’s own website.

As many news organisations continue to search for sustainable revenue models, in 2017 we may also see new and improved forms of native advertising offered by major publishers who have previously opted not to offer this method of advertising, further increasing its potential.

8. Conversational Commerce

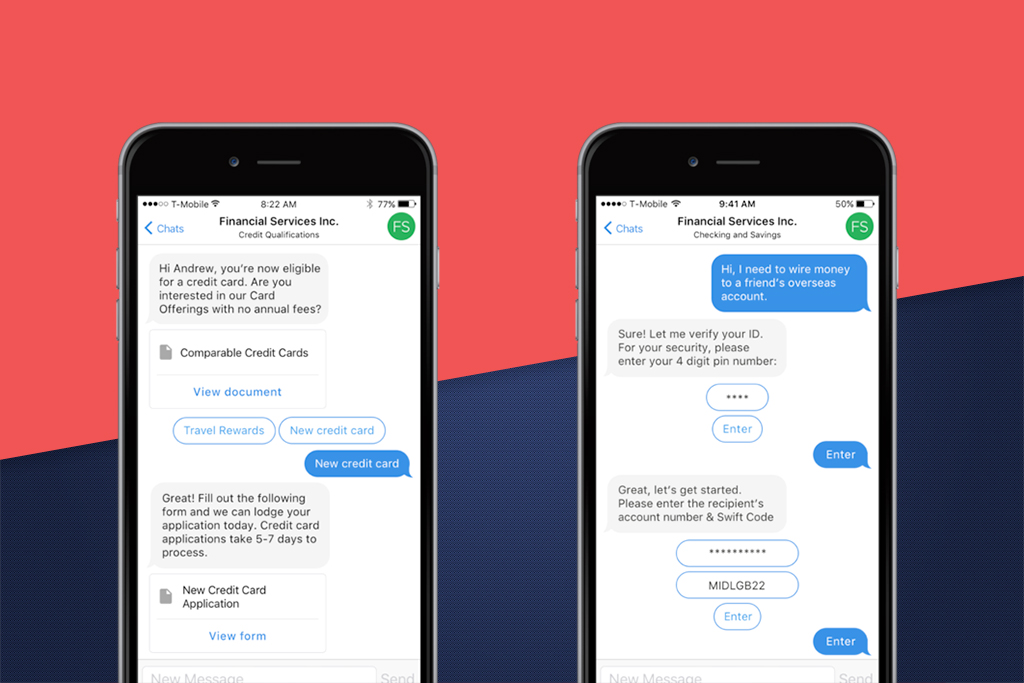

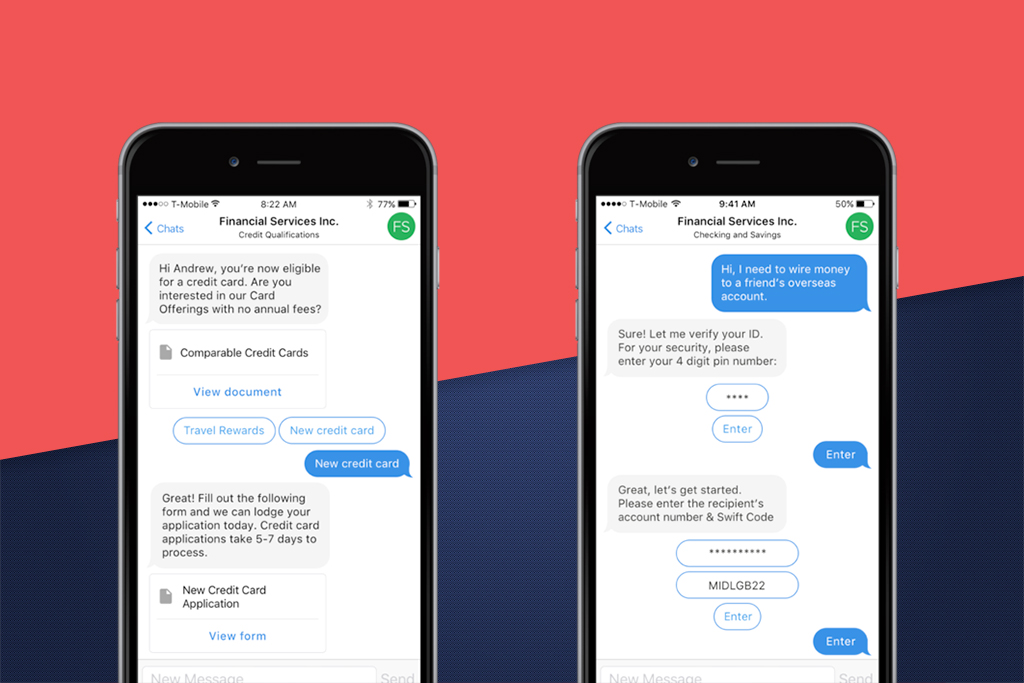

We have already looked at the rise of bots in the technology section of this piece, but what we didn’t cover there was the implications for financial services marketing.

The opportunity here is for organisations to engage prospects and users through ‘conversational commerce’ — using messaging apps to market, to sell through and to answer service queries that would traditionally been processed through call centers.

Conversational commerce is predicted to be particularly popular amongst younger consumers – the ‘millennials’ who now spend a huge amount of their time interacting through messenger apps, rather than social networks. While an app was once the first to reach millennials on their smartphones is to build an app, chatbots circumvent the requirement of downloading an app, reducing friction and allowing brands to reach millennials in the channels where they’re already highly active e.g. Facebook Messenger, WhatsApp, or SMS.

One development that will be interesting to watch in 2017 is where Financial Services chatbots will actually live – whether it’s on Facebook Messenger, Whatsapp, SMS or just ‘livechat’ on organisations’ websites.

The need for security in the collection and protection of a customer’s private information, together with Government regulations may mean be that for many financial services organisations, conversational commerce occurs primarily through their ‘owned’ web channels, where they have greater control over security.

9. Increase in investment in Customer Experience

While being the ‘voice of the customer’ has long been a focus for marketing, 2017 looks set to be the year that more financial services organisations realise that being truly customer-centric is the only way to compete in a world of limited attention spans, commoditised products and potential disruption from fintech start-ups.

While previously Customer Experience efforts may have been limited in their effectiveness due to the limited sphere of influence of the Marketing or Customer Services teams that were leading the projects, the rise in the visibility of Customer Experience as a discipline has resulted in higher engagement with the C-Level. The increase in buy-in from senior management means that the Customer Experience projects now have the backing of those with the requisite authority to deliver the organisational and behaviour changes that are needed to transform an organisation into a truly customer-centric one. As we continue to see an increase in C-Level engagement with Customer Experience in 2017, the result will be an increase in higher quality products and services provided to Australian financial services consumers, raising the barrier for others who haven’t embraced CX.

Success in this environment requires organisations to nurture, sustain and foster the relationship they build with their customers, and to do this they need to truly understand them. This is now easier, and cheaper, than ever before due to the development of easily accessible ‘Voice of the Customer’ and social listening technologies. These technologies allow organisations to monitor customer sentiment on an ongoing basis, instead of collecting customer data at one point in time and then assuming that this won’t change.

Why is this important? Financial services organisations can now continue to learn the real reasons that a customer keeps coming back to do business with them. Whether it was the product quality, the turnaround time, customer assistance, post-sale service or something else.

Only by having this understanding can organisations ensure that their organisation is delivering what is required to be cater to customer needs. And, while employing these technologies and embarking on a Customer Experience program is undoubtedly an investment, recent developments in CX analytics frameworks can be used to demonstrate the ROI of the Customer Experience investment, demonstrating its worth to the customer and to the business.

Three financial services trends for 2017

10. Will phone payments final break through?

Near field communication (NFC) has been around in smartphones for some time now, but the introduction of mobile payments in Australia has been delayed due to the running battle over the introduction of Apple Pay between Apple between most of the banks (with the exception of ANZ).

This is a fundamental battle between the traditional financial services firms and tech firms looking to disrupt points along the customer transaction lifecycle. We’ll be seeing more of this in a general context in 2017, but this year will see a ‘who blinks first’ tussle between the world’s biggest company and the world’s most profitable banking sector.

If the two sides do actually decide to put customers first (unlikely as it sounds) and reach an agreement, then 2017 will see the start of the death of plastic and the continued acceleration of the end of cash in Australia.

With Australians loving smartphones like they do and already having one of the highest saturations of use of contactless in the world, the use of digital wallets will become more commonplace – with Apple taking a clip of the ticket along the way.

11. The year of InsureTech

Insurance is an industry ripe for change and disruption.

Often seen as a grudge purchase associated with unfortunate life events, the industry’s reputation has not been helped by a lack of transparency, poor processes and increasing costs.

2017 will see the traditional insurance model and perceptions challenged by a number of market entrants that will look to leverage customers’ existing technology to improve the customer experience.

Wearables and smart phones are enabling disruptors to change the model around the key interaction points between customers and insurers, allowing more accurate recording of insured items, reducing premiums based on behaviour and making the claims process easier and more efficient.

On demand insurance has already launched in Australia, through Trov, an InsureTech start-up that enables customers to use smartphones to capture images of items that require insuring, and manage the claims process through the Trov app for those items. Using this tech integration allows customers to select cover for specific items rather than blanket cover; providing transparency and reducing costs. It also makes the claims process so much easier! A truly customer-centric solution.

12. The year of peer-to-peer

We believe we’re going to see am increase in grass roots disruption through the growth of peer-to-peer offers. We’ve already seen a plethora of peer-to-peer lenders launch in Australian over the last couple of years, including SocietyOne, Ratesetter and Moneyplace. We’ve even seen the launch of parent to child peer-to-peer mortgage lending.

What these offers all have in common is a sense of community, a strong mistrust of the big financial institutions and in many cases a desire to contribute through charitable giving, or a mutual approach to profits.

This trend is set to expand across different industry verticals, with insurance, being the most likely industry to see the most disruption. Take it from us, it’s not going to be long before the likes of Lemonade and Friendsruance start to make a big impact in Australia.